2023-10-19 08:26:00 Thu ET

stock market paypal facebook apple microsoft google amazon tesla smart beta stock investment vitae virtual stock market simulation free stock search tool personal finance tool top tech titans proprietary alpha stock signals leaderboards ebooks analytic reports research articles investors

We would like to provide both economic and non-economic thoughts and insights into world politics and international relations in the rare episode from World Wars I and II to Cold War (between the U.S. and Soviet Union). These threads combine the realist, liberalist, and constructivist views, which collectively shape the modern paradigm of U.S. liberal capitalism and democracy. Additional insights portray and characterize the information revolution and its implications for globalization, economic interdependence, trade liberalization, and post-Cold War multilateral governance.

Parting from its geographically semi-isolated position as a balancer off the coast of Europe, Britain moved toward an alliance with France in 1904. In 1907, the Anglo-French partnership broadened to include Russia and became known as Tripe Entente. In response to this encirclement, Germany tightened its relations with Austria-Hungary and Italy (Triple Alliance).

As the strategic alliances became more rigid, diplomatic flexibility was lost. In Europe, this new balance of power could no longer operate through the shifting alignments that characterized the balance of power during Bismarck's day before the early-twentieth century. Instead, the major powers wrapped themselves around the opposite poles of Tripe Entente versus Triple Alliance on the eve of World War I.

With these major military blocs, the resultant bifurcation might serve as one of the root causes of World War I.

At the structural level, World War I did not solve the collective security problem of German territory and sovereignty. The Versailles treaty was harsh enough to stir up German nationalism, but not harsh enough to leave the Germans incapable of launching aggression on the European continent. Until 1941, the absence of the U.S. and Soviet Union from the European balance of power meant little deterrence of Germany from pursuing its expansionist policies.

Although Hitler mastered maneuvers to diplomatically demand territorial integrity and self-determination in Sudetenland and Poland (both examples of the perfidy of the Versailles treaty by western democracies), Hitler's monomaniacal personality traits of fear and insecurity eventually led Germany to make the crucial mistakes of invading the Soviet Union and then declaring war against the U.S. after Japan blitz-bombed Pearl Harbor in the Pacific war.

Both World Wars I and II were not inevitable. Human choices mattered a great deal.

After the collapse of all the other great powers in World War II, the bipolar relations and misperceptions between the U.S. and Soviet Union made the Cold War seem highly probable (if not inevitable). Under Stalin's global ambitions of spreading communism to all legitimate governments around the world, the Soviet Union applied an expansionist foreign policy to better align Eastern Europe (Estonia, Latvia, Lithuania, East Germany, Poland, Czechoslovakia, Hungary, Romania, and Bulgaria) and China, North Korea, and Vietnam in East Asia. In response, the U.S. adopted both foreign policies of containment and deterrence to tip the balance of power in these parts of the world.

At the systemic level, the new bipolar structure led to the Cold War in the rare and unique form of an ideological conflict between liberal capitalism and communism. In America, the sudden change in foreign policy from postwar Roosevelt reformation to the Truman doctrine created useful ambiguities in the U.S. containment of Soviet power. Instead of an incessant arms race with nuclear weapons, the U.S. and Soviet Union eventually secured the delicate balance of power. With proper U.N. support and collective security, the peaceful resolution of the Cold War came to fruition in time.

The information revolution flattens government hierarchies and then replaces them with network organizations. The bureaucratic central governments of the twentieth century now tend to decentralize as new forms of governments of the twentieth-first century. Today, private markets and non-profit organizations handle more and more government functions. With this global decentralization, virtual communities and network organizations develop on the Internet and so cut across territorial jurisdictions and formulate their own patterns of governance. Although sovereign states continue to co-exist with multinational corporations, network platforms, and non-profit organizations, these states become less important and less central to the social and economic lives of most global citizens. People live by multiple voluntary contracts and drop in and out of virtual communities at the click of a mouse. The new patterns of virtual communities of governance prevail as a new modern civil analogue to the feudal world order before the Westphalian system of sovereign states dominated Europe.

In his landmark research article on The End of History, Francis Fukuyama (1989) predicts the global convergence toward liberal democratic capitalism. With the demise of communism (on the collapses of the Berlin Wall and Soviet Union in the late-1980s and early-1990s), we seem to have reached the end point of ideological evolution and, as a result, the emergence of western liberal democracy as the final form of human government. Former British prime minister Winston Churchill once famously observed that democracy is the worst form of government, except for all the other forms that have been tried from time to time. Deep ideological cleavages drove global conflict over the twentieth century, and non-liberal movements such as communism and fascism were radical responses to the disruption of traditional life by modernization. Industrialization tore people from their small communities and villages and then made them available for mobilization in large ideological movements. Over the 40-year Cold War between the U.S. and Soviet Union, however, liberal capitalism proved more successful in delivering better economic welfare and citizen participation. With open and transparent democratic political processes, checks, and balances, liberal capitalism prevailed toward the end of the Cold War. Complex economic interdependence forms large islands of democratic peace in the modern world, along the classic lines of Immanuel Kant’s liberal predictions.

The return of human history means more normal circumstances in which a single ideological cleavage does not drive the larger global conflicts in world politics. Liberal capitalism has many competitors, although communism and fascism show prohibitively high levels of state fragmentation. China and Russia rely on state capitalism and global markets too; yet, neither is liberal nor fully capitalist. In other regions, religious fundamentalism challenges the norms and practices of liberal capitalism. What many global citizens have in common is a reaction against secular liberal capitalism. The major response to liberal capitalism after the Cold War is ethnic, religious, and national communalism.

By comparison to Fukuyama’s liberal vision, Samuel Huntington (1993) proposes an alternative thesis in The Clash of Civilizations. Huntington argues that the great global conflicts arise from cultural clashes (rather than the fundamental sources of warfare in the secular economic and ideological worlds). Huntington divides the world into 8 major civilizations (Western and Latin American, African, Islamic, Sinic, Hindu, Orthodox, Buddhist, and Japanese). In this view, Huntington predicts global conflicts along the fault lines of these civilizations. In contrast to realists who use balance-of-power theory to predict interstate wars between Japan and Germany and their close neighbors, or liberalists who expect democratic peace to spread around the globe, Huntington views cultural clashes and the main source of global conflict. As constructivists suggest, cultures are neither static nor homogeneous; instead, cultures are often fluid across overlapping generations. In modern human history, more wars and conflicts have occurred within the large civilizations (of Islam and Africa for instance) in Huntington’s map of the world. Not only are there multiple cultures, but there are also very different types of states in terms of levels of modern economic development. Fukuyama’s triumph of liberal capitalism and democratic peace fits well with much of the post-industrial world. Huntington’s focus on cultural conflict fits better with the pre-industrial world and its relations with most other regions. Neither fits anywhere perfectly. One size does not fit all.

AYA fintech network platform https://ayafintech.network/blog/american-federalism-and-domestic-institutional-arrangements/

In his relatively short commencement speech to UC Berkeley graduates, Nobel Laureate Thomas Sargent provides a concise summary of central insights in the economic science.

Economics is organized common sense. Here is a short list of valuable lessons that our beautiful subject teaches.

AYA fintech network platform https://ayafintech.network/blog/macro-economic-innovations-and-asset-alphas-show-significant-mutual-causation/

We should use our money to gain control over our time. Not having control of our time is such as powerful and universal drag on happiness. The ability to do what we want, when we want, with whom we want, for as long as we want, pays the highest dividend in personal finance.

We need no specific reason to save money. It is great to save for a car, a down payment, or a medical emergency. Saving for an uncertain and unpredictable future is one of the best reasons to save money. Everyone’s life is a continuous chain of surprises. Saving money serves as a hedge against the inevitable events in our life journey.

Nothing worthwhile is free. We often need to pay the hidden cost of success. In fact, most financial investment costs have no visible price tags. Doubt, regret, and uncertainty are common costs in personal finance. We should view these hidden costs as fees (a price worth paying to get high dividends and returns in exchange) rather than fines (a hefty penalty not worth paying to get over the inevitable reality of life).

A gap between what could happen in the future and what we need to happen in the future in order to accomplish much is what gives us endurance. Endurance makes compound interest work wonders over time. Room for error often looks at a conservative hedge. If this margin of safety keeps us in the stock investment game, this margin of safety can pay for itself many times over.

We should define our own unique stock investment game. We should never let others influence our actions in playing our own game. Smart and reasonable people can disagree in personal finance because people have very different goals and desires. Long-term value investors can learn to time the stock market more aggressively than myopic momentum investors. Investor disagreement breeds persistent deviations of asset prices and returns from equilibrium steady states.

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors. AYA fintech network platform uses the safe and secure online payment gateway through PayPal (the biggest online fund transfer platform in USA with 83% online market penetration). https://ayafintech.network/blog/our-proprietary-alpha-investment-model-outperforms-most-stock-market-benchmarks-february-2023/

We should try to find humility when our stock market investments go right. At the same time, we should try to find forgiveness and compassion when our stock market investments go wrong. It is never as good or bad as it looks at first glance. The world is big and complex. Luck and risk are both real and hard to identify in practice.

We should respect the power of luck and risk, so we can have a better chance of focusing on stock market investments under our control. In this unique way, we can have a better chance of finding the right role models with rare and unique competitive advantages in each profitable industry.

Because a small minority of long-tail stock market investments account for the majority of high stock market returns, we can be wrong half the time and still manage to make a fortune in the long run. For this reason, we should measure how the full portfolio performs in due course (rather than how each individual stock investment performs in comparison to the market model). It is fine for us to keep a large chunk of mediocre stock investments and a few outstanding ones. Judging how we have done by focusing on individual stock investments makes winners look more brilliant than they were, and losers appear more regrettable than they should.

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors. AYA fintech network platform uses the safe and secure online payment gateway through PayPal (the biggest online fund transfer platform in USA with 83% online market penetration). https://ayafintech.network/blog/ayafintech-network-platform-update-notification/

When we invest consistently in a basket of value stocks (with high and steady gross and net profit margins but low current stock market valuation), we can consistently achieve a higher average return across the value stock portfolio.

The typical value stock portfolio return of 15% to 20% per annum often exceeds the long-run average return of only 11% for the broader stock market indexes such as S&P 500, Russell 3000, and MSCI USA.

Very few investors appreciate the counterintuitive rule of compound interest that this value stock portfolio doubles in market value every 4 to 5 years (when the value investor consistently achieves the superior average return of 15% to 20% per annum).

For better asset diversification, the value stock investor places his or her other safe bets on inflation hedges such as real estate investment trusts (REIT) and long-term U.S. government bonds etc.

The key bottomline is that the long-term value investor should time the stock market more aggressively than the myopic conservative investor.

However, the common psychology of money suggests that very few investors are bold and audacious enough to invest in a broad basket of value stocks, especially when the economy moves into a severe recession.

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors. AYA fintech network platform uses the safe and secure online payment gateway through PayPal (the biggest online fund transfer platform in USA with 83% online market penetration). https://ayafintech.network/blog/our-proprietary-alpha-investment-model-outperforms-most-stock-market-benchmarks-february-2023/

Saving money is the gap between our ego and our income.

Wealth is often what we cannot see in the common form of houses, cars, computers, smartphones, tablets, and other personal possessions.

Consistent wealth creation suppresses what we could buy today to have more asset investment options in the future.

No matter how much we earn, we may never build wealth unless we can put a lid on how much fun we can have with our money right now today.

For this reason, we learn to manage our money in a new way that helps us sleep well at night.

Some people cannot sleep well unless they earn the highest asset returns; and others only get a good rest if they maintain a few conservative stock picks.

If we want to achieve better asset investment performance, the single most powerful force is for us to increase the time horizon for compound interest.

A substantially longer time horizon allows compound interest to work wonders: it takes only 4 to 5 years for the typical value stock investment portfolio to double in market value with a 15% to 20% average annual return.

More time cannot neutralize luck and risk, but more time pushes results closer toward what people deserve.

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors. AYA fintech network platform uses the safe and secure online payment gateway through PayPal (the biggest online fund transfer platform in USA with 83% online market penetration). https://ayafintech.network/blog/ayafintech-network-platform-update-notification/

Compound interest often defies the conventional wisdom of wealth creation.

In fact, many people cannot adequately comprehend the rather counterintuitive rule of compound interest.

Specifically, how many years does it take for the typical value stock investment strategy to double in market value?

Most people have the wrong guesses in the broad range of 10 to 20 years or more.

If the typical value stock investment strategy yields an average return of 15% to 20% per annum, it takes only 4 to 5 years for the portfolio to double in market value.

Through boom-bust fluctuations in the business cycle, most stock market investors should patiently allow compound interest to work wonders for consistent long-term wealth creation.

AYA fintech network platform provides the safe and secure online payment gateway through PayPal, the biggest online fund transfer platform in USA with 83% online market penetration. https://ayafintech.network/blog/ayafintech-network-platform-update-notification/

We should often learn to manage our expectations.

If expectations rise with results, there is no logic in striving for more because we feel the same after we put in extra effort.

It gets dangerous when the taste of having more - more money, more power, and more prestige - increases ambition faster than satisfaction.

In that case, one step forward pushes the goalpost two steps ahead.

We feel as if we are continuously falling behind, and the only way for us to catch up is to take greater amounts of risk.

Life is not any fun without a sense of *enough*.

Happiness equates just results minus expectations.

AYA fintech network platform provides the safe and secure online payment gateway through PayPal, the biggest online fund transfer platform in USA with 83% online market penetration. https://ayafintech.network/blog/the-bank-credit-card-model-and-fintech-platforms-have-adapted-well-to-the-recent-digitization-of-cashless-finance/

JPMorgan Chase Asset Management once published the distribution of returns for the Russell 3000 stock market index, a big and broad collection of public companies from 1980 to 2015.

About 40% of all Russell 3000 stocks lost at least 70% of their value and never recovered over this data span.

Effectively all of the Russell 300 index's overall returns came from only 7% of individual stocks that outperformed S&P 500 by at least 2 standard deviations.

The Russell 3000 increased more than 73-fold during this data span.

This overall average return was a spectacular tail-driven success.

The 7% or 200 individual stocks that performed extremely well were more than enough to offset the duds.

Not only did a few companies account for most of the stock market return, but these companies were also rare positive tail events.

Therefore, retail investors can be wrong half the time but still manage to make a fortune in the stock market.

AYA fintech network platform provides the safe and secure online payment gateway through PayPal, the biggest online fund transfer platform in USA with 83% online market penetration. https://ayafintech.network/blog/government-intervention-remains-a-core-influence-over-global-trade-finance-and-technology/

At the Berkshire Hathaway shareholder meeting in 2013, Warren Buffett said he has owned 400 to 500 stocks during his life and made most of his money on about 10 of them. Charlie Munger followed up: "If you remove just a few of Berkshire's top stock investments, its long-term track record is pretty average."

"It is not whether you are right or wrong that is important in the vast majority of asset investment decisions," George Soros once said, "but how much money you make when you are right and how much money you lose when you are wrong."

You can be wrong half the time and still make a fortune.

AYA fintech network platform provides the safe and secure online payment gateway through PayPal, the biggest online fund transfer platform in USA with 83% online market penetration. https://ayafintech.network/blog/our-proprietary-alpha-investment-model-outperforms-most-stock-market-benchmarks-february-2023/

This ebook delves into the macroeconomic and technological aspects of Bidenomics from mid-2020 to present. This ebook comprises 4 main parts. The first part explains the pre-Biden Trump economic policy reforms in trade, taxation, and technology in accordance with anti-China investor sentiment and neo-liberal public choice. The second, third, and fourth parts discuss the central foundations of Biden economic policy reforms in fiscal and monetary policy coordination, climate change, and the Inflation Reduction Act. Through these latter analytic reports, Bidenomics focuses on the recent technological advances and their broader policy implications for environmental, social, and governance (ESG) stock market investment strategies etc. This macro trend has profound public policy implications for U.S. tech titans Meta, Apple, Microsoft, Google, Amazon, Nvidia, and Tesla etc (MAMGANT).

AYA fintech network platform ebook library:

https://ayafintech.network/library/new-bidenomics-trade-taxation-and-technology/

Length: 206 pages (90,405 words)

Part 1: pre-Biden Trump economic policy reforms in trade, taxation and technology.

The global economy faces a paradigm shift toward pervasive peculiar phenomena due to Sino-U.S. fair trade and Brexit deals.

Technological advances, geopolitical risks, and pandemic outbreaks cannot shake investor confidence in the American dollar as the global reserve currency.

U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon enjoy platform advantages, competitive moats, positive network effects, and scale economies.

Artificial intelligence continues to push boundaries for several tech titans to sustain their disruptive innovations, competitive moats, and first-mover advantages.

Part 2: Biden economic reforms in fiscal and monetary policy coordination, climate change, and the Inflation Reduction Act.

The corona virus crisis helps reshape global trade, taxation, and technology.

The Biden administration launches economic policy reforms in fiscal and monetary stimulus, global trade, finance, and technology.

The global asset management industry is central to modern capitalism.

Banks must now compete with central bank digital currencies (CBDC) and fintech payment platforms in processing inter-bank and cross-border payments worldwide.

Part 3: Biden tech advances and their broader policy implications for environmental, social, and governance (ESG) stock market investment strategies.

Artificial intelligence, 5G, and virtual reality can help transform global trade, finance, and technology.

There are several structural antitrust issues and concerns in U.S. digital markets.

What are the major demand-supply factors and concerns in light of semiconductor microchip shortages and financial services?

Electrification can help substantially reduce global carbon emissions worldwide in accordance with the Paris climate agreement.

Part 4: Biden tech advances and their broader policy implications for environmental, social, and governance (ESG) stock market investment strategies.

The Biden Inflation Reduction Act is central to modern world capitalism.

What are the top global macro tech risks?

Government intervention remains a major influence over global trade, finance, and technology.

The bank-credit-card model and fintech platforms have adapted well to the recent digitization of cashless finance.

The new world order of trade helps accomplish non-economic policy goals such as national security and environmental protection.

Length: 206 pages (90,405 words)

AYA fintech network platform provides the safe and secure online payment gateway through PayPal, the biggest online fund transfer platform in USA with 83% online market penetration. https://ayafintech.network/model.php

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-10-15 09:13:00 Tuesday ET

U.K. prime minister Boris Johnson encounters defeat during his new premiership. The first major vote would pave the path of least resistance to passing a no

2019-04-11 07:35:00 Thursday ET

European Central Bank designs its current monetary policy reaction function and interest rate forward guidance in response to key delays in inflation conver

2018-06-09 16:40:00 Saturday ET

The Trump administration introduces new tariffs on $50 billion Chinese goods amid the persistent bilateral trade dispute. The tariffs effectively boost cost

2018-09-30 14:34:00 Sunday ET

Goldman, JPMorgan, Bank of America, Credit Suisse, Morgan Stanley, and UBS face an antitrust lawsuit. In this lawsuit, a U.S. judge alleges the illegal cons

2017-08-01 09:40:00 Tuesday ET

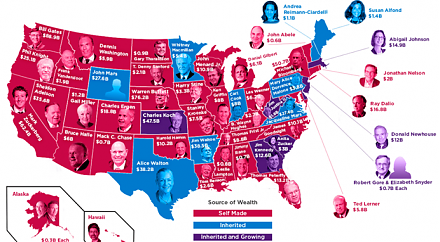

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N

2023-08-28 08:26:00 Monday ET

Jared Diamond delves into how some societies fail, succeed, and revive in global human history. Jared Diamond (2004) Collapse: how societies