2019-02-17 14:40:00 Sun ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

U.S. economic inequality increases to pre-Great-Depression levels. U.C. Berkeley economics professor Gabriel Zucman empirically finds that the top 0.1% richest adults own about 25% of total household wealth in America (in accordance with a similar economic inequality situation back in the 1920s).

When we broaden the core definition of the upper socioeconomic echelon, the top 1% richest households own 40% of national wealth as of 2016. This high wealth share compares with the 25%-30% thresholds back in the 1980s. Over the past 30 years, the bottom 90% household wealth share has significantly declined in similar proportions. Russia is the only comparable country with similar wealth inequality. The current Zucman empirical study resonates with the main themes of persistent global economic inequality in the recent book, Capital in the new century, written by Thomas Piketty. The root causes of U.S. income and wealth inequality include information technology adoption, elite education, high-skill human capital shortage, and talent concentration.

The government can design affordable college and graduate school education for young adults to better prepare for their vocational pursuits. Ubiquitous information technology adoption allows fresh talents to better appreciate the knowledge-driven productivity gains from robotic automation, artificial intelligence, and smart data analysis etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-03-27 11:28:00 Wednesday ET

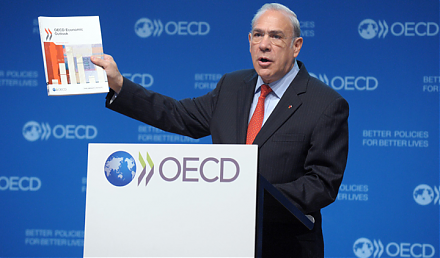

OECD cuts the global economic growth forecast from 3.5% to 3.3% for the current fiscal year 2019-2020. The global economy suffers from economic protraction

2018-11-15 12:35:00 Thursday ET

Warren Buffett approves Berkshire Hathaway to implement new meaningful stock repurchases. Buffett sends a positive signal to the stock market with the Berks

2018-05-19 09:29:00 Saturday ET

Treasury Secretary Steve Mnuchin indicates that the Trump team puts the trade war with China on hold. The interim suspension of U.S. tariffs should offer in

2018-08-21 11:40:00 Tuesday ET

President Trump criticizes his new Fed Chair Jerome Powell for accelerating the current interest rate hike with greenback strength. This criticism overshado

2022-03-15 10:32:00 Tuesday ET

Capital structure theory and practice The genesis of modern capital structure theory traces back to the seminal work of Modigliani and Miller (1958

2018-03-15 07:41:00 Thursday ET

The Trump administration's $1.5 trillion hefty tax cuts and $1 trillion infrastructure expenditures may speed up the Federal Reserve interest rate hike