2017-09-03 10:44:00 Sun ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

President Donald Trump has released his plan to slash income taxes for U.S. citizens and corporations. The corporate income tax rate will decline from 35% to 20%. The number of marginal income tax bands will be reduced to 3 at 12%, 25%, and 35%.

This tax overhaul represents a progressive pro-growth economic reform with better jobs, higher wages, and lower taxes for most American consumers, as well as lower risks, fewer financial constraints, and more investments in M&A, Capex, and R&D for many U.S. corporations. Tech stocks such as FAMGA (aka Facebook, Apple, Microsoft, Google, and Amazon) are likely to benefit most from this tax reform by repatriating offshore cash stockpiles to invest in U.S. job creation, robotic manufacturing automation, and more patent-intensive tech-savvy development in artificial intelligence, cloud software development, virtual reality, and network platform orchestration.

The ripple effect manifests in the subsequent Fed interest rate hike, greenback appreciation, and positive stock investor sentiment. All of these probable macro ramifications contribute to an upward GDP growth trajectory toward the Trump administration's 2.7%-3.3% target range.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-11-23 10:42:00 Thursday ET

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano

2019-12-04 14:35:00 Wednesday ET

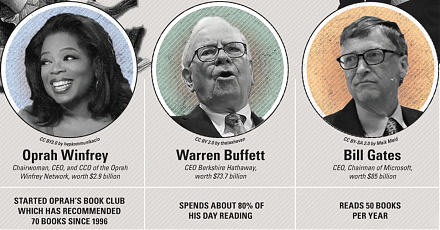

Many billionaires choose to live below their means with frugal habits and lifestyles. Those people who consistently commit to saving more, spending less, an

2019-12-30 11:28:00 Monday ET

AYA Analytica finbuzz podcast channel on YouTube December 2019 In this podcast, we discuss several topical issues as of December 2019: (1) The Trump adm

2020-05-05 09:31:00 Tuesday ET

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.

2018-07-23 07:41:00 Monday ET

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff

2025-07-05 11:23:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why working with emotional intelligence helps hone our social skills f