2018-04-17 12:38:00 Tue ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Value investment strategies make investors wiser like water with core fundamental factor analysis. Value investors tend to buy stocks below their intrinsic book values and then wait for them to rebound to fair market values. This old-school investment philosophy echoes the *buy-low-sell-high* mantra of dynamic asset management. Nonetheless, the Russell 1000 Value index now trails the Russell Growth index by 130% in the 9.5-year bull market from late-2008 to mid-2018. Also, the former lags the S%P 500 market benchmark by more than 50%. Stock market valuation blows most conventional benchmarks, and the recent mega-cap tech juggernauts drive most of this outperformance. These tech titans include Facebook, Apple, Microsoft, Google, Amazon, Netflix, and Twitter (FAMGANT).

Some recent quantitative value investment strategies have quietly transformed into smart-beta factor strategies. The latter entail attributing the broad variation in total returns to several fundamental factors such as size, value, momentum, profitability, asset growth, and market risk exposure.

Subtracting multi-beta risk premiums from total returns yields alpha estimates or average excess returns after the econometrician controls for multiple fundamental factors in the smart-beta value investment strategies. On this basis of fundamental risk adjustment, value stocks earn higher *alphas* or average excess returns than their glamor counterparts.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-08-16 17:37:00 Friday ET

Amazon faces E.U. antitrust scrutiny over the current e-commerce use of merchant data. The European Commission probes into whether Amazon uses key third-par

2019-10-23 15:39:00 Wednesday ET

American CEOs of about 200 corporations issue a joint statement in support of stakeholder value maximization. The Business Roundtable offers this statement

2019-04-17 11:34:00 Wednesday ET

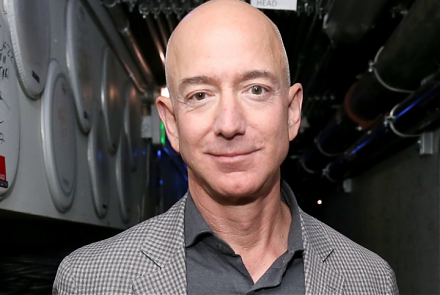

Amazon CEO Jeff Bezos admits the fact that antitrust scrutiny remains a primary imminent threat to his e-commerce business empire. In his annual letter to A

2019-11-13 11:34:00 Wednesday ET

The new Brexit deal can boost British pound appreciation and economic optimism. British prime minister Boris Johnson wins the parliamentary vote on his new

2020-09-10 08:31:00 Thursday ET

Most business organizations should continue to create new value in order to achieve long-run success and sustainable profitability. Todd Zenger (2016)

2018-06-25 12:43:00 Monday ET

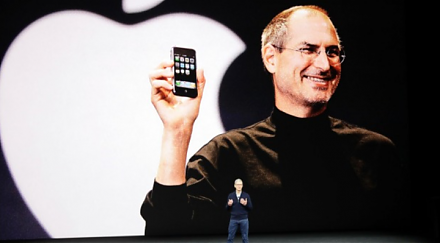

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung