2018-04-17 12:38:00 Tue ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Value investment strategies make investors wiser like water with core fundamental factor analysis. Value investors tend to buy stocks below their intrinsic book values and then wait for them to rebound to fair market values. This old-school investment philosophy echoes the *buy-low-sell-high* mantra of dynamic asset management. Nonetheless, the Russell 1000 Value index now trails the Russell Growth index by 130% in the 9.5-year bull market from late-2008 to mid-2018. Also, the former lags the S%P 500 market benchmark by more than 50%. Stock market valuation blows most conventional benchmarks, and the recent mega-cap tech juggernauts drive most of this outperformance. These tech titans include Facebook, Apple, Microsoft, Google, Amazon, Netflix, and Twitter (FAMGANT).

Some recent quantitative value investment strategies have quietly transformed into smart-beta factor strategies. The latter entail attributing the broad variation in total returns to several fundamental factors such as size, value, momentum, profitability, asset growth, and market risk exposure.

Subtracting multi-beta risk premiums from total returns yields alpha estimates or average excess returns after the econometrician controls for multiple fundamental factors in the smart-beta value investment strategies. On this basis of fundamental risk adjustment, value stocks earn higher *alphas* or average excess returns than their glamor counterparts.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-08-07 09:39:00 Monday ET

Global financial markets suffer as President Trump promises *fire and fury* in response to the recent report that North Korea has successfully miniaturized

2018-05-15 08:40:00 Tuesday ET

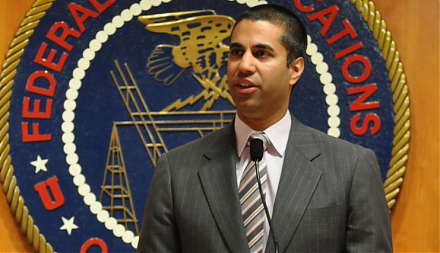

Net neutrality rules continue to revolve around the Trump administration's current IT agenda of 5G telecom transformation. Republican Senate passes the

2018-05-04 06:29:00 Friday ET

Commerce Secretary Wilbur Ross suggests that 5G remains a U.S. top technology priority in light of the telecom merger proposal between Sprint and T-Mobile a

2019-08-18 11:33:00 Sunday ET

House Judiciary Committee summons senior executive reps of the tech titans to assess online platforms and their market power. These companies are Facebook,

2018-10-11 08:44:00 Thursday ET

Treasury bond yield curve inversion often signals the next economic recession in America. In fact, U.S. bond yield curve inversion correctly predicts the da

2018-08-05 12:34:00 Sunday ET

JPMorgan Chase CEO Jamie Dimon sees great potential for 10-year government bond yields to rise to 5% in contrast to the current 3% 10-year Treasury bond yie