2017-08-25 13:36:00 Fri ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

The U.S. Treasury's June 2017 grand proposal for financial deregulation aims to remove several aspects of the Dodd-Frank Act 2010 such as annual macro stress tests, supervisory bank capital reviews, proprietary trading restrictions, and so forth. Fed Vice Chair Stanley Fischer warns that the current financial deregulation can be extremely dangerous and myopic: "It took almost 80 years after 1930 for America to experience another [global] financial crisis that could have been of that magnitude... now after 10 years everyone wants to return to a status quo before the [next financial downturn]."

As prior monetary policy turns out to be a rather ineffective solution for the post-crisis macro malaise, fiscal stimulus garners a lion's share of public attention toward lower income taxation and indefinite tax holiday for corporate offshore cash repatriation. Regardless of whether the Dodd-Frank supervisory stress instruments should remain for a more stable U.S. banking system, the Fischer comment rings the alarm bell of fiscal quid pro quo for weak monetary stimulus. This information exchange offers valuable food for thought to the typical stock market investor. While the trend can be his or her friend, the investor needs to weigh the pros and cons of short-term stock price momentum vis-a-vis the close nexus between long-term economic fluctuations and stock market gyrations.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-03 11:35:00 Wednesday ET

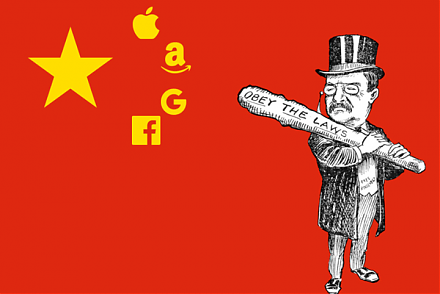

U.S. regulatory agencies may consider broader economic issues in their antitrust probe into tech titans such as Amazon, Apple, Facebook, and Google etc. Hou

2017-10-27 06:35:00 Friday ET

Leon Cooperman, Chairman and CEO of Omega Advisors, points out that the current Trump stock market rally now approaches normalization. The U.S. stock market

2017-09-25 09:42:00 Monday ET

President Trump has allowed most JFK files to be released to the general public. This batch of documents reveals many details of the assassination of Presid

2018-06-03 07:35:00 Sunday ET

Several recent events explain why Trump may undermine multilateral world order. First, Trump withdraws the U.S. from the 12-nation Trans-Pacific Partnership

2018-07-01 08:34:00 Sunday ET

Are China and Russia etc gonna dethrone the petrodollar? Over the years, China, Russia, France, Germany, and Japan have made numerous attempts to use their