2019-03-17 14:35:00 Sun ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

U.S. trade rep Robert Lighthizer proposes America to require regular touchpoints to ensure Sino-U.S. trade deal enforcement. America has to maintain the threat of tit-for-tat tariffs on Chinese goods for years even though the Trump administration seeks to achieve a new agreement with China to end the prohibitively costly Sino-U.S. trade war. U.S. trade negotiators and lawmakers need to monitor-and-enforce Chinese compliance with the new trade rules. The Trump team aims to eradicate the $350 billion bilateral U.S. trade deficit. In response, the Chinese administration offers to buy $1.2 trillion U.S. goods and services over the next 6 years. Also, the Trump administration has to deter the Chinese government from forcing U.S. tech companies to involuntarily transfer trade secrets, tech advances, and other major intellectual properties such as patents, trademarks, and copyrights.

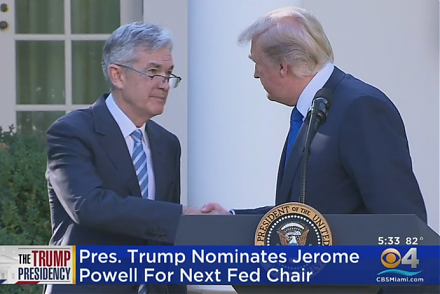

On balance, tariffs remain an important instrument for the Trump administration to push China to start structural trade policy changes in light of the specific perennial enforcement issue. Due to few major surprises, U.S. stock market indices such as from S&P 500 to Dow Jones and NASDAQ remain steady after the congressional testimonies by U.S. trade envoy Robert Lighthizer and Fed Chair Jerome Powell.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2025-09-18 08:03:32 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2017-10-03 18:39:00 Tuesday ET

President Trump has nominated Jerome Powell to run the Federal Reserve once Fed Chair Janet Yellen's current term expires in February 2018. Trump's

2019-06-05 10:34:00 Wednesday ET

Fed Chair Jay Powell suggests that the recent surge in U.S. business debt poses moderate risks to the economy. Many corporate treasuries now carry about 40%

2024-02-04 08:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2024. Our proprietary alpha investment model outperforms the ma

2017-03-03 05:39:00 Friday ET

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2022-04-25 10:34:00 Monday ET

Corporate ownership governance theory and practice The genesis of modern corporate governance and ownership studies traces back to the seminal work