2018-02-01 07:38:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

U.S. senators urge the Trump administration with a bipartisan proposal to prevent the International Monetary Fund (IMF) from bailing out several countries that face predatory Chinese loans. These predatory Chinese loans are part of the Belt-and-Road infrastructure development plan for the next decade. Belt-and-Road is a $8 trillion global infrastructure plan that the Xi administration now uses to expand its economic prowess around the world.

In effect, the Xi administration makes productive use of this infrastructure debt to control the economic policies in Asian countries such as Sri Lanka and Pakistan. President Xi intends to transform Belt-and-Road into a new world economic order with fresh and unique Chinese dominance.

U.S. State Secretary Mike Pompeo points out that at least 23 of these 68 Belt-and-Road countries now face financial debt difficulties. This debt distress signals the collective reliance of Belt-and-Road countries on China. Also, China holds about $1.2 trillion U.S. Treasury bonds, bills, and notes and hence can directly influence the U.S. yield curve. Should the Belt-and-Road countries fail to honor their principal and interest payments on their current debt contracts with China in the absence of IMF bailout finance, the Xi administration may unload its Treasury bond positions. In turn, China may effectively use its rich foreign reserves to entrench its current 260% public-debt-to-GDP ratio and Belt-and-Road infrastructure debt distress.

In the worst-case scenario, these ripple effects may inadvertently cause U.S. yield curve inversion. U.S. yield curve inversion reflects a negative term spread between short-term and long-term interest rates, indicates corporate investment sentiments with respect to mergers and acquisitions and capital expenditures, and hence often recurs in the early dawn of a severe economic recession. This red alert poses a major gray rhino, or some obvious highly probable negative incidence, in contrast to improbable black-swan rare events such as the U.S. subprime mortgage crisis, the European sovereign debt spiral, and the Global Great Depression. For these legitimate reasons, the Trump administration's advisors such as Pompeo, Mnuchin, and Kudlow need to alleviate this economic security concern in due course.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2024-10-27 07:56:01 Sunday ET

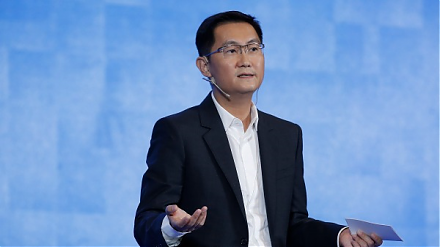

Stock Synopsis: China Internet tech titans continue to grow amid greater competition. We launch our unique coverage of top 25 China Internet stocks. In t

2018-10-23 12:36:00 Tuesday ET

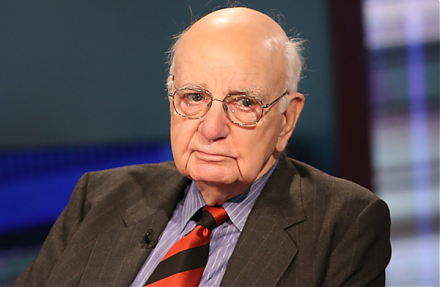

Former Fed Chair Paul Volcker releases his memoir, talks about American public governance, and worries about plutocracy in America. Volcker suggests that pu

2018-05-02 06:32:00 Wednesday ET

What are the primary pros and cons of free trade or fair trade in the current Sino-American quagmire? Free trade means allowing goods and services to move a

2018-08-17 11:45:00 Friday ET

In accordance with the extant corporate disclosure rules and requirements, all U.S. public corporations have to report their balance sheets, income statemen

2018-01-03 08:38:00 Wednesday ET

President Trump targets Amazon in his call for U.S. Postal Service to charge high delivery prices on the ecommerce giant. Trump picks another fight with an

2020-05-05 09:31:00 Tuesday ET

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.