2019-07-03 11:35:00 Wed ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

U.S. regulatory agencies may consider broader economic issues in their antitrust probe into tech titans such as Amazon, Apple, Facebook, and Google etc. House Judiciary Committee now expects to hold the inaugural session on anti-competitive practices among these tech companies. This new investigation represents the first congressional probe into allegations that these tech companies may abuse their quasi-monopoly power with suspicious anti-competitive behaviors.

House Democrats back this landmark investigation, and Republicans also have huge concerns around the potential abuse of tech monopoly power (although most conservatives intend to avoid excessive government intervention). Federal Trade Commission and Justice Department focus on how Facebook and Google affect consumer privacy and competitor survival across the news media landscape. The regulatory agencies also probe into whether Apple abuses its market power in collaboration with Spotify to dominate digital music and the key iOS app ecosystem. Moreover, the regulatory agencies examine whether Amazon not only drives down retail prices but also conducts collusive schemes in e-commerce.

Antitrust scrutiny remains one of the biggest bipartisan tech issues. The regulatory agencies may impose punitive fines to diminish the market power of the tech titans, or may break up some of the tech titans for better consumer welfare and competitor survival.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-06-19 10:31:00 Monday ET

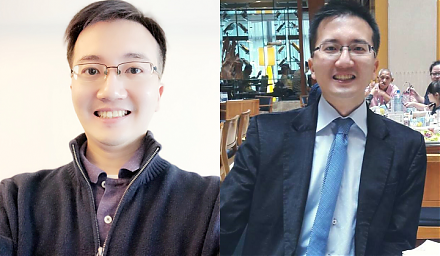

A brief biography of Dr Andy Yeh (PhD, MFE, MMS, BMS, FRM, and USPTO patent accreditation) Dr Andy Yeh is responsible for ensuring maximum sustainable me

2025-09-14 14:23:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-10-21 10:35:00 Monday ET

American state attorneys general begin bipartisan antitrust investigations into the market power and corporate behavior of central tech titans such as Apple

2024-04-30 09:30:00 Tuesday ET

With clean and green energy resources and electric vehicles, the global auto industry now navigates at a newer and faster pace. Both BYD and Tesla have

2025-10-08 11:34:00 Wednesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-05-05 07:33:00 Saturday ET

Warren Buffett shares his fresh economic insights and value investment strategies at the Berkshire Hathaway shareholder forum in May 2018 despite the new GA