2018-10-25 10:36:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Trump tariffs begin to bite U.S. corporate profits from Ford and Harley-Davidson to Caterpillar and Walmart etc. U.S. corporate profit growth remains high at 22% as of October 2018, but fewer S&P 500 companies manage to beat stock analyst estimates of both bottom-lines and sales. This lackluster stock performance erodes investor sentiment and thus contributes to the recent sharp sell-off in equities. The negative ripple effects and externalities spread to East Asian and European stock markets.

On the quiet western front, President Trump remains rather bellicose toward China, whereas, the Chinese trade delegates, diplomats, and negotiators etc become less belligerent and less truculent in the Sino-U.S. trade standoff. In the meantime, the Federal Reserve continues the current neutral interest rate hike to contain inflation and wage growth in America. Key greenback appreciation arises as a result of this current interest rate hike. As a consequence, U.S. dollar appreciation exacerbates the bilateral trade deficit between America and China.

In this light, the Trump administration may or may not be able to effectively curb the current bilateral trade deficit with China. The Federal Reserve monetary policy reaction can lead to U.S. dollar appreciation that inevitably weakens the impact of Trump tariffs on Chinese imports.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-11-25 06:34:00 Saturday ET

Mario Draghi, President of the European Central Bank, heads the international committee of financial supervisors and has declared their landmark agreement o

2024-01-31 14:33:00 Wednesday ET

The new world order of trade helps accomplish non-economic policy goals such as national security and technological dominance. To the extent that freer

2025-06-21 05:25:00 Saturday ET

President Trump refreshes American fiscal fears, worries, and concerns through the One Big Beautiful Bill Act. The Congressional Budget Office (CBO) estimat

2018-07-11 09:39:00 Wednesday ET

In recent times, the Trump administration sees the sweet state of U.S. economic expansion as of early-July 2018. The latest CNBC All-America Economic Survey

2017-07-13 08:35:00 Thursday ET

President Donald Trump has announced that a major Apple iPhone upstream supplier, Foxconn Technology Group (aka Hon Hai Precision Group), will invest $10 bi

2017-12-01 06:30:00 Friday ET

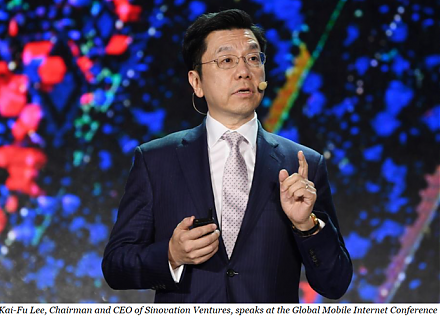

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M