2019-06-17 11:25:00 Mon ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

To secure better economic arrangements with European Union, Jeremy Corbyn encourages Labour legislators to back a second referendum on Brexit. In recent times, Theresa May has indicated her intention to resign as British Prime Minister, and the European election results shine light on a second referendum on Brexit. Nigel Farage, his Brexit Party, and Conservative Brexit supporters are likely to fight hard against Corbyn-led Labour legislators.

Labour Party now has a strategic advantage if Corbyn and his fellow MPs pivot in favor of a second Brexit referendum. As the European Union remains the largest trade bloc to Britain, Britons must reconsider the economic pros and cons of closer trade ties with the Eurozone. The Brexit withdrawal agreement may involve a gross amount of €100 billion. Net of some U.K. assets, the final bill would involve about €65 billion. The key withdrawal transfer funds can contribute to better British health care, welfare, infrastructure, taxation, and other aspects of public finance. However, Britons primarily use the British pound but not the Euro, thereby the U.K. has never been part of the E.U. monetary union. Many British millennials prefer to remain in the E.U. for closer trade ties and better economic arrangements.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-09-03 14:29:00 Tuesday ET

Due to U.S. tariffs and other cloudy causes of economic policy uncertainty, Apple, Nintendo, and Samsung start to consider making tech products in Vietnam i

2020-09-03 10:26:00 Thursday ET

Agile business firms beat the odds by building faster institutional reflexes to anticipate plausible economic scenarios. Christopher Worley, Thomas Willi

2023-03-28 11:30:00 Tuesday ET

The Federal Reserve System conducts monetary policy decisions, interest rate adjustments, and inter-bank payment operations. Peter Conti-Brown (2017)

2023-04-21 12:39:00 Friday ET

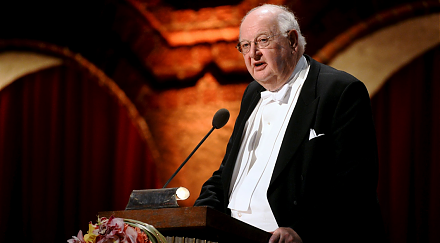

Angus Deaton analyzes the correlation between health and wealth in light of the economic origins of inequality worldwide. Angus Deaton (2015)

2017-03-03 05:39:00 Friday ET

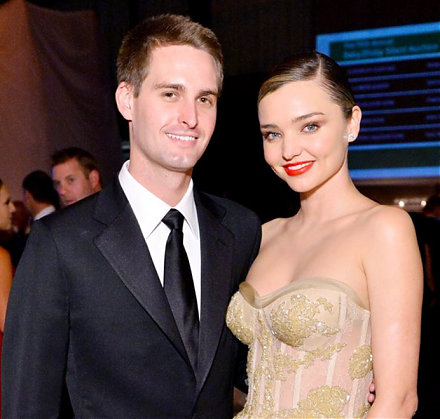

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2019-07-21 09:37:00 Sunday ET

Facebook introduces a new cryptocurrency Libra as a fresh medium of exchange for e-commerce. Libra will be available to all the 2 billion active users on Fa