2023-04-07 12:29:00 Fri ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Timothy Geithner (2014)

Macrofinancial stress tests: reflections on financial crises

Former Treasury Secretary Timothy Geithner shares his reflections and details of how macrofinancial stress tests show the U.S. political constraints and lessons for future financial crises and rare events such as the Global Financial Crisis of 2008-2009. Geithner supports the creative and constructive use of overwhelming force to re-establish investor confidence, whereas, the classical rule for fighting financial crises suggests that the central bank should lend against good collateral at a high discount rate. Although the Federal Reserve crisis rescue programs often need to be anonymous with no revelation of weak bank identities, the macrofinancial stress tests help discover vital information for open bank resolution and liquidity provision. In essence, both the asset relief programs and macrofinancial stress tests can help alleviate the fundamental concerns about moral hazard from many crisis response policies amid the Great Recession. In accordance with the dual mandate of price stability and maximum employment, the Treasury and Federal Reserve coordinate their joint efforts via large-scale asset purchases, zero interest rates, and several fiscal stimulus programs etc in order to revive the American real economy in terms of better economic growth, employment, and capital investment accumulation. The historical record of both the formation and implementation of U.S. policy responses offers fresh economic insights into the Global Financial Crisis. Future policymakers can learn from this historical record to cope with future crises and recessions.

Geithner emphasizes conducting triage during the Global Financial Crisis. Further, Geithner highlights the importance of avoiding stigma in terms of the costs to banks from revealing their institutional identities at near-term emergency bank capital and liquidity programs. Geithner has to navigate through domestic political constraints. Soon after the failure of Lehman Brothers, Geithner learns to deal with the financial policy naysayers to time the use of overwhelming force. With the Federal-Reserve-Treasury fiscal-monetary coordination, Geithner and Fed Chair Ben Bernanke then introduce macrofinancial stress tests as a new prudential policy tool to re-establish investor confidence in the financial system. In rare times of severe financial stress, the law of inadvertent consequences counsels caution. In the worst-case scenario, it would be wise for both fiscal and monetary policy decision-makers to ensure that most big banks retain sufficient equity capital buffers to safeguard against extreme losses amid macro financial turmoil.

Overwhelming force refers to having a credibly large amount of policy commitment for fiscal and monetary policy decision-makers to apply with judicious discretion in rare times of severe macro financial stress. Earlier non-U.S. financial crises include the Mexican currency crisis and the East Asian bank run etc. Congress would need to expand fiscal and monetary policy authority for better bank failure resolution and crisis response. The subsequent episodes of Lehman Brothers and AIG persuade the incumbent administration to seek legislative authority to overhaul the American financial system. Geithner has to time the use of overwhelming force at the suitable pace. Overwhelming force cannot come too early because this early warning signal may indicate that the situation is worse than most market expectations. In addition, overwhelming force cannot come too late because this tool would be less effective for most policy practitioners to reduce the adverse impact of the rare financial crisis. As Geithner suggests in his personal reflections of the Global Financial Crisis 2008, any policy response is open to the charge of moral hazard; however, a crisis is not the right time for most policymakers to address this issue. Moral hazard is perhaps controversial, and both fiscal and monetary policy decision-makers should attempt to ameliorate the next financial crisis in the first place.

Bernanke and Geithner suggest that they would not be able to avoid the eventual failure and bankruptcy of Lehman Brothers back in September 2008. Whether big banks should be viewed as too big to fail remains open to controversy. The classic Bagehot rule suggests that the central bank should offer near-term liquidity finance against good bank collateral in rare times of severe financial stress. However, what constitutes good bank collateral is not clear during a major crisis. For this reason, the classic rule is passive and incomplete in response to the Global Financial Crisis of 2008-2009. Pervasive stigma can arise from the worst-case scenario where the bank remains reluctant to go through the discount window due to fears of technical default because depositors, creditors, and investors may view this stigma as a sign of bank vulnerability. In turn, this stigma can cause banks to borrow at much higher costs. This stigma can even lead to an unfortunate bank run. In this light, Geithner advocates the new principle that it is paramount for most policymakers to maintain the secrecy of bank identities during financial crises. The U.S. congressional asset relief program would allocate $700 billion among big banks for rare loss absorption. At the same time, the macrofinancial stress tests would require the banks to figure out how much capital helps safeguard against extreme losses in several pro forma stress scenarios. U.S. regulators can stipulate these rare stress scenarios in terms of macroeconometric likelihood. In effect, the macrofinancial stress tests can help reduce residual uncertainty about bank solvency and equity capital conservation.

Appropriate policy responses to the Global Financial Crisis 2008 are fundamentally about calibrating bank capital requirements to the prevalent market expectations. From this fundamental viewpoint, the banks need to be confident that it is safe for them to extend credit again. Geithner proposes that the smart use of overwhelming force is the key to regaining investor confidence. In essence, overwhelming force requires supporting fiscal and monetary policies with a sufficiently large amount of money. U.S. Treasury and Federal Reserve System should convince most market participants to perceive this war chest as sufficient.

A financial crisis is often a systemic rare event. Most of the big banks would need to transform their business structure to avoid failure, insolvency, or bankruptcy via mergers and acquisitions (Bear Stearns, Countryside, Merrill, and Wachovia etc), additional capital injections from the government (AIG, Bank of America, Citigroup, Fannie, and Freddie), or reorganizations (Goldman Sachs, JPMorgan Chase, and Morgan Stanley etc). Bank runs are about cash as banks must pay out cash to key lenders who cannot roll over their short-term debt contracts. The banks would then have to sell assets to raise cash. These fire sales can cause substantial asset price declines. The vast majority of asset prices correlate and decrease substantially at the same time. Such asset price declines can cause reductions in bank risk control incentives and margin calls. With less effective financial risk management systems, borrowers would need to sell assets to meet these margin calls. With 95%+ short-term debt, some systemic banks cannot meet their obligations in due course. The counterparties sometimes overreact to this problem by liquidating the collateral at substantial haircuts. A self-reinforcing downward spiral of higher haircuts can force fire sales with substantially lower asset prices across the entire financial system.

In the broader business context of a severe crisis, market prices and expectations become less informative. If the bank sells an asset at its $100 par value this week, the same bank may not be able to sell the asset at $55 when a financial crisis hits tomorrow. However, the asset may be worth $87 in 5 years. When push comes to shove, it would be quite difficult for the bank (even the central bank and some other financial regulators) to determine the true asset value with some major write-down or haircut. In a severe financial crisis, insolvency can be in the eye of the beholder. If the big banks would need to mark all their assets to the respective market prices during massive fire sales, most of these big banks would be technically insolvent. Most U.S. financial markets would effectively shut down for a wide range of asset securitizations. Inter-bank markets would shut down too. In any case, asset prices cannot be readily observable (especially in rare times of severe financial stress).

In a severe financial crisis, most banks face the fear of adverse selection that many counterparties can choose to engage in private price discovery. In this worst-case scenario, the banks sell assets to raise cash. Since the vast majority of the banks sell assets at the same time, most asset prices plummet due to bank contagion. In a bank run, no one wants the bank assets for fear of adverse selection. Specifically, no private actors want to buy these bank assets in a systemic financial crisis. Only the government would serve the vital role of the lender of last resort.

Short-term debt can be an optimal security for trading valuable assets because no economic actor has an incentive to privately produce information about the ultimate payoffs of the debt. This debt is free from adverse selection. In effect, information insensitivity equates liquidity. A bank run or panic is a rare information event, and a severe crisis occurs when the short-term debt becomes information sensitive as the pervasive fear of adverse selection makes market prices much less informative. Short-term debt that emerges from the asset securitization of subprime mortgages works well in practice until lenders start to doubt the value and quality of the asset securitization process. Many market participants and economic actors further lose confidence in the quality assurance mechanism design of special purpose vehicles (SPV) for asset securitization. Geithner views the Global Financial Crisis of 2008-2009 as the main result of information cascades from subprime mortgage defaults. In this fundamental view, the Global Financial Crisis is a rare bank panic event that differentiates itself from a typical economic recession.

Geithner emphasizes the major issue of bank stigma in the use of the central bank discount window. Most banks often remain reluctant to go to the discount window because depositors, creditors, and investors tend to regard this access as an early warning sign of bank weakness, vulnerability, or even insolvency. This stigma can cause banks to borrow at higher costs of capital. Sometimes, this pervasive stigma can even generate a bank run. In light of these considerations, Geithner suggests that bank stigma represents a real clear and present danger in rare times of severe financial stress. Some actuarial estimation shows that discount window stigma can be economically relevant as this stigma increases bank costs of capital by 33% of net average income during the Global Financial Crisis of 2008-2009. Bank stigma would create serious problems if the financial regulators reveal borrower identities. This stigma can quickly place the bank in a subpar condition vis-à-vis its rivals and competitors by causing an inevitable loss of public confidence in the wider financial system. The ripple effects can manifest in the form of a sudden outflow of deposits, a bank run, a key loss of investor confidence, or a withdrawal of market sources of liquidity. In extreme cases, these information cascades can lead to closure, failure, insolvency, or even bankruptcy of the bank. If bank-specific information leaks out, the financial system may unravel sequentially as the weakest bank experiences a massive bank run, and then the next weakest bank follows suit, and so on. For this reason, it is important for the financial regulators to design anonymous emergency capital programs to protect bank-specific information and stock return performance. The government has to show both the will and capacity to resolve the rare financial crisis through a credible anonymous emergency capital program, liquidity provision, and overwhelming force. This smart combination helps assuage pervasive investor concerns about bank insolvency and equity capital conservation.

Given his prior experiences with financial crises, Geithner proposes the smart use of overwhelming force to cope with rare events such as the Global Financial Crisis of 2008-2009. Overwhelming force arises from the bank asset relief program, part of the Emergency Economic Stabilization Act 2008. This U.S. legislation authorizes $700 billion expenditures for U.S. banks to recover from the Global Financial Crisis of 2008 due to the adverse impact of widespread subprime mortgage defaults. The first step entails injecting at least $125 billion common equity capital to the 9 largest banks, which account for almost 70% of all bank assets in the U.S. financial system. In order to prevent revealing the relative strengths and weaknesses of the 9 largest banks, the financial regulators require all the 9 largest banks to take the emergency capital. This requirement effectively helps reduce bank stigma in the crisis.

Overwhelming force is about managing market expectations in the broader context of a macroprudential information-sensitive environment from a systemic viewpoint because bank-specific information is not present (as a matter of policy). To ensure positive expectations of asset market stabilization, policy decision-makers such as Bernanke and Geithner must demonstrate that the war chest is large enough to be readily available to all of the systemically important financial institutions (SIFIs). In practice, there is no way for the policymakers to know in advance whether the war chest suffices to avoid bank stigma and insolvency etc. The Treasury and Federal Reserve System mull over numerous types of overwhelming force policies such as deposit freezes, bank holidays, blanket guarantees of bank debt, large-scale asset purchases, or bank reorganizations. These alternative policies represent essential forms of medium-term liquidity support. Their success or failure often relates to the credibility of bank capital resources in support of overwhelming force policies.

In a colossal crisis (such as the eventual failure of Lehman Brothers), no financial regulators would want to allow a messy liquidation of a major systemic bank unless the regulators can manage to draw a circle of protection around the rest of the core financial system (a firebreak for the financial regulators to contain the flames). After the eventual failure of Lehman Brothers, the government still conveys to the public that bailouts have come to an end. In this crisis, rational investors would run from other systemic banks. The information cascades would inevitably cause additional rare events such as bank failures, reorganizations, pervasive asset price declines, and other systemic complications etc. Solvency is in the eye of the beholder. The Treasury and Federal Reserve System must prevent bank failure contagion in light of the core trade-off between moral hazard creation and open bank recapitalization. However, this dichotomy of bailing out banks or not is a false one because the best policies would help prevent financial crises in the first place (at least for significant periods of time from the 1930s to 2007).

There are many good reasons why banks would not engage in moral hazard. One reason is that the bank charter value depreciates substantially if the bank becomes insolvent. Charter value is the present value of economic rents that the bank keeps due to the extant barriers to new entry. Another reason shows that bank reputation would be lost if the bank becomes insolvent. The bank-specific information can be lost in the rare event of bank insolvency. Through his time at the Federal Reserve Bank of New York and then the Treasury, Geithner learns that the systemic banks with internal cultures of sound risk management tend to be financially stronger with better common equity capital conservation.

Geithner indicates that the macrofinancial stress tests would serve as a fresh form of triage. In effect, this triage helps separate the fundamentally healthy banks from the terminally ill. If a financially unhealthy bank cannot raise enough equity capital from private investors, the government would forcibly inject the emergency capital. This bank capital support helps reduce residual uncertainty about extreme losses on bank assets. The macrofinancial stress tests further shine fresh light on opaque financial institutions and their opaque bank assets. From a fundamental viewpoint, the macrofinancial stress tests can help reduce economic policy uncertainty as this uncertainty causes the bank run or subprime mortgage credit contagion.

With the Treasury and Federal Reserve Supervisory Capital Assessment Program (SCAP), the banks have to quantify extreme losses, profits, and loan loss reserves over the next 9 quarters under a baseline scenario and an adverse stress scenario. The financial regulators make their own independent projections under each worst-case scenario. Comparing the bank capital projection to the regulatory one yields the capital shortfall. In the presence of a significant capital shortfall, the bank must formulate proactive plans to ameliorate the capital shortfall in the medium term. If the bank cannot fill the capital shortfall in the medium term, the bank would bridge private capital through the Treasury Capital Assistance Program (CAP).

The macrofinancial stress tests focus on abnormal stock returns with no new basic information. In retrospect, the SCAP represents one of the critical turning points in the Global Financial Crisis of 2008-2009. Supervisory disclosure of macrofinancial stress test results can help restore investor confidence in the financial system with some smooth and successful open bank recapitalization. Both credible supervisory capital assistance and assessment would be vital to asset market stabilization.

The new Basel III internal risk models and parameters often tend to systematically underpredict actual default rates. Through the macroeconomic cycle, the resultant capital bias adjustment would result in substantial increases in minimum regulatory capital requirements. With the new Basel III bank capital regime, many banks have the incentive and discretion to try to evade rules in some gray areas. The financial regulators often take proactive actions to catch these banks. However, the banks themselves cannot reverse-engineer the supervisory macro stress test models. In these macrofinancial stress tests, only the financial regulators know and figure out the supervisory models. In a unique fashion, the discretion has been shifted in this direction. It is important for the financial regulators to ensure that the banks cannot game the unknown supervisory models for macrofinancial stress tests. In essence, these macro stress tests can be microprudential or macroprudential in nature. The macrofinancial stress tests can help find weak banks. Alternatively, these tests can focus on finding fragile macrofinancial features from a systemic viewpoint.

The macrofinancial stress tests turn out to serve as a major financial innovation in the Global Financial Crisis of 2008-2009. These macro stress tests continue to be important in some future form in both normal times and rare times of macrofinancial stress. To avoid revealing the relative strengths and weaknesses of the big banks, the financial regulators use overwhelming force to require all the big banks to take the emergency capital. In effect, this supervisory requirement helps reduce stigma in the severe financial crisis. Geithner uses overwhelming force to better manage market expectations in the wider systemic information environment because bank-specific information is absent as a matter of policy. In the crisis, both the fiscal and monetary policymakers ensure positive expectations of asset market stabilization because the war chest is sufficiently large to be available to all of the systemically important financial institutions (SIFIs).

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2021-11-22 11:29:00 Monday ET

U.S. judiciary subcommittee delves into the market dominance of online platforms in terms of the antitrust, commercial, and administrative law in America.

2019-02-06 10:36:49 Wednesday ET

President Trump delivers his second state-of-the-union address to U.S. Congress. Several key themes emerge from this presidential address. First, President

2018-06-01 07:30:00 Friday ET

The U.S. federal government debt has risen from less than 40% of total GDP about a decade ago to 78% as of May 2018. The Congressional Budget Office predict

2017-12-01 06:30:00 Friday ET

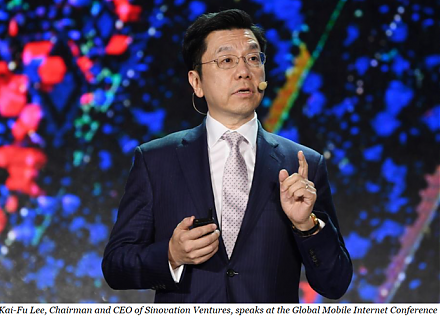

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M

2023-05-21 12:26:00 Sunday ET

Amy Chua and Jed Rubenfeld suggest that relatively successful ethnic groups exhibit common cultural traits in America. Amy Chua and Jed Rubenfeld (2015)

2019-11-19 09:33:00 Tuesday ET

American unemployment declines to the 50-year historical low level of 3.5% with moderate job growth. Despite a sharp slowdown in U.S. services and utilities