2019-05-07 09:30:00 Tue ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

The Trump team receives a 3.2% first-quarter GDP boost as Fed Chair Jay Powell halts the next interest rate hike in early-May 2019. This smooth upward economic trajectory exceeds most stock market expectations and projections of about 2.5% real GDP growth as of 2019Q1. Moreover, this favorable rebound puts to rest prior pervasive investor fears of an economic recession. This key economic momentum arises without fresh inflationary pressure. As core CPI inflation continues to hover near the 2% target level and the U.S. economy operates with lower unemployment near 3.6%, the Federal Reserve remains patient on the next round of interest rate adjustments after mid-2019.

In the current economic scenario, there is no clear trade-off between inflation and unemployment as the New Keynesian Phillips Curve (NKPC) might indicate. The Phillips curve seems to substantially flatten in recent years, thus the U.S. economy operates near full employment with low inflation. This economic outlook resonates with the Federal Reserve dual mandate of maximum sustainable employment and price stability. Meanwhile, the greenback depreciates a little for U.S. export prices to remain competitive in the global economic landscape. These positive economic events can contribute much to the Trump economic scorecard for his presidential re-election in 2020.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-04-24 11:33:00 Friday ET

Disruptive innovations tend to contribute to business success in new blue-ocean markets after iterative continuous improvements. Clayton Christensen and

2020-06-10 10:35:00 Wednesday ET

Most lean enterprises should facilitate the dual transformation of both core assets with fresh cash flows and new growth options. Scott Anthony, Clark Gi

2018-05-29 11:40:00 Tuesday ET

America and China, the modern world's most powerful nations may stumble into a **Thucydides trap** that Harvard professor and political scientist Graham

2024-02-04 08:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2024. Our proprietary alpha investment model outperforms the ma

2018-06-25 12:43:00 Monday ET

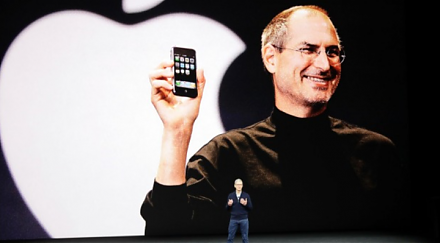

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

2018-03-15 07:41:00 Thursday ET

The Trump administration's $1.5 trillion hefty tax cuts and $1 trillion infrastructure expenditures may speed up the Federal Reserve interest rate hike