2017-08-07 09:39:00 Mon ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Global financial markets suffer as President Trump promises *fire and fury* in response to the recent report that North Korea has successfully miniaturized nuclear warheads to place on intercontinental ballistic missiles (ICBMs) in the face of new economic sanctions. Trump follows up with inaccurate tweets about the more powerful U.S. nuclear arsenal, whereas, State Secretary Rex Tillerson and Defense Secretary Jim Mattis both urge de-escalating the current situation and warn against North Korea's prospective nuclear threats and missile strikes near the U.S. military bases in Guam. In the presence of the dictatorial regime's ICBMs and nuclear threats, the current standoff might eventually become the Nash equilibrium of mutually-assured destruction (MAD).

This deterrence doctrine helps prevent subsequent escalation and belligerence on both sides (U.S. and North Korea now and U.S. and Russia in the cold war and the Cuban missile crisis). Due to this imminent political complexity, global stock markets experience a pervasive decline in market valuation. This decline may be a temporary dip, and this transience can be a valuable stock investment opportunity for the typical contrarian investor.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-01-23 06:38:00 Tuesday ET

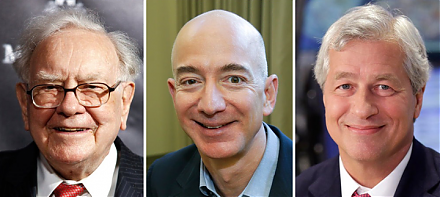

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

2017-12-07 08:31:00 Thursday ET

Large multinational tech firms such as Facebook, Apple, Microsoft, Google, and Amazon can benefit much from the G.O.P. tax reform. A recent stock research r

2017-02-25 06:44:00 Saturday ET

As the White House economic director, Gary Cohn suggests that the Trump administration will tackle tax cuts after the administration *repeals and replaces*

2020-06-24 09:32:00 Wednesday ET

Several business founders and entrepreneurs take low risks with high potential rewards to buck the conventional wisdom. Renee Martin and Don Martin (2010

2019-04-19 12:35:00 Friday ET

Federal Reserve proposes to revamp post-crisis rules for U.S. banks. The current proposals would prescribe materially less strict requirements for community

2019-04-26 09:33:00 Friday ET

JPMorgan Chase CEO Jamie Dimon defends capitalism in his recent annual letter to shareholders. As Dimon explains here, socialism inevitably produces stagnat