2022-02-22 09:30:00 Tue ET

stock market federal reserve monetary policy treasury fiscal policy deficit debt bankruptcy currency dollar renminbi payment technology paypal alibaba tencent facebook covid-19 employment inflation fintech global macro outlook stock investment asset management

Mutual funds, pension funds, sovereign wealth funds, endowment trusts, and asset management companies own and control more than $100 billion worth of financial assets such as stocks, bonds, currencies, and futures worldwide. The global asset management industry earns professional fees and commissions from both active and passive multi-asset investment optimization. Central to modern capitalism, this asset management industry often tends to focus on stocks, bonds, currencies, and so on. Asset managers support both domestic employment and economic growth by directing capital to public corporations, lean startups, or tech unicorns. The core business opportunities lead to the best growth prospects in e-commerce, software, Internet search, cloud service provision, social media, mobile connectivity, electric car production, green energy provision, or semiconductor microchip production etc. Higher returns can help ordinary savers and savvy investors to reach their financial goals such as retirement, financial freedom, education, and so forth. Further, asset managers play an important social role in acting as the guardians and stewards of both corporate boards and upper echelons for better performance in pursuing long-term environmental, social, and governance (ESG) goals and missions.

In asset management, profit margins are high by the standards of many other core industries. For most global asset management companies, the profit margins often exceed 35%. Despite recent consolidation, asset management is a fractal industry with no clear exploitation of market power by a few large oligarchs and numerous new entrants. Mutual fund managers often cannot beat the U.S. stock market index. From time to time, arithmetic odds are not in their favor. It is as impossible for most investor to outperform the U.S. stock market index as for everyone to be of above average height and intelligence. The empirical evidence of long-term stock market outperformance is quite rare. Few fund managers turn out to be as successful as several investor-billionaires such as Warren Buffett, Charlie Munger, Bill Ackman, George Soros, and so forth. Since 2010, passive mutual funds such as BlackRock and Vanguard attract steady and consistent fund flows of $200+ billion each year; whereas, active funds attract positive fund flows only when active fund managers earn abnormal returns to beat several U.S. stock market benchmarks such as Dow Jones, S&P 500, Nasdaq, MSCI USA, and MSCI World etc. In asset management, capital serves as a pervasive store of value in the form of mutual fund flows. This store of value chases fewer opportunities for retail investors and asset managers to beat the U.S. stock market index.

Most asset managers offer their pragmatic advisory service as an experience good just like college education and medical practice. Even savvy retail investors often find it tricky to distinguish a good stock picker from a lucky one. Once mutual fund managers have attracted substantial assets under management, these fund flows tend to be sticky. These assets are lost only slowly through bad mutual fund return performance over time. In practice, most asset managers have a fiduciary duty of care to perform in the best interests of retail investors. In America, the Securities Exchange Commission (SEC) oversees asset managers. Asset managers are not subject to stringent rules for banks, the latter of which borrow from depositors and bond markets to lend to households and corporations. The thrust of SEC regulation involves consumer protection from fraud or any conflict of interest. This regulation cannot prescribe fund fees, stock investment styles, multi-asset portfolio strategies, and other advisory issues. The vast majority of retail investors are a long way from the prescient paragons of textbook finance theory.

Most people have little idea how they should invest their free and open capital, just as these people have little idea how they should treat health care problems. Much medical advice is quite generic, but patients still value this advice from doctors. In this fresh light, mutual fund managers act as money doctors and stock investment specialists. Most money doctors are in the same hand-holding business. Their job helps people have enough confidence to take on stock investment risk.

As in medicine, manner and confidence are as important as investment efficacy in the global asset management industry. Just as many patients trust their respective medical doctors and so prefer not to go to some random doctor even if he or she has the equivalent qualifications, most retail investors trust their financial advisors and asset managers. As long as asset returns tend to increase in the long term, a rising tide lifts all boats in the global asset management industry. Specifically, the 2 largest passive index funds, BlackRock and Vanguard, attract almost $15 trillion assets under management worldwide from 2020 to 2022. Increasingly greater fund flows and assets held by pension funds, endowments, and sovereign wealth funds go into private equity, residential property, commercial real estate, venture capital, and infrastructure. What has spurred this structural shift in asset management is a desperate search for higher returns. Several boutique Wall Street investment firms (such as Apollo, Blackstone, Carlyle, and KKR) have captured much of the recent asset growth in private equity markets.

In the global asset management industry, this structural shift arises fundamentally from macroeconomic mega trends. Since 1980, the U.S. and E.U. natural interest rates have gradually declined to low single digits. In Germany and Switzerland, for instance, government bond yields are below zero across the Treasury yield curve (from 1 month to 30 years). The U.S. Federal Reserve and European Central Bank hit the zero lower bound during the Global Financial Crisis 2008-2009 and corona virus crisis 2020-2022. In light of substantial fiscal deficits and monetary stimulus programs worldwide, inflation turns out to be a rampant global phenomenon. Many countries experience large general price increases across the board. Hence, ultra-low interest rates are not likely to persist in the medium term. Specifically, the U.S. Federal Reserve, Bank of England, and European Central Bank expect at least 3 to 5 interest rate hikes in 2022-2024. Many macro economists and financial media commentators expect to see similar rental yield hikes on stocks, corporate bonds, and commercial real estate trusts etc.

Demography serves as a fundamental explanation for the global stock investment glut. Better health care helps extend life expectancy worldwide and thus effectively boosts the global demand for retirement, stock investment, and financial freedom. Nowadays people live longer, but the average working life has not changed much. Most people must save more for better retirement and personal finance over time. This long-term trend tilts economic inequality in favor of financially savvy investors who manage to better prepare for steady wealth creation in due course. In recent decades, the bulge in the size of the middle-age cohort tends to expand the global credit supply. In turn, this expansionary increase in global credit supply sows the seeds of both economic growth and employment in the real business cycle.

Apart from demographic reasons, another fundamental factor relates to the better stock market return performance in East Asia, especially China, Hong Kong, Japan, Singapore, South Korea, and Taiwan. The upshot is that more money now chases fewer profitable stock investment opportunities in these countries. Global investors respond to this mega trend by keeping fund management costs down and investing more money in private equity markets in the hopes of higher returns. This response helps reshape the global asset management industry.

Nowadays, most investors can buy beta exposure to the stock market return (such as S&P 500) for only a few basis points. These investors tend to focus on passive index funds from BlackRock and Vanguard. These passive index funds track only the closest U.S. stock market returns and alternative benchmarks for some specific sectors such as technology and disruptive innovation (e.g. Meta, Apple, Microsoft, Google, Amazon, Nvidia, and Tesla (aka MAMGANT)). Technology can allow cost-effective access to global stock markets. BlackRock, State Street, and Vanguard owe their growing heft to matching stock market indices worldwide. In reality, these asset management firms benefit from a virtuous circle. Lower costs translate into lower fees, more fund flows, and even lower costs for the passive asset managers. Their dominance is the most salient sign of recent consolidation in the global asset management industry. The biggest asset management firms become bigger in light of simple passive stock investment portfolios. Global elites emerge from the asset management firms that each manage more than one trillion dollars in assets under management. These asset management companies include BlackRock, Vanguard, State Street, Fidelity, Allianz, Capital Group, BNY Mellon, PIMCO, Northern Trust, Goldman, JPMorgan Chase, Morgan Stanley, UBS, AXA, BNP Paribas, Invesco, Wellington Management, Prudential Financial Group, and so forth. Size has hence become a core competitive advantage in the global asset management industry.

Passive index funds hold stocks in proportion to their market capitalization. Trading costs are tiny. Each mutual fund buys a stock when it qualifies for the passive index, and then sells a constituent stock if it drops out of the index. The free open market for large-cap stocks is liquid enough to absorb sales or purchases whenever index funds need to match inflows or redemptions.

Beta passive stock investment strategies are not the only game in town. Most asset managers design billions-of-dollars smart-beta factor strategies in search of higher alphas. These alphas represent excess returns that mutual funds earn in response to multi-factor exposure to size, value, momentum, cash profitability, asset growth, market risk, and so forth. In the global history of asset management, value stocks with higher book-to-market equity ratios often tend to cyclically outperform growth stocks with lower book-to-market equity ratios; small-cap stocks often outperform large-cap stocks; momentum stocks tend to beat the broader stock market; and it is often profitable to invest in stocks with high operating cash profitability, low asset growth (or low capital investment), and low to medium market risk exposure. Also, stocks often offer substantially higher average long-term returns in the reasonable range of 11% to 15% in stark contrast to bonds, currencies, futures, and residential real estate trusts (REIT). Many financial economists expect these mega trends to persist in the next few decades. Better financial development can help breed better economic growth and employment in the presence of inclusive institutions.

The recent growth of the big 3 passive asset managers BlackRock, Vanguard, and State Street is part of the mega trend toward greater industry concentration. Of all assets under management (AUM) held by the top 500 stock investment companies, the top 20 asset management firms own and control almost 45% in 2020-2022. In search of scale economies, these stock investment firms try to offset pressure on mutual fund fees and commissions with multi-asset advisory portfolio optimization. The new financial expertise spans several asset classes from large-cap stocks and liquid Treasury bonds to Eurodollar currencies, residential real estate trusts (REIT), and private assets. Many asset managers now bet on the mutual benefits of both economic scope and scale. With this broader spectrum of fund products, the retail gatekeepers such as online brokerage firms (e.g. TD Ameritrade, Charles Schwab, and Firstrade), social finance platforms (e.g. AYA fintech network platform), as well as mobile apps (e.g. eToro and Robinhood) start to provide proprietary alpha stock signals and personal finance tools for American retail investors and traders.

Most retail investors and traders are quite conservative. Inflows often tend to follow better mutual fund return performance, but outflows do not. For most retail traders, a move from one mutual fund to another often triggers taxation on capital gains. In this respect, institutional investors suffer from inertia. A bold response for mid-size asset management firms would be to downsize mutual fund operations with fewer core asset choices and lower fund fees. This fee pressure is quite intense on new business operations for most mutual funds and asset management firms. Hence, the virtue of passive index funds is their low cost. These passive index funds buy stocks in the core stock market index (and what the quantitative multi-factor smart-beta models prescribe in due course). There is no need for passive index funds to worry too much about the financial statement analysis of each public corporation. Multi-factor stock portfolio optimization helps diversify away idiosyncratic risks. As a result, retail investors can become financially better off if they delve into whether public corporations act in the best interests of shareholders in accordance with the environmental, social, and governance (ESG) goals and missions. Specifically, our AYA fintech network platform provides proprietary multi-factor alpha stock signals and personal finance tools for the better analysis of both financial statements and key financial ratios across about 6,000+ U.S. stocks. There can be many different ways for financial economists to skin the cat, and all roads eventually lead to Rome. However, no one can build Rome in one day.

The art of modern asset management relates to global capital allocation. It can be quite easy for asset managers to miss this target goal in the midst of alpha versus beta proprietary stock signals, active versus passive fund management styles, and private versus public equity markets. Capital gravitates toward the most productive uses of funds as water runs to find its level. In light of global capital allocation, core asset managers play an important social role in picking stocks in accordance with the broader environmental, social, and governance (ESG) goals and missions. As a worthy vocation, modern asset management has become a means to an end but not an end in itself. Many asset managers and institutional investors serve as the guardians and stewards of better corporate governance worldwide.

An index fund cannot screen the best stocks from the worst in terms of multi-factor alpha stock signals. Each index fund typically holds whatever remains in the index. Other passive index strategies select stocks, bonds, and currencies etc for better multi-asset portfolio optimization. This quantitative fundamental approach can help balance long-term average return performance against stock market risk exposure. Fundamental financial characteristics such as size and book-to-market equity etc reveal key information about the nature of the public corporation behind the stocks, bonds, Eurodollar currencies, and so forth. How well corporate boards and senior management teams run the business to perform their fiduciary duties of care, good faith, and loyalty etc can prove to be crucial in corporate governance. Fund capital allocation often tends to focus on the search of corporate talent retention for better long-term stock market return performance. This Keynesian search relies on good senior executive management and corporate performance in accordance with the broader environmental, social, and governance (ESG) requirements. Good mutual fund stewardship helps ensure that the current capital allocation results in the most productive uses of past capital investment projects in due course.

Index inclusion often leads to a much higher correlation with the stock market index. This passive index inclusion further spurs a commensurate reduction in search and information production in the form of fewer financial research reports from quarter to quarter. From time to time, the constituent public corporations often experience significant improvements in stock prices and returns right after their index inclusion. At the same time, the fallen stars (prior constituent public corporations) experience significant declines in stock prices and returns right after their index exclusion. This empirical evidence reveals dramatic changes in investor sentiment in response to sudden changes in index inclusion and exclusion.

Most public corporations earn enough positive profits and cash flows to meet their capital investment needs. When some public corporation taps the capital markets, the additional net stock issuance helps buttress the corporate capital structure. For instance, the public corporation buys back shares to lengthen the maturity of debt. Alternatively, the corporation builds up cash reserves in order to safeguard against extreme losses in rare times of severe financial stress such as the Global Financial Crisis 2008-2009 and current corona virus crisis 2020-2022. In the latter scenario, good stewardship becomes important in global capital allocation. Many institutional investors and asset managers need to engage with corporate senior management in order to verify that the business is well run. Asset managers that bear the costs of ESG stewardship capture only a small share of the benefits of good stewardship. Specifically, key asset managers often tend to avoid making shareholder proposals, nominating new independent directors, and conducting proxy contests to vote out corporate senior managers. In essence, asset managers prefer not to rock the boat in corporate governance. Sometimes passive index inclusion empowers corporate senior managers to pursue subpar mergers and acquisitions. These deals can be detrimental to firm valuation and stock return performance in the long run.

ESG looks like a lifeline for many active asset managers and institutional investors. SEC regulators suggest that composite ESG scores can soon become regulatory requirements in due course. Sometimes it is relatively easy to measure the extent of environmental protection in terms of corporate carbon footprint. Also, the social criterion requires some qualitative judgment about corporate recruitment and talent retention, inequality, and the broader socioeconomic impact of investment projects. Good governance requires that top management teams exercise sound business judgment to make corporate decisions in the best interests of shareholders subject to board approval and correction. For asset managers, sifting public corporations by ESG or any other qualitative criteria helps better balance stock market portfolios. In this fresh light, active asset managers thus often require some fee premium over passive index funds. A greater longer-term focus would be welcome for both public corporations, shareholders, and other stakeholders such as employees, upstream suppliers, customers, regulators, and special interest groups etc.

In active asset management, the best-performing stock pickers often turn out to be patient and strong in their ESG convictions. These active asset managers hold key stocks for long periods of time with higher portfolio concentration. These traits such as patience and commitment persuade many investors to flock into private equity and other closely held assets.

Private equity investors often lock up their money for many years. These investors cannot easily sell out their private equity stakes due to special liquidity preferences. Substantial private equity assets trade quite rarely. As a result, private equity asset managers are often able to eke out better returns. Also, many pension funds flock into private equity markets in search of higher returns in recent years. In America, at least 63% of institutional investors plan to increase their capital allocation to core private equity assets in the next decade. The top 3 asset managers (i.e. BlackRock, Vanguard, and State Street) invest the majority of $4 trillion in private equity assets. Whether these private equity asset managers can sustain the current fee premium and stock return performance remains open to controversy.

Many life insurance funds, endowments, and sovereign wealth funds face key debt obligations in the distant future. So these private equity asset managers can afford to take a long-term view. Private equity markets are relatively inefficient, and these efficiency gains emerge in the form of higher multi-factor alpha stock signals. Now it has become harder for active asset managers to receive higher rewards for due diligence in the fundamental stock return analysis of U.S. public corporations. The common fundamental analysis often entails discounting future cash flows to gauge the current present value of the common stock for each public enterprise. Further, active asset managers can use the P/E and P/B ratios for quantitative comparisons across the industry spectrum. Active asset managers apply the same fundamental analysis to appraise enterprise value in private equity markets. In many cases, key private equity funds and venture capital funds add operational expertise to private firms. These private equity asset managers inspire better top management styles in lean startups, tech unicorns, and family firms etc. From time to time, most private equity asset managers promote better efficiency by taking capital off sunset firms and putting this additional capital into sunrise firms with proprietary technology and R&D specialty etc.

As some recent empirical evidence shows, private equity funds and venture capital funds outperform the U.S. S&P 500 stock market index in the long run. With higher fiscal deficits, many U.S. pension funds now have an incentive to invest in private equity assets in the hope that their beneficiaries can reap the rewards in the form of substantially higher returns. Sovereign wealth funds and other asset managers further tilt their capital allocation toward private equity markets for higher long-term asset return performance. As more capital tends to chase fewer profitable business opportunities in active asset management, the evidence often points to diminishing returns to scale. Consistent stock market outperformance attracts positive mutual fund flows, so these fund flows add to total asset under management (AUM). When asset managers and institutional investors deal with larger-scale capital allocation, the marginal returns decline in due course. The global asset management industry equilibrates until all of the marginal returns equate the broader stock market return. In this fundamental sense, no active asset manager can consistently beat the stock market in the long run. In time, active asset managers work hard to absorb alphas in the form of excess returns. Through the real business cycle, the vast majority of active asset managers (charlatans) tend to underperform the broader stock market index. In the history of modern asset management, only about 30% of active asset managers sometimes outperform the U.S. stock market, whereas, more than 70% of active asset managers tend to slightly underperform the U.S. stock market. For this reason, several asset managers such as BlackRock and Vanguard emphasize the basic importance of passive index fund strategies. These passive index funds often tend to at least match the broader stock market return performance after we adjust for mutual fund fees. Key asset managers charge a 2% annual fee and 20% of the annual profits worldwide. This norm sets a high standard for the active asset management industry.

Our analysis reveals several mega trends in the global asset management industry. First, active asset management often offers due diligence and financial statement analysis in support of efficient asset price discovery in stocks, bonds, currencies, and even private equity markets. Most financial economists need to consider more than the simple arithmetic Sharpe ratio and multi-factor alpha stock signals in order to better assess the long-term efficacy of active asset management. Second, many pension funds, sovereign wealth funds, and other institutional investors delve into private equity market in search of higher returns. In accordance with their mandate, these private equity asset managers better balance their stock portfolios with high Sharpe ratios (of long-run average returns to their respective standard deviations). Third, the winners can sometimes outperform the U.S. stock market, whereas, the winners often tend to rotate through the real business cycle. Most of the time, most asset managers underperform the U.S. stock market. In light of this evidence, core asset managers such as BlackRock, Vanguard, and State Street etc prefer to focus on passive index fund strategies (in stark contrast to active fund strategies). In fact, this last mega trend shines fresh light on the higher average returns to multi-factor, multi-asset portfolio optimization in the long term. When push comes to shove, the basic law of inadvertent consequences counsels caution.

Asset management is primarily an economic affair in the rich world. North America, Australia, Britain, Europe, and Japan etc account for more than 75% of total assets under management (AUM) worldwide. America is far and away the most important stock market. Just as the U.S. Federal Reserve System sets the macro metronome for global monetary policy coordination, the U.S. stock market often sets the tone for capital allocation everywhere else in OECD countries. In the meantime, China has become the second largest economy in the world. In global finance, Chinese heft lags behind, and China is now putting much effort to catch up with core OECD countries. China has opened the mainland markets (i.e. Shanghai and Shenzhen) to foreign asset managers and institutional investors in stocks, bonds, currencies, and futures etc. Time, size, value, and momentum etc are in favor of China and its close East Asian tiger economies such as Hong Kong, Malaysia, Singapore, South Korea, and Taiwan.

The Chinese financial markets are relatively immature. Much household wealth is on deposit in banks and non-bank financial institutions. In China, the predominant types of household investments resemble bank deposits (i.e. either money market funds or wealth management products). Retail investors tend to dominate Chinese stock market investments. These retail stock market investors trade directly in core stocks via online brokerages. Chinese domestic mutual funds own and control only about 10% of common stocks in public corporations from 2020 to 2022.

As China gets richer in terms of both domestic economic output and employment, households are likely to change their mix of wealth concentration (perhaps less in bank deposits, money market funds, and wealth management products, and more in stocks, bonds, and currencies). Chinese GDP is likely to continue to grow faster than OECD GDP in most rich countries. A larger Chinese economy suggests more retail investments in stocks and bonds. As a result, both the government and state enterprises expect to issue new common stocks and corporate bonds in time.

Many macro economists and financial media commentators consider China to be a big deal. However, corporate CEOs and CFOs are not confident about how most mega trends shake out the global asset management industry for Chinese financial markets. There are at least 3 major sources of economic uncertainty. First, it is not certain how retail banks, insurance companies, and investment banks can acquire new customers and retail investors in China. Most foreign asset managers with no brand in China need to find alternative channels for building the business presence in East Asia. For several foreign asset managers and institutional investors, a joint venture with Chinese local banks can be a good fit. In China, the top 4 banks (Bank of China, China Construction Bank, Industrial and Commercial Bank of China, and Agricultural Bank of China) each attract hundreds of millions of customers in China, Hong Kong, and Macao. The top 2 tech titans Alibaba and Tencent provide mobile payment platforms in lieu of credit cards and cross-border wire transfers. Vanguard now keeps a joint venture with Ant Financial Group to offer stock investment advice in China. Chinese retail investors often draw a distinction between high tech mobile payment platforms and bank network systems. Yet, this distinction is false because modern financial services are both human and digital in America, Australia, Britain, China, Europe, Japan, and elsewhere in the world.

Second, the Chinese asset management industry can evolve in due time. In China, mutual funds have the muscle, but Chinese retail investors and noise traders often tend to follow social media fads. Cost-effective passive index funds can track most stock market return benchmarks to outperform active asset managers. From time to time, mutual fund flows gravitate toward high-skill asset managers who can earn consistent abnormal excess returns in the form of higher stock market alphas. As the Chinese financial markets mature in due course, professional arbitrageurs and active asset managers provide both proprietary alpha stock signals and personal finance tools for better retirement, financial freedom, innovation, and education etc in China. We expect to see more diverse stock market products, mutual funds, and global active alpha portfolio strategies for Chinese retail investors and traders to reap diversification benefits in the form of higher Sharpe ratios of long-run average returns to their respective standard deviations.

Third, economic policy uncertainty remains an important game changer in Chinese financial markets. The prospect of selling rich-world securities to Chinese investors critically depends on China allowing capital to flow freely abroad. In the meantime, however, the Chinese government imposes strict cross-border capital controls for effective monetary policy decisions and interest rate adjustments. This heavy hand defies the odds of the Mundell-Fleming trilemma. In China, the government retains stringent capital controls in order to sustain monetary autonomy under the flexible exchange rate regime. Perhaps the trade-and-tech wars make China inhospitable to American asset managers and institutional investors. Perhaps Europe can have the upper hand in the Chinese asset management industry. If the Chinese financial markets strive to catch up with London, New York, and most other financial centers in the world, the Chinese renminbi should become freely convertible. China has to be open and transparent about cross-border capital controls and foreign exchange arrangements in the foreseeable future.

Speculations about the foreseeable future are often helpful in organizing thoughts about the present. In global asset management, the recent mega trends highlight at least 3 main predictions about the future of finance. First, many economists and financial media commentators expect the global asset management industry to be a small club of giant asset managers in the next decade. From 2020 to 2022, most passive index funds already account for the vast majority of stock investment funds in North America. Vanguard, BlackRock, and State Street etc can extend their heft to Australia, Britain, China, Europe, and Japan. This wealth concentration is likely to cause important public policy implications for economic inequality worldwide in due course.

Second, fierce competition among global asset managers tends to revolve around stock market funds and wealth management products for particular needs. These particular needs often include better retirement, health care, financial freedom, and education etc. A rising tide can lift all boats in global asset management. Therefore, passive index funds that better track the upward mega trend in stock market return performance can prove to be the ultimate winners in the global asset management industry. Perhaps multi-asset portfolio optimization helps combine the best of both passive and active mutual funds in terms of long-run stock market outperformance and diversification for specific lifecycle needs from retirement and health care etc to education and disruptive innovation. When push comes to shove, the basic law of inadvertent consequences counsels caution.

Third, environmental, social, and governance (ESG) mandates are likely to emerge as the mainstream source of differentiation for active asset managers. ESG hence becomes one of the pivotal competitive advantages for each active asset manager and institutional investor. In search of better corporate governance, passive index funds may eventually choose not to use their vast voting power to influence public corporations. U.S. SEC regulators can continue to push these index funds to vote their respective shares in order to fulfill their fiduciary duty of care to most investors. At the same time, antitrust regulators increasingly fret about the latent ability of big index funds to soften competition among public corporations that the passive index funds own for long periods of time. Global capital markets continue to be the main avenue for asset managers to diversify risk by geography. Foreign asset managers can become a crucial conduit for Chinese leadership in most global stock markets. In this respect, China has to keep open the main distribution channels for the global currencies such as the greenback, euro, and renminbi. In this quiet revolution, the global asset management industry remains central to modern capitalism.

Special Purpose Acquisition Companies (SPAC) now represent more than half of American IPOs in the current corona virus crisis from 2020 to 2022. In the common SPAC structure, a sponsor decides to launch a new SPAC. This new share holding company provides an investor roadshow. The sponsor covers the SPAC operating costs and then acquires some block of common equity. This new block of common equity often promotes and amounts to 20% of post-IPO common equity. The SPAC then lists on a U.S. stock exchange. Each share costs at least $10 and comprises some common share and a fractional warrant. The proceeds held from the SPAC IPO enter a trust account. The sponsor invests the proceeds in U.S. Treasury bills and notes. The SPAC shares trade on the open stock market. The common shares and warrants are often separate and independent on the same stock exchange.

The SPAC sponsor looks for a target company in a particular industry worldwide. In practice, the sponsor either completes a merger or acquisition within 2 years, or returns the shareholder funds to investors and then liquidates the SPAC within this reasonable time frame. If the sponsor can identify a target company, both parties negotiate the terms of a merger or acquisition with a common letter of intent. In the meantime, the sponsor raises additional shareholder capital to fund the M&A deal through some private investment in public equity. In due course, the SPAC share holders vote on the merger or acquisition in accordance with the best practices of corporate governance. If the shareholders fail to approve the M&A deal, the SPAC sponsor can continue to look for another target company. If the shareholders can agree to approve the M&A deal, the sponsor executes this deal. The shareholders keep their own common equity shares, redeem these shares with their initial stock investments plus interest payments, or sell these shares in the U.S. stock market. In the post-IPO period, the SPAC acquires the target company and then begins to trade under some new brand on the same stock exchange.

In America, there are over 900 IPOs plus SPACs from 2020 to 2022. This tech IPO activity reaches its new peak in almost 20 years. SPACs prove to be cost-effective IPOs for new private tech unicorns to go public in America. This new avenue turns out to be consistent with higher equity valuations in North America. Ample venture capital, as well as late-stage money from sovereign wealth funds and mutual funds, has been available on attractive terms of M&A deals. For this reason, successful tech unicorns and lean startups remain private for longer. The recent higher public stock market valuations convince financially viable business firms (such as Airbnb, DoorDash, and Snowflake) to go public for better stock market liquidity. In fact, the huge success stories of Alibaba, Facebook, Google, Tencent, and Tesla etc show relatively high P/E ratios in the reasonable range of 20 to 25. These tech legends outperform most market expectations. Numerous U.S. stock market investors are often willing to buy into higher equity valuations for new private tech unicorns and lean startups that can create a great future to enrich the social and economic lives of residents in North America, Australia, Britain, China, Europe, Japan, and several other parts of the world.

There is some real differentiation among U.S. sectors. Tech and health care stocks have historically been the best performing sectors of the IPO stock market. From 1980 to 2022, the IPO stock returns often tend to beat broad stock market returns by about 27% on average over the 3-year time horizon from the offer price (except the dotcom bubble). SPACs have now risen to the IPO challenge of higher equity valuations in America.

SPAC mergers and acquisitions can save billions of dollars in a cost-effective way. In effect, these M&A deals help reduce the direct fees that private companies pay to investment banks. Several other costs include legal fees, audit service charges, and indirect costs of underpricing shares in the IPO process (or leaving money on the table for the issuer). In exchange for sweet common equity, the SPAC sponsor takes a cut of the M&A deal (or 20% of the IPO shares for some nominal price). In practice, this common equity dilution can be detrimental to public shareholders and the private target company in due course. On balance, most SPAC M&A deals are more cost-effective than the conventional IPO, whereas, the hidden equity dilution sometimes makes these SPAC M&A deals harmful to post-IPO shareholders.

Although SPACs issue shares at the uniform price of $10, the median SPAC holds cash of only $7 per share when the SPAC acquires the private target company. In recent times, the empirical evidence shows that the post-IPO return performance of the representative SPAC significantly correlates with the dollar size of the cash shortfall. The post-merger SPAC stock return performance effectively reflects the common equity dilution for the vast majority of post-IPO shareholders.

In a regulatory view, the U.S. Securities Exchange Commission (SEC) supervises SPAC M&A deals, whereas, the SEC regulates traditional IPOs under public share issuance rules. There are 2 fundamental differences in U.S. SEC regulations. First, there is a legal safe harbor in support of both the SPAC and target companies from lawsuits for misstatements in pro forma financial cost and revenue projections. No such safe harbor lends credence to traditional IPOs. As a result, SPAC M&A deals almost always provide the stock market with reasonable pro forma financial reports and projections (whereas traditional IPOs never do). Second, share underwriters and investment banks face liability under Section 11 of the U.S. Securities Act in the traditional IPO for any financial misstatement. However, SPAC sponsors never face the same legal risk in SPAC M&A deals. Nowadays the U.S. SEC delves into these fundamental differences in the regulation and supervision of both traditional IPO and SPAC M&A deals. In recent times, many corporate governance scholars advocate that the U.S. SEC should subject SPAC M&A deals to the strict IPO rules for more holistic fundamental financial statement analysis of both SPAC sponsors and private target companies. In light of these mega trends worldwide, global asset management remains central to modern capitalism.

Our proprietary alpha stock investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement our proprietary alpha investment model for U.S. stock signals. A comprehensive model description is available on our AYA fintech network platform. Our U.S. Patent and Trademark Office (USPTO) patent publication is available on the World Intellectual Property Office (WIPO) official website.

Our core proprietary algorithmic alpha stock investment model estimates long-term abnormal returns for U.S. individual stocks and then ranks these individual stocks in accordance with their dynamic conditional alphas. Most virtual members follow these dynamic conditional alphas or proprietary stock signals to trade U.S. stocks on our AYA fintech network platform. For the recent period from February 2017 to February 2020, our algorithmic alpha stock investment model outperforms the vast majority of global stock market benchmarks such as S&P 500, MSCI USA, MSCI Europe, MSCI World, Dow Jones, and Nasdaq etc.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

We update and refresh part of memetic financial information on a sporadic basis. We aim to facilitate this information exchange only for illustrative purposes. Some information may be stale and incomplete. Therefore, we recommend each member to consult the respective external website(s) for more up-to-date information.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

The conventional disclaimers apply to this key case where each freemium member bewares, understands, and acknowledges the service terms and conditions for our courteous fintech network platform. Any omissions, errors, or other blemishes do not necessarily reflect the official views and opinions of our AYA fintech platform orchestrator. We make a conscious effort to keep most major omissions to 1% to 5% of the fintech information for about 6,000 U.S. stocks on NYSE, NASDAQ, and AMEX. These omissions tend to concentrate around some rare corporate events (e.g. IPO, delisting occurrence and recurrence, abrupt trading suspension, and M&A initiation etc). Overall, these disclaimers, terms, and conditions of our service should be viewed as baseline house rules for fintech network platform usage and development.

Under pending subsequent patent-law confirmation, the relevant legal text protects our proprietary alpha software technology for ubiquitous knowledge transfer. Each freemium member enjoys his or her interactive usage and information exchange on our AYA algorithmic fintech network platform with sound and efficient dynamic conditional asset return prediction.

Our AYA fintech network platform helps promote better financial literacy, inclusion, and freedom of the global general public with an abiding interest in core economic reforms, financial markets, and stock market investments. In this broader context, each freemium member can consult our mission statement that provides more in-depth explanatory details on our long-term aspiration.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-10-01 11:33:00 Tuesday ET

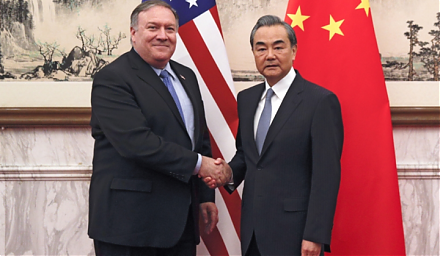

The Trump administration postpones increasing 25% to 30% tariffs on $250 billion Chinese imports after China extends an olive branch to de-escalate Sino-Ame

2019-05-05 10:34:00 Sunday ET

Former Vice President Joe Biden enters the next U.S. presidential race with many moderate-to-progressive policy proposals. At the age of 76, Biden stands ou

2017-08-19 14:43:00 Saturday ET

In a recent tweet, President Donald Trump criticizes Amazon over taxes and jobs. Without providing specific evidence, Trump accuses of the e-commerce retail

2024-04-02 04:45:41 Tuesday ET

Stock Synopsis: High-speed 5G broadband and mobile cloud telecommunication In the U.S. telecom industry for high-speed Internet connections and mobile cl

2019-01-29 10:33:00 Tuesday ET

Global trade transforms from labor cost arbitrage to high-skill knowledge work. In fact, multinational manufacturers have been trying to create global suppl

2019-04-13 14:28:00 Saturday ET

Saudi Aramco unveils the financial secrets of the most profitable corporation in the world. In its recent public bond issuance prospectus, Aramco offers the