2018-06-14 10:35:00 Thu ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

The Federal Reserve's current interest rate hike may lead to the next economic recession as credit supply growth ebbs and flows through the business cycle. All of the 35 U.S. large banks such as JPMorgan Chase, Citigroup, Bank of America, and Wells Fargo pass the annual stress test and thus would be able to lend even under the grimmest economic conditions. During the Trump administration, the U.S. Treasury and Federal Reserve may roll back at least some of the Dodd-Frank rules and regulations.

These extreme economic conditions include 10% unemployment, a sharp decline in general house prices, and a severe recession in Europe and elsewhere. Even under these dire conditions, the big banks hold sufficient capital buffers that would exceed the financial-sector equity claims back in the years just before the Global Financial Crisis. The Federal Reserve retains the final veto power to restrict any dividend hikes or share repurchases that the banks may pursue in order to return cash distributions to their shareholders.

It is important for financial intermediaries to substantially increase their core equity capital buffers in order to safeguard against extreme losses that might arise in rare times of financial stress such as the Global Financial Crisis from 2008 to 2009.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-11-17 09:42:00 Friday ET

The Trump administration garners congressional support from both Senate and the House of Representatives to pass the $1.5 trillion tax overhaul (Tax Cuts &a

2023-11-21 11:32:00 Tuesday ET

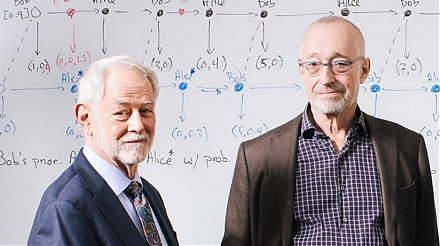

Nobel Laureate Paul Milgrom explains the U.S. incentive auction of wireless spectrum allocation from TV broadcasters to telecoms. Paul Milgrom (2019)

2019-07-09 15:14:00 Tuesday ET

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies t

2018-06-17 10:35:00 Sunday ET

In the past decades, capital market liberalization and globalization have combined to connect global financial markets to allow an ocean of money to flow th

2018-05-29 11:40:00 Tuesday ET

America and China, the modern world's most powerful nations may stumble into a **Thucydides trap** that Harvard professor and political scientist Graham

2018-10-07 13:39:00 Sunday ET

The U.S. greenback soars in value as the Federal Reserve continues its interest rate hike. With impressive service-sector data and non-farm payroll wage gro