2018-06-02 09:35:00 Sat ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

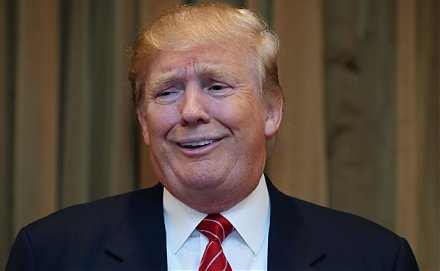

The finance ministers of Britain, Canada, France, Germany, Italy, and Japan team up against U.S. President Donald Trump and Treasury Secretary Steven Mnuchin at a G7 forum. These finance ministers suggest that the recent U.S. trade actions undermine economic confidence in the Western alliance.

The G6 delegation requests Mnuchin to communicate their unanimous concern and disappointment to President Trump. Meanwhile, Commerce Secretary Wilbur Ross completes his recent trade talks in China with little sign of progress. In China, the state-run news agency Xinhua states that all the economic outcomes of recent trade talks will not take effect if the U.S. imposes any tariffs or other trade sanctions. These recent developments suggest the delicate balance that both Mnuchin and Ross need to maintain as Trump moves forward with 25% tariffs on aluminum and 10% tariffs on steel from his close Western allies and another $50 billion tariffs on Chinese imports.

OECD figures suggest that the current global economic growth rate is 3.8% without any exogenous tariff shocks. S&P chief economist Paul Gruenwald suggests that these tariffs can take a quarter off the world's economic growth rate in a Sino-U.S. trade war. The European Central Bank's projections also warn of a 1% contraction in global economic growth in the first year of Trump tariffs. The medium-term real effects of Trump tariffs may be detrimental to global economic growth and stock market resilience.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-11-01 08:36:00 Thursday ET

Ford and Baidu team up to test autonomous cars in China. For the next few years, Ford and Baidu plan to collaborate on the car design and user acceptance te

2018-08-27 09:35:00 Monday ET

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2017-09-19 05:34:00 Tuesday ET

Facebook, Twitter, and Google executives head before the Senate Judiciary Committee to explain the scope of Russian interference in the U.S. presidential el

2020-03-26 10:31:00 Thursday ET

The unique controversial management style of Steve Jobs helps translate his business acumen into smart product development. Jay Elliot (2012) Leading

2019-08-07 08:32:00 Wednesday ET

Our fintech finbuzz analytic report shines fresh light on the current global economic outlook. As of Summer-Fall 2019, the current analytic report focuses o

2019-05-05 10:46:10 Sunday ET

This video collection shows the major features of our AYA fintech network platform for stock market investors: (1) AYA stock market content curation;&nbs