2019-01-11 10:33:00 Fri ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

The Economist Intelligence Unit (EIU) continues to track major business risks in light of volatile stock markets, elections, and geopolitics. EIU monitors geopolitical uncertainty and market-and-credit risks in 180 countries. At the global level, EIU outlines several persistent business risks. These risks include the Sino-U.S. trade war, oil supply shrinkage, and financial contagion from Turkey and Argentina. As the Sino-U.S. trade talks take place at the deputy secretary level, key stock market indices from Dow Jones to NASDAQ and S&P500 demonstrate hefty gains of 3%-5% in early-January 2019. Stock market investors hope these deputy dialogues to reach some form of compromise for better Sino-U.S. trade war resolution. Also, oil prices are likely to surge when OPEC countries cut their current oil supply. This oil price hike can cause inflationary concerns in most OECD countries.

Several emerging-economies may suffer near-term stock market gyrations due to oil supply contraction and financial contagion from Turkey and Argentina. The EIU report sheds fresh light on the biggest business risks in early-January 2019: Trump economic sanctions on Iran, social unrest in in Nicaragua, and corruption and tax policy uncertainty in Lithuania. In comparison, Nepal and Egypt receive lower risk scores due to political stability, macroeconomic momentum, and gradual currency devaluation.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-12-13 09:32:00 Friday ET

Saudi Aramco aims to initiate its fresh IPO in December 2019. Several investment banks indicate to the Saudi government that most investors may value the mi

2025-06-21 05:25:00 Saturday ET

President Trump refreshes American fiscal fears, worries, and concerns through the One Big Beautiful Bill Act. The Congressional Budget Office (CBO) estimat

2018-05-29 11:40:00 Tuesday ET

America and China, the modern world's most powerful nations may stumble into a **Thucydides trap** that Harvard professor and political scientist Graham

2018-03-27 07:33:00 Tuesday ET

CNBC's business anchorwoman Becky Quick interviews Nobel Laureate Joseph Stiglitz on the current trade war between America and China. As America imposes

2019-02-21 12:37:00 Thursday ET

Apple shakes up senior leadership to initiate a new transition from iPhone revenue reliance to media and software services. These changes include the key pr

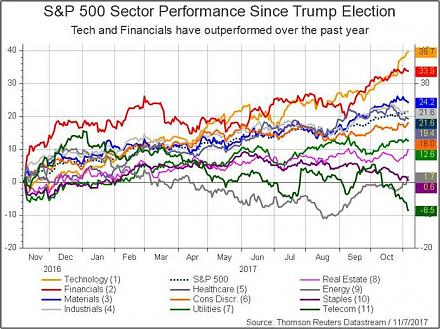

2017-10-09 09:34:00 Monday ET

The current Trump stock market rally has been impressive from November 2016 to October 2017. S&P 500 has risen by 21.1% since the 2016 presidential elec