2019-03-21 12:33:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Senator Elizabeth Warren proposes breaking up key tech titans such as Facebook, Apple, Microsoft, Google, and Amazon (FAMGA). These tech titans have become too dominant and thus tend to leverage their market power to squelch competition to the detriment of consumers. In addition to bulldozing market competition, these tech titans use private user information for profits, tilt the playing field against small-to-medium enterprises, and stifle R&D innovation as their M&A deals encapsulate niche competitors.

For better scale economies and network effects, several strategic M&A examples include the recent acquisitions of Instagram, Whatsapp, and Oculus (by Facebook), DoubleClick, Waze, and Nest (by Google), Whole Foods and Zappos (by Amazon), and Shazam, Texture, InVisage, Regaind, and Lattice Data (by Apple).

Warren further proposes to bar these prime platform orchestrators (FAMGA) from sharing private user data with third parties. Under the Warren proposal, small tech startups would have a fair shot to sell their products on Amazon without the fear of facing fierce competition from Amazon and its affiliates; Google could not smother competitors by demoting their products and services on the Internet search engine; and Facebook would face real pressure from Instagram and WhatsApp to improve the user experience with better privacy protection.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-02-05 10:28:00 Wednesday ET

Our proprietary AYA fintech finbuzz essay shines light on the modern collection of business insights with executive annotations and personal reflections. Th

2018-03-07 07:34:00 Wednesday ET

President Trump tweets his key decision to oust State Secretary Rex Tillerson after several months of intense disagreement over diplomatic affairs. Trump so

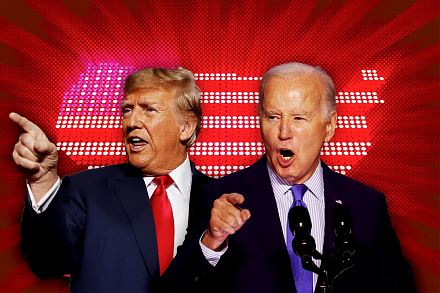

2024-03-19 03:35:58 Tuesday ET

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi

2020-08-26 10:33:00 Wednesday ET

Through purposeful leadership, senior managers inspire teams to reach heights of both innovation and profitability with great brand identity and customer lo

2017-01-17 12:42:00 Tuesday ET

Former Treasury Secretary and Harvard President Larry Summers critiques that the Trump administration's generous tax holiday for American multinational

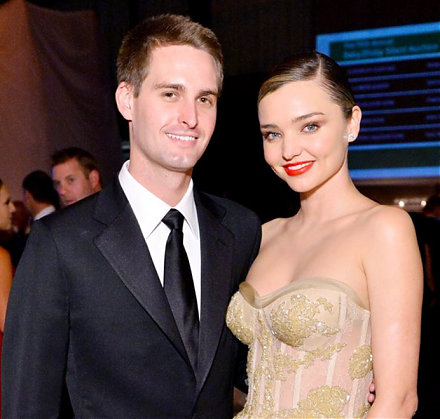

2017-03-03 05:39:00 Friday ET

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.