2019-04-13 14:28:00 Sat ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Saudi Aramco unveils the financial secrets of the most profitable corporation in the world. In its recent public bond issuance prospectus, Aramco offers the first official view of its financial affairs. The bottomline is about $111 billion for the fiscal year 2018-2019. This annual profit is more than the sum of net profits from Apple and Alphabet. As the sole controlling shareholder of the oil company Aramco, the Saudi Arabia government receives $56 billion oil production royalties, $102 billion income taxes, and $107 billion cash dividends from Aramco in the fiscal year 2018-2019. This capital allocation is equivalent to 2.5+ times the $100 billion SoftBank Vision Fund in Japan.

If the international stock investment community pays the equivalent market value of 16-18 times the $100+ billion net profit per annum, the forthcoming Aramco IPO can reach the astronomical stock market capitalization of almost $2 trillion. Saudi Arabia government can use the cash proceeds to buy equity stakes in multinational tech companies for better diversification and national security. In the grand scheme, this stock investment strategy brings forward the future cash flows from Aramco for the middle-east government to diversify outside the energy sector.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-03 11:35:00 Wednesday ET

U.S. regulatory agencies may consider broader economic issues in their antitrust probe into tech titans such as Amazon, Apple, Facebook, and Google etc. Hou

2019-05-30 16:44:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube May 2019 In this podcast, we discuss several topical issues as of May 2019: (1) Our proprietary alp

2017-11-24 08:41:00 Friday ET

Is Bitcoin a legitimate (crypto)currency or a new bubble waiting to implode? As its prices skyrocket, bankers, pundits, and investors increasingly take side

2017-04-25 06:35:00 Tuesday ET

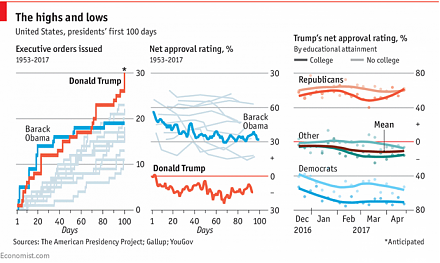

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2020-03-05 08:28:00 Thursday ET

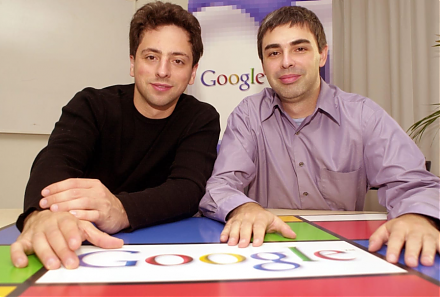

The Stanford computer science overlords Larry Page and Sergey Brin design and develop Google as an Internet search company. Janet Lowe (2009) Google s

2019-10-15 09:13:00 Tuesday ET

U.K. prime minister Boris Johnson encounters defeat during his new premiership. The first major vote would pave the path of least resistance to passing a no