2018-12-09 08:44:00 Sun ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

President Trump meets with Chinese President Xi again at the G20 summit in the city of Buenos Aires, Argentina, in late-November 2018. President Donald Trump and President Xi JinPing, the political leaders of the 2 largest economies on earth, agree to a 90-day trace truce and ceasefire in the Sino-U.S. trade war. After the 3-hour dinner discussion at the G20 summit, Trump agrees to retain the 10% tariffs on $200 billion Chinese goods without raising the tariffs to 25% in the next 90 days. In exchange, China agrees to buy substantial amounts of agriculture, energy, and other goods from America to help reduce the Sino-U.S. bilateral trade deficit.

Chinese state councilor and foreign minister Wang Yi extends many reconciliatory gestures and regards the Trump-Xi summit *candid and amicable*. Wang remains optimistic about opening up the Chinese market for U.S. multinational corporations from Apple and Microsoft to Ford and Merck etc. Wang further expects Sino-U.S. trade delegates to step up serious negotiations toward the eventual elimination of all additional tariffs.

However, stock market analysts and commentators warn that the trade truce may be only an interim tactical solution. This trade truce can barely be a major business breakthrough on substance, but a new framework for subsequent Sino-American economic dialogues. Over the steak dinner at G20, Trump and Xi agree on mutual compromises that help pause their unproductive trade conflict. Both presidents set an ambitious 90-day timeline for Sino-American trade negotiators to reach broader economic agreements.

All key stock market indices worldwide rise in response to the Sino-U.S. trade truce. Dow Jones, NASDAQ, and S&P 500 reap 3% healthy gains for many U.S. stocks. Chinese, European, and other Asian stock market indices see similar 2%-5% gains as a natural result of investor optimism after the Trump-Xi G20 summit. Whether the Trump administration can continue to contain the economic prowess of *China 2025* remains a complex and mysterious national security concern. On balance, the Trump team should downplay the importance of seeking diplomatic means to dramatically reduce the current bilateral trade deficit with China. A more important strategic issue pertains to the fact that several Chinese regulations require U.S. tech titans to transfer critical technologies in the form of both backdoor intellectual property theft and infringement. The latter issue persists as a moot question.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-08-07 07:33:00 Tuesday ET

President Trump sounds smart when he comes up with a fresh plan to retire $15 trillion national debt. This plan entails taxing American consumers and produc

2023-04-28 16:38:00 Friday ET

Peter Schuck analyzes U.S. government failures and structural problems in light of both institutions and incentives. Peter Schuck (2015) Why

2023-05-31 11:27:00 Wednesday ET

What are the top global risks in trade, finance, and technology? In this macro report, we focus on the current global risks from inflation and growth con

2019-07-09 15:14:00 Tuesday ET

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies t

2019-04-25 09:35:00 Thursday ET

Bridgewater hedge fund founder Ray Dalio suggests that the current state of U.S. capitalism poses an existential threat for many Americans. Dalio deems the

2017-11-23 10:42:00 Thursday ET

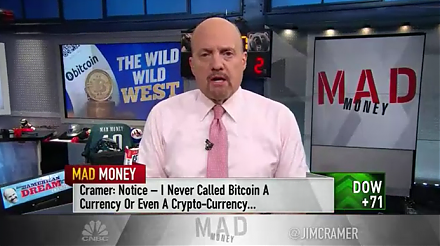

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano