2018-11-13 12:30:00 Tue ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

President Trump promises a great trade deal with China as Americans mull over mid-term elections. President Trump wants to reach a trade accord with Chinese President Xi Jin-Ping at the G20 summit in Argentina later in November 2018. Also, President Trump asks key Cabinet secretaries to draft a potential trade deal to halt escalating the current trade conflict with the Chinese Xi administration. If President Trump can achieve an accord on trade with President Xi, the Trump administration would refrain from imposing tariffs and other economic sanctions on another $267 billion Chinese imports. These economic sanctions focus on the perennial shady Chinese practices of intellectual property theft. These shady practices often entail requiring foreign companies to establish data centers and IT theme parks in China such that both proprietary data and techniques transfer to Chinese tech firms.

Several e-commerce giants such as Amazon and Alibaba express grave concerns about U.S. domestic job creation in the wake of tariffs, quotas, and other retaliatory trade barriers. For instance, Alibaba executive vice chairman Joe Tsai reiterates that his boss Jack Ma has promised the creation of 1 million small business jobs on the premise of few Sino-U.S. trade barriers. His conservative tone departs from the previous promise by Alibaba executive chairman Jack Ma (who now withdraws his earlier claim of ubiquitous U.S. job creation in a low-key fashion).

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2025-06-21 05:25:00 Saturday ET

President Trump refreshes American fiscal fears, worries, and concerns through the One Big Beautiful Bill Act. The Congressional Budget Office (CBO) estimat

2024-05-05 10:31:00 Sunday ET

Stock Synopsis: Pharmaceutical post-pandemic patent development cycle In terms of stock market valuation, the major pharmaceutical sector remains at its

2019-11-23 08:33:00 Saturday ET

MIT financial economist Simon Johnson rethinks capitalism with better key market incentives. Johnson refers to the recent Business Roundtable CEO statement

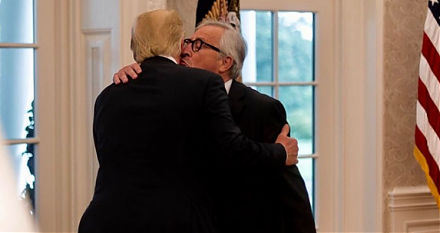

2018-07-23 07:41:00 Monday ET

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff

2017-11-19 08:37:00 Sunday ET

In 2000, a former law professor at Harvard proposed establishing the Financial Product Safety Commission in order to protect consumer rights in the provisio

2023-09-21 09:26:00 Thursday ET

Jordi Gali delves into the science of the New Keynesian monetary policy framework with economic output and inflation stabilization. Jordi Gali (2015)