2019-02-07 07:25:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

President Trump picks David Malpass to run the World Bank to curb international multilateralism. The Trump administration seems to prefer bilateral negotiations for favorable fiscal budgets and trade deals. The World Bank serves the core mission of extending $10+ billion loans to low-income countries to fund investment projects from global markets. A close competitor is the Chinese Infrastructure Investment Bank that uses dollar diplomacy to win allies without stringent concessions (which the World Bank often would require due to multilateral involvement).

Justin Sandefur, senior fellow at the Center for Global Development, suggests that Malpass shows disdain for the World Bank mission of fighting global poverty just as John Bolton, U.S. national security advisor, shows respect for numerous U.N. endeavors. Thus, the recent nomination of David Malpass as World Bank president threatens an implicit multilateral agreement that the U.S. appoints the head of the World Bank while European Union appoints the head of the International Monetary Fund (IMF). The current IMF head, Christine Lagarde, is a former French finance minister and warns against the Sino-American trade war, which may be detrimental to the long-term global economic revival. The Malpass appointment may hence tilt the delicate balance from E.U. multilateral agreement toward U.S. dominance.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-09-21 09:25:00 Saturday ET

President Trump praises great unity and progress at the G7 summit with respect to Sino-U.S. trade conflict resolution, global climate change, containment fo

2023-01-09 10:31:00 Monday ET

Response to USPTO fintech patent protection As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. utility patent

2025-09-24 09:49:53 Wednesday ET

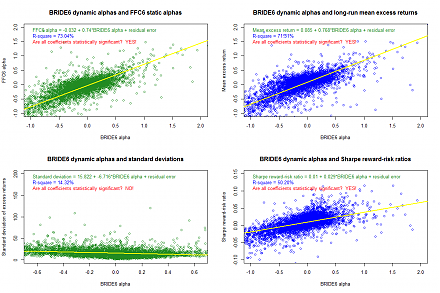

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2023-02-28 10:27:00 Tuesday ET

Basic income reforms can contribute to better health care, public infrastructure, education, technology, and residential protection. Philippe Van Parijs

2022-05-30 09:32:00 Monday ET

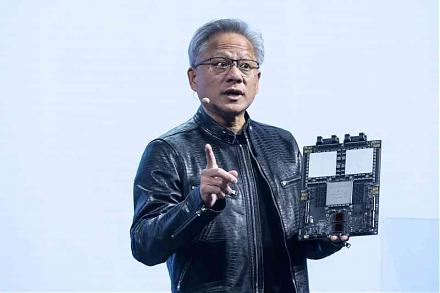

The new semiconductor microchip demand-supply imbalance remains quite severe for the U.S. tech and auto industries. Our current fundamental macro a

2017-03-21 09:37:00 Tuesday ET

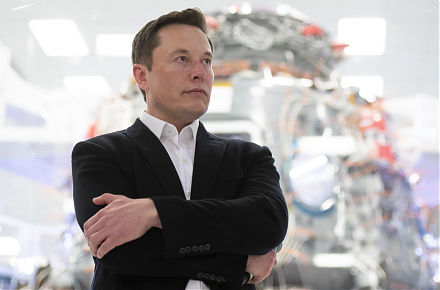

Trump and Xi meet in the most important summit on earth this year. Trump has promised to retaliate against China's currency misalignment, steel trade