2019-02-07 07:25:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

President Trump picks David Malpass to run the World Bank to curb international multilateralism. The Trump administration seems to prefer bilateral negotiations for favorable fiscal budgets and trade deals. The World Bank serves the core mission of extending $10+ billion loans to low-income countries to fund investment projects from global markets. A close competitor is the Chinese Infrastructure Investment Bank that uses dollar diplomacy to win allies without stringent concessions (which the World Bank often would require due to multilateral involvement).

Justin Sandefur, senior fellow at the Center for Global Development, suggests that Malpass shows disdain for the World Bank mission of fighting global poverty just as John Bolton, U.S. national security advisor, shows respect for numerous U.N. endeavors. Thus, the recent nomination of David Malpass as World Bank president threatens an implicit multilateral agreement that the U.S. appoints the head of the World Bank while European Union appoints the head of the International Monetary Fund (IMF). The current IMF head, Christine Lagarde, is a former French finance minister and warns against the Sino-American trade war, which may be detrimental to the long-term global economic revival. The Malpass appointment may hence tilt the delicate balance from E.U. multilateral agreement toward U.S. dominance.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-02-13 09:35:00 Monday ET

JPMorgan Chase CEO Jamie Dimon says President Trump has now awaken the *animal spirits* in the U.S. stock market. The key phrase, animal spirits, is the

2019-07-13 07:17:00 Saturday ET

Japanese prime minister Shinzo Abe outlines the main economic priorities for the G20 summit in Osaka, Japan. First, Asian countries need to forge the key Re

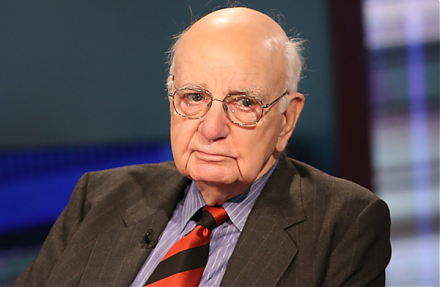

2018-10-23 12:36:00 Tuesday ET

Former Fed Chair Paul Volcker releases his memoir, talks about American public governance, and worries about plutocracy in America. Volcker suggests that pu

2017-12-17 11:41:00 Sunday ET

Warren Buffett points out that it is important to invest in oneself. Learning about oneself empowers him or her to lead a meaningful life. This valuable inv

2025-06-28 10:39:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why great mental focus serves as a vital mainstream driver of personal

2018-08-01 11:43:00 Wednesday ET

Apple becomes the first company to hit $1 trillion stock market valuation. The tech titan sells about the same number of smart phones or 41 million iPhones