2018-07-23 07:41:00 Mon ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff barriers, and zero subsidies on non-automobile industrial goods*. Trade barriers in services, chemical products, and pharmaceutical medications are on the chopping block too. Pundits point out that President Trump secures direct trade talks with the European Union to negotiate a similar deal to the prior Transatlantic Trade and Investment Partnership (TTIP).

Trump agrees to hold off further tariffs, halts punitive measures and sanctions on European cars, and thus avoids escalation into a tit-for-tat trade dispute. However, many international trade experts remain skeptical of Trump's mercurial personality and his pet peeve over America's trade deficits with the European partners. The current trade truce may or may not be permanent during the Trump administration.

In addition to China and Canada, the European Union causes large bilateral trade deficits with America. U.S. farm producers of soy, corn, wheat, cotton, dairy, and pork can receive $12 billion temporary subsidies in light of Trump tariffs, quotas, and even embargoes on Europe. Whether this trade protectionism proves to be effective remains an open debate. The law of inadvertent consequences counsels caution.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-11-24 08:41:00 Friday ET

Is Bitcoin a legitimate (crypto)currency or a new bubble waiting to implode? As its prices skyrocket, bankers, pundits, and investors increasingly take side

2025-05-21 04:27:10 Wednesday ET

Carol Dweck describes, discusses, and delves into the scientific reasons why the growth mindset often helps motivate individuals, teams, and managers to acc

2019-02-05 10:32:00 Tuesday ET

President Trump remains optimistic about the Sino-American trade war resolution of both trade deficit eradication and tech transfer enforcement. Trump now s

2019-08-01 11:33:00 Thursday ET

Many young and mid-career Americans fall into the financial distress trap in rural communities. A recent analysis of 25,800 zip codes for 99% of the U.S. po

2019-01-27 12:39:00 Sunday ET

British Prime Minister Theresa May faces her landslide defeat in the parliamentary vote 432-to-202 against her Brexit deal. British Parliament rejects the M

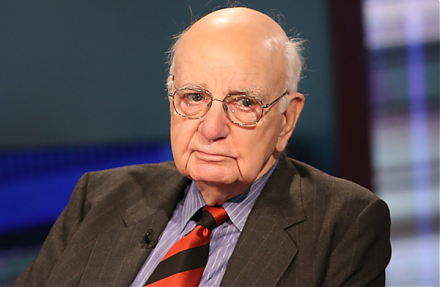

2018-10-23 12:36:00 Tuesday ET

Former Fed Chair Paul Volcker releases his memoir, talks about American public governance, and worries about plutocracy in America. Volcker suggests that pu