2018-07-25 11:41:00 Wed ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

President Trump hails and touts America's new high real GDP economic growth in 2018Q2. The U.S. is now a $20+ trillion economy, and America hits this milestone for the first time in the world. A major rebound in core consumer expenditures from 2018Q1 is the largest contribution to real GDP economic growth.

Personal consumption increases by a hefty 4% margin, and business investments and government expenditures also surge quarter-to-quarter. These great numbers arise in the broader context of Trump economic reforms on trade, fiscal stimulus, infrastructure, credit supply expansion, and health care.

This fundamental prediction of healthy real GDP economic growth shatters most fears and doubts that America may not remain tax-neutral when push comes to shove. Some economists and pundits forecast that American needs at least 3%-3.5% real GDP economic growth in order to better balance its medium-term budget.

Now it seems plausible for the Trump administration to herald supply-side macro economic policies. These policies help fiscal stimulus and government welfare to trickle down to the typical American.

Since Trump's presidential election victory in November 2016, offshore corporate cash repatriation rakes in $300 billion and partly contributes to the fresh creation of 3.7 million domestic jobs. Overall, the Trump stock market rally can continue in the foreseeable future.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-01 12:35:00 Monday ET

Apple releases the new iOS 13 smartphone features. These features include Dark Mode, Audio Share, Memoji, better privacy protection, smart photo collection,

2017-07-19 11:35:00 Wednesday ET

This brief article encapsulates the timeless wisdom of Warren Buffett's famous quotes on fundamental stock investment, fear and greed, patience, risk co

2019-09-11 09:31:00 Wednesday ET

Central banks in India, Thailand, and New Zealand lower their interest rates in a defensive response to the Federal Reserve recent rate cut. The central ban

2019-10-29 13:36:00 Tuesday ET

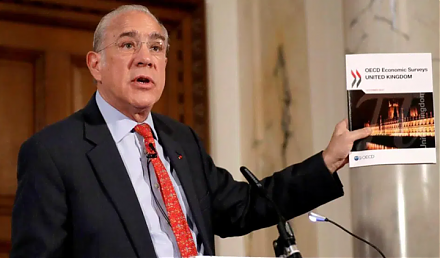

The OECD projects global growth to decline from 3.2% to 2.9% in the current fiscal year 2019-2020. This global economic growth projection represents the slo

2018-12-20 13:40:00 Thursday ET

T-Mobile and Sprint indicate that the U.S. is likely to approve their merger plan as they take the offer from foreign owners to stop using HuaWei telecom te

2023-11-21 11:32:00 Tuesday ET

Nobel Laureate Paul Milgrom explains the U.S. incentive auction of wireless spectrum allocation from TV broadcasters to telecoms. Paul Milgrom (2019)