2019-07-15 16:37:00 Mon ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

President of US-China Business Council Craig Allen states that a trade deal should be within reach if Trump and Xi show courage at G20. A landmark trade agreement between China and the U.S. should be attainable insofar as Presidents Trump and Xi have the courage to compromise on some particular aspects of the trade deal. This compromise can be difficult for both leaders, whereas, both sides signal the positive intent that Sino-U.S. trade negotiations should get back on track.

Allen indicates that setbacks are quite normal in most bilateral trade negotiations. Perhaps the China-U.S. trade envoys, Liu He and Robert Lighthizer, seem to agree to a major trade deal *in principle*. However, the legal details may not fully reflect mutual agreement for both presidential leaders. The Trump administration calls for significant bilateral trade deficit removal and better intellectual property protection and enforcement in China. Yet, the Chinese Xi administration expects all future fair trade practices to be realistic with reasonable product procurement, market access, and technology transfer etc. Respecting these fundamental interests can help both sides reach a tractable solution. In essence, Allen suggests that addressing these concerns helps China achieve sustainable economic growth in the long run.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2024-02-04 08:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2024. Our proprietary alpha investment model outperforms the ma

2019-12-30 11:28:00 Monday ET

AYA Analytica finbuzz podcast channel on YouTube December 2019 In this podcast, we discuss several topical issues as of December 2019: (1) The Trump adm

2018-02-01 07:38:00 Thursday ET

U.S. senators urge the Trump administration with a bipartisan proposal to prevent the International Monetary Fund (IMF) from bailing out several countries t

2025-06-21 05:25:00 Saturday ET

President Trump refreshes American fiscal fears, worries, and concerns through the One Big Beautiful Bill Act. The Congressional Budget Office (CBO) estimat

2018-01-23 06:38:00 Tuesday ET

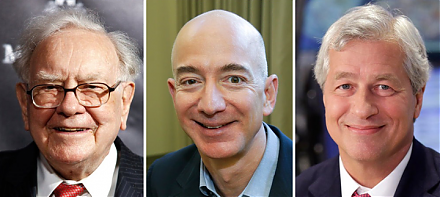

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

2018-01-04 07:36:00 Thursday ET

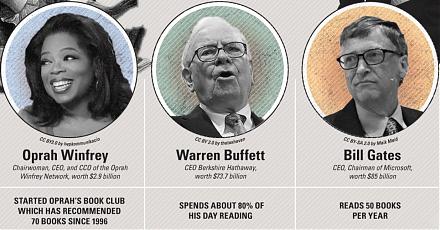

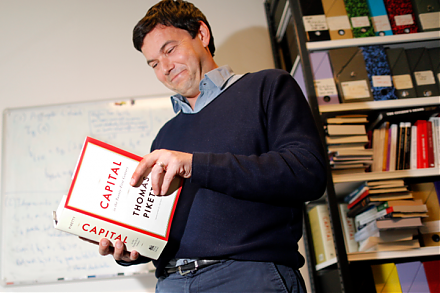

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal