2019-10-27 17:37:00 Sun ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

International climate change can cause an adverse impact on long-term real GDP economic growth. USC climate change economist Hashem Pesaran and his co-authors analyze a panel dataset of 174 countries for the years from 1960 to 2014. The major empirical punchline suggests that persistent changes in the temperature above or below its historical norm cause per-capita real economic output growth ceteris paribus. Specifically, a persistent increase in average global temperature by 0.04°C reduces global real GDP per capita by at least 7.22% by 2100 once the econometrician controls for all other relevant covariates and endogenous effects.

However, if all the sample countries abide by the Paris climate agreement to limit the temperature increase to 0.01°C per annum, this climate policy coordination can lower the economic output loss substantially to no more than 1.07%. Canada, India, Japan, New Zealand, Switzerland, and the U.S. can experience 10% larger losses of economic output growth. Also, climate change can cause a long-term adverse impact on economic output, labor productivity, and employment across at least 48 U.S. states and industrial sectors for the period from 1963 to 2016. This landmark study confirms and corroborates the progressive agenda that climate change can cause a first-order adverse impact on economic consequences.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-05-02 13:30:00 Thursday ET

Netflix has an unsustainable business model in the meantime. Netflix maintains a small premium membership fee of $9-$14 per month for its unique collection

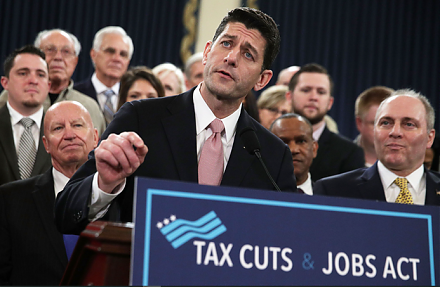

2017-11-17 09:42:00 Friday ET

The Trump administration garners congressional support from both Senate and the House of Representatives to pass the $1.5 trillion tax overhaul (Tax Cuts &a

2017-11-27 07:39:00 Monday ET

Is it anti-competitive and illegal for passive indexers and mutual funds to place large stock bets in specific industries with high market concentration? Ha

2020-02-12 09:31:00 Wednesday ET

Mark Zuckerberg develops Facebook as a social network platform to help empower global connections among family and friends. David Kirkpatrick (2011) T

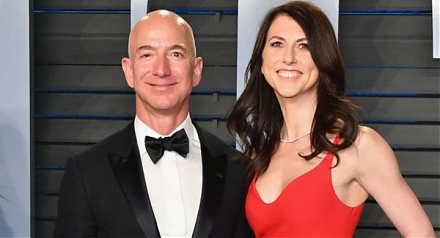

2018-01-03 08:38:00 Wednesday ET

President Trump targets Amazon in his call for U.S. Postal Service to charge high delivery prices on the ecommerce giant. Trump picks another fight with an

2019-06-25 10:34:00 Tuesday ET

Investing in stocks is the best way for people to become self-made millionaires. A recent Gallup poll indicates that only 37% of young Americans below the a