2020-02-02 10:31:00 Sun ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq.

We implement our proprietary alpha investment model for positive U.S. stock signals.

A complete model description is available on our AYA fintech network platform.

Our U.S. Patent and Trademark Office (USPTO) patent publication is available on the World Intellectual Property Office (WIPO) official website.

Every freemium member can sign up for free to check out our proprietary alpha signals on our AYA fintech network platform.

Each freemium member can thus learn from these proprietary alpha signals over time.

The proprietary alpha investment model estimates long-term average abnormal returns for U.S. individual stocks and then ranks these stocks in accordance with their dynamic conditional alpha signals.

Several virtual members follow these dynamic conditional alpha signals to trade U.S. stocks on our AYA fintech network platform.

Sign up for free to learn more about our proprietary alpha signals for U.S. stocks, economic trends, investment memes, and personal finance tips.

Our free podcasts and blog posts cover the latest stock market issues.

AYA is the new Facebook for stock market investors.

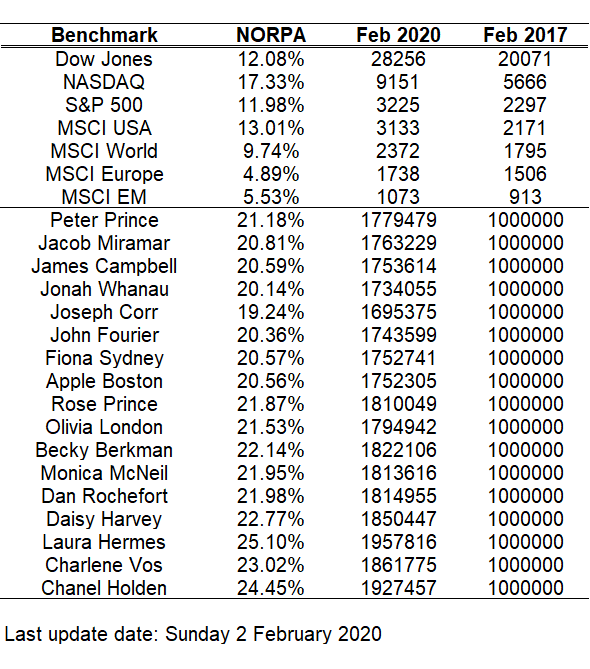

For convenient review, we list the U.S. stock portfolio positions for these virtual members on our AYA fintech network platform:

We track the stock prices and returns for the recent 3-year period from early-February 2017 to early-February 2020.

This data span allows us to conduct an out-of-sample test to assess our proprietary alpha investment model performance in comparison to the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq etc.

S&P 500 yields an 12% net overall return per annum (NORPA) while Dow Jones and Nasdaq generate 12%-17% NORPAs.

MSCI stock market benchmarks deliver 5%-13% NORPAs (MSCI USA, MSCI World, MSCI Europe, and MSCI Asia).

With our proprietary alpha investment model, all of our virtual members from Laura Hermes and Chanel Holden to Jonah Whanau and Joseph Corr outperform the S&P 500 and MSCI stock market benchmarks with 19.2%-25.1% NORPAs (cf. the above tabular results for all net overall returns per annum (NORPAs)).

In fact, all of the 17 virtual stock portfolios deliver higher NORPAs than Dow Jones, Nasdaq, S&P 500, and MSCI stock market index returns.

The recent double-digits model performance corroborates the scientific fact that our proprietary alpha investment model outperforms the major stock market benchmarks.

Sign up for free to learn more about our proprietary alpha signals for U.S. stocks, economic trends, investment memes, and personal finance tips.

Our free podcasts and blog posts cover the latest stock market issues.

AYA is the new Facebook for stock market investors.

Our recent research suggests that the proprietary alpha investment model captures dynamism in several fundamental factors such as size, value, momentum, asset growth, operating profitability, and market risk exposure (cf. Fama-French fundamental factors).

Also, the empirical evidence indicates substantial mutual causation between macroeconomic innovations and dynamic conditional alphas.

This causal relation serves as a core qualifying condition for fundamental factor selection in our modern asset pricing model design and performance evaluation.

In conclusion, we help demystify the pervasive misconception that it is often difficult for individual investors to beat the long-term average 11% stock market return.

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq.

We implement our proprietary alpha investment model for positive U.S. stock signals.

A complete model description is available on our AYA fintech network platform.

Our U.S. Patent and Trademark Office (USPTO) patent publication is available on the World Intellectual Property Office (WIPO) website.

Every freemium member can sign up for free to check out our proprietary alpha signals on our AYA fintech network platform.

Each freemium member can thus learn from these proprietary alpha signals over time.

AYA fintech network platform serves as the social toolkit for profitable stock investment management.

AYA is the new stock market Facebook that helps promote better financial literacy, freedom, and inclusion of the global general public.

We empower investors through technology, education, and social integration.

Sign up for free to learn more about our proprietary alpha signals for U.S. stocks, economic trends, investment memes, and personal finance tips.

Our free podcasts and blog posts cover the latest stock market issues.

AYA is the new Facebook for stock market investors.

Andy Yeh

Andy Yeh Alpha (AYA) fintech network platform founder

Brass Ring International Density Enterprise (BRIDE)

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-04-23 07:43:00 Monday ET

Harvard professor and former IMF chief economist Kenneth Rogoff advocates that artificial intelligence helps augment human productivity growth in the next d

2023-10-19 08:26:00 Thursday ET

World politics, economics, and new ideas from the Psychology of Money written by Morgan Housel We would like to provide both economic and non-economic th

2020-02-12 09:31:00 Wednesday ET

Mark Zuckerberg develops Facebook as a social network platform to help empower global connections among family and friends. David Kirkpatrick (2011) T

2022-05-05 09:34:00 Thursday ET

Corporate payout management This corporate payout literature review rests on the recent survey article by Farre-Mensa, Michaely, and Schmalz (2014). Out

2018-09-25 10:35:00 Tuesday ET

Sirius XM pays $3.5 billion shares to acquire the music app company Pandora. This acquisition would form the largest audio entertainment company worldwide.

2018-03-03 11:37:00 Saturday ET

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de