2018-09-17 12:40:00 Mon ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Nobel Laureate Robert Shiller's long-term stock market indicator points to a recent peak. His cyclically-adjusted P/E ratio (or CAPE) accounts for long-term corporate profitability and market valuation. CAPE has correctly helped anticipate the Black Monday 1987 stock market crash, the dotcom bubble collapse in the dawn of the new millennium, and the global financial crisis from 2008 to 2009.

As of September 2018, this metric gauges the U.S. stock market value at 33 times the average corporate income over the past decade. CAPE serves as a useful key economic indicator of U.S. stock market overvaluation at this stage of the business cycle. In fact, the current U.S. stock market capitalization well exceeds American real GDP economic output. It is often difficult to beat the market, whereas, it can be quite easy and imperative to save on capital income taxes and transaction costs.

Wharton finance professor Jeremy Siegel, however, disagrees with this simplistic CAPE analysis of U.S. stock market valuation. Even though U.S. stocks appear to be expensive, they remain good bargains in comparison with bonds in light of the small default risk premium. Relative valuation of stocks-versus-bonds continues to be favorable during the current Trump stock market rally in modern U.S. economic history.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-08-24 14:38:00 Saturday ET

Warren Buffett warns that the current cap ratio of U.S. stock market capitalization to real GDP seems to be much higher than the long-run average benchmark.

2019-05-15 12:32:00 Wednesday ET

The May administration needs to seek a fresh fallback option for Halloween Brexit. After the House of Commons rejects Brexit proposals from the May administ

2019-07-03 11:35:00 Wednesday ET

U.S. regulatory agencies may consider broader economic issues in their antitrust probe into tech titans such as Amazon, Apple, Facebook, and Google etc. Hou

2019-02-04 07:42:00 Monday ET

Federal Reserve remains patient on future interest rate adjustments due to global headwinds and impasses over American trade and fiscal budget negotiations.

2017-08-01 09:40:00 Tuesday ET

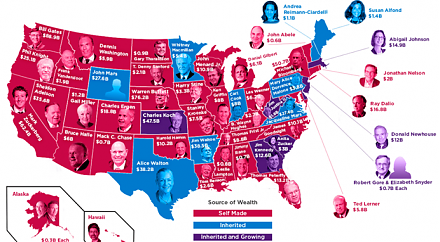

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N

2017-12-21 12:45:00 Thursday ET

Tony Robbins summarizes several personal finance and investment lessons for the typical layperson: We cannot beat the stock market very often, so it w