2019-01-02 06:28:00 Wed ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

New York Fed CEO John Williams listens to sharp share price declines as part of the data-dependent interest rate policy. The Federal Reserve can respond to stock market plunges, but key FOMC members still view the U.S. economy as sufficiently strong to grow with higher interest rates. Williams emphasizes softening the central bank language that the next 2 interest rate increases are only economic projections. The upward interest rate trajectory is not a matter of right-or-wrong with Wall Street, and the central bank cannot be on autopilot at this stage of the real business cycle. Williams expects U.S. real GDP to slow to 2%-2.5% in 2019 from 3%-3.5% in 2018, whereas, inflation should be around 2% in 2019. Trump tariffs continue to pose a major tone of economic policy uncertainty.

Treasury Secretary Steven Mnuchin tries to assuage bank CEOs and stock market investors that the Trump administration has no power to oust Fed Chair Jay Powell for his recent interest rate hike. Mnuchin seeks consultation with the Securities and Exchange Commission and Federal Reserve on the partial government shutdown and stock market turmoil. This stock market plunge protection team hence receives reassurance from banks that there is ample liquidity for lending to both consumers and firms.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2022-11-25 09:29:00 Friday ET

Uniform field theory of corporate finance While the agency and precautionary-motive stories are complementary, these stories can be nested as special cas

2025-10-10 12:31:00 Friday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-02-19 08:39:00 Monday ET

Snap cannot keep up with the Kardashians because its stock loses market value 7% or $1 billion after Kylie Jenner tweets about her decision to leave Snapcha

2017-12-23 10:40:00 Saturday ET

Despite having way more responsibility than anyone else, top business titans such as Warren Buffett, Charlie Munger, and Oprah Winfrey often step away from

2020-06-24 09:32:00 Wednesday ET

Several business founders and entrepreneurs take low risks with high potential rewards to buck the conventional wisdom. Renee Martin and Don Martin (2010

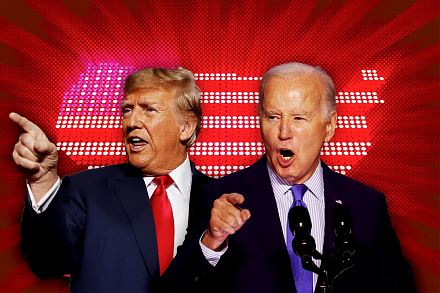

2024-03-19 03:35:58 Tuesday ET

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi