2023-09-21 09:26:00 Thu ET

stock market federal reserve monetary policy treasury fiscal policy deficit debt technology employment inflation global macro outlook interest rate fiscal stimulus economic growth central bank fomc capital gdp output commitment discretion

Jordi Gali (2015)

Monetary policy, inflation, and the business cycle

Jordi Gali presents the theoretical foundations and empirical studies in support of the New Keynesian monetary policy framework with economic output and inflation stabilization. Since the 1980s, many empirical studies bolster the case that interest rate adjustments significantly influence the short-term course of the real business cycle in terms of both output and inflation fluctuations. Also, New Keynesians have proposed several improvements in the theoretical foundations for monetary policy analysis and evaluation. The baseline New Keynesian model departs from the core real business cycle (RBC) model with the sound inclusion of both nominal rigidities and monopolistic competitive forces. The resultant New Keynesian model includes the New Keynesian Phillips Curve (NKPC) (i.e. the trade-off between inflation and output), the IS curve (cf. the relation between interest rates and output fluctuations), and the Taylor-style monetary policy interest rate rule (Taylor, 1993; Bernanke and Mishkin, 1997; Clarida, Gali, and Gertler, 1999). With this new dynamic stochastic general equilibrium (DSGE) model, New Keynesian macro economists are able to generate monetary non-neutrality in the form of large and persistent ripple effects of interest rate adjustments on both output and inflation fluctuations at least in the medium term. Monopolistic competitive forces and nominal price rigidities provide the major market frictions in support of large and persistent non-neutral effects of monetary policy.

The New Keynesian baseline model focuses on monetary policy interest rate rules in terms of primitive factors such as household consumption, capital accumulation, labor supply, economic output, national income, technical progress, and so forth. Like the DSGE models in the RBC school of economic thought, the New Keynesian baseline model evolves from first principles. Within this model, the core instrument of monetary policy is the short-term interest rate (the federal funds rate in America). The monetary policy design problem relates to how macro decision-makers mold the current paths and future expectations of interest rates in response to business cycle fluctuations (both output growth and inflation rates) in the general state of the real economy.

In the New Keynesian monetary policy framework, macro decision-makers derive gains from enhancing central bank credibility and communication. This credibility results from formal commitment to some Taylor-style interest rate rule via domestic institutional arrangements. In reality no central bank can make any specific type of commitment over the future course of monetary policy. In the absence of nominal wage rigidities, the optimal monetary policy embeds some clear inflation target (e.g. a 2%-4% average inflation target). Specifically, the central bank gradually adjusts the short-term interest rate in order to smooth output and inflation fluctuations over time. In practice, the central bank should adjust the nominal short-run interest rate more than one-for-one with future inflation expectations. The central bank should adjust the nominal short-run interest rate sufficiently to shift the real interest rate in the same direction that offsets any movement in future inflation expectations. How the central bank should adjust the interest rate in response to output shocks often depends on the basic nature of these output shocks. In a nutshell, the central bank offsets demand shocks with interest rate hikes, but accommodates supply shocks with no major interest rate changes. This New Keynesian baseline monetary policy framework helps better balance the divine coincidence of both output and inflation stabilization in the form of zero or minimal quadratic welfare losses (Blanchard and Gali, 1997; Clarida, Gali, and Gertler, 1999; Woodford, 2003; Blanchard and Gali, 2010; Gali, 2015).

If the central bank target for real economic output exceeds the market equilibrium level, an inefficiently high steady-state inflation rate may emerge in the absence of commitment. The welfare gain from commitment helps reduce this inflationary bias. In the New Keynesian monetary policy framework, there can be large welfare gains from commitment if the current price-wage formulation depends on future inflation expectations. The central bank chooses to commit to a credible low inflation target, and this central bank commitment can help improve the current trade-off between output and inflation. Specifically, this commitment can help reduce the welfare cost in terms of current output loss that the conservative macro decision-maker requires to reduce current inflation. A simple and feasible solution entails appointing some conservative central bank chair with a greater distaste for inflation than society as a whole (Rogoff, 1985). In practice, this hawkish monetary policy stance can help boost economic output and employment toward their maximum sustainable levels with low and steady intermediate inflation rates from quarter to quarter.

Modern central banks from the Federal Reserve System to European Central Bank and Bank of England downgrade the role of monetary aggregates (such as M2 and M3) in the practical implementation of monetary policy. The opportunistic approach boils down to trying to keep low and steady inflation, but allowing inflation to ratchet down in rare times of favorable supply shocks. The optimal monetary policy design depends on the degree of persistence in both output and inflation. The degree of output persistence is important because the future path of output gaps influences the market expectations of both inflation and the short-run interest rate. The degree of inflation persistence is critical because this factor governs the trade-off between output and inflation in both the current and future episodes. In the baseline model, output and inflation persistence arises from serial correlation in exogenous shocks. Most central banks commit to some Taylor-like robust interest rate rules, and these robust rules product desirable output and inflation outcomes in a broad variety of alternative macro economic frameworks. Empirical evidence suggests that the U.S. monetary policy follows the vast majority of New Keynesian interest rate principles (especially in the pre-Volcker episode). From Volcker and Greenspan to Bernanke, Yellen, and then Powell, U.S. monetary policy adopts some implicit low and steady inflation target of 2% to 4% in accordance with good policy management.

The New Keynesian baseline macro model is a dynamic general equilibrium model with nominal price rigidities, monopolistic competitive price adjustments, and real money balances. This baseline macro model comprises the IS curve, the Phillips curve, and the Taylor-like interest rate rule. Within the model, monetary policy can affect the real economy in the short run, much as in the traditional Keynesian IS/LM framework. A key difference relates to the fact that aggregate behavioral equations evolve from optimization by households and firms. The current economic behavior depends on both the current interest rate adjustments and rational expectations of the future course of monetary policy. The IS curve relates the output gap inversely to the real interest rate. Here the output gap represents the discrepancy between the current output level and the efficient output level under full capacity utilization. The Phillips curve relates inflation positively to the output gap (and so employment). The Taylor-like interest rate rule relates the current nominal interest rate to inflation and the output gap.

Because households often smooth consumption over time, market expectations of higher future consumption lead households to prefer to consume more now. This preference raises the current output demand. In turn, the negative effect of the real interest rate on current output therefore reflects the intertemporal substitution of consumption. In the IS curve, the real interest elasticity of output corresponds to the intertemporal elasticity of consumption. The output gap depends not only on the real rate and the demand shock, but also on the future paths (expectations) of these 2 macro variables. To the extent that monetary policy has leverage over the short-run real interest rate due to nominal rigidities, both current policy actions and future expectations affect aggregate demand in the output gap equation.

The Phillips curve evolves from nominal price rigidities in the spirit of Fischer (1977) and Taylor (1980). When the monopolistically competitive firm has the opportunity, each firm chooses its nominal price(s) to maximize profits subject to constraints on the frequency of future price adjustments. In a given period, each monopolistically competitive firm keeps its nominal price markup(s) with some non-zero probability 0<z<1. With some probability 1–z, each monopolistically competitive firm adjusts nominal price(s) toward the equilibrium steady state. This Calvo (1983) formulation of nominal price rigidities captures the spirit of monopolistic competition, but then facilitates aggregation by making the frequency of rare inflexible price adjustments independent of past price history. In this fresh light, the Phillips curve is a log-linear approximation about the steady state of the aggregation of individual firm markup decisions (Blanchard, 1997; Fuhrer and Moore, 1995). Inflation depends on both the current and likely future economic conditions (output gaps). Specifically, each firm sets nominal prices on the basis of expectations of future marginal costs. This price formulation further allows for the cost push shock through the monetary policy transmission mechanism. As the nominal rate serves as the policy instrument, it is not necessary for the social planner to set the money market equilibrium condition (i.e. an LM curve).

With nominal rigidities present, monetary policy-makers can effectively change the short-term real interest rate by varying the nominal rate. In this macro environment, how monetary policy should react to short-run disturbances is a significant macro decision. Resolving this technical issue is the essence of the contemporary debate over monetary policy.

Most macro models cannot capture what many economists would view as a major cost of inflation. This cost of inflation manifests in the form of economic uncertainty that inflation variance generates for lifetime business plans (DeLong, 1997). When some groups suffer more than others in recessions (e.g. blue-collar workers versus white-collar specialists) in incomplete credit and insurance markets, then the utility of a representative agent may not provide an accurate barometer of business cycle fluctuations in quadratic welfare (Woodford, 1998; Rotemberg and Woodford, 1999; Clarida, Gali, and Gertler, 1999; Steinsson, 2003; Woodford, 2003; Gali, 2015).

In America, macroeconomic policy-makers follow the dual mandate of maximum employment and price stability. Here price stability should be the ultimate goal, and Federal Reserve governors define price stability as the low and steady 2% inflation rate at which inflation is no longer a public concern. In practice, the low and steady inflation rate between 1% and 3% seems to meet this broad definition (Bernanke and Mishkin, 1997; Gali, 2015). In stochastic calibration, macroeconomic policy-makers choose to assign all the weight to inflation stabilization (and a zero weight to output stabilization) in order to better balance the trade-off between output and inflation. This divine coincidence accords with the macroeconomic consensus view that price stability should be the ultimate goal in light of the dual mandate.

The monetary policy problem is to choose a time path for the policy instrument (i.e. the nominal interest rate) to engineer time paths of the target variables (i.e. inflation and the output gap). The solution can help maximize the economic welfare function in terms of quadratic losses due to economic output and inflation variances, subject to the constraints in the dual form of the IS curve and the Phillips curve. This core combination of quadratic losses and linear constraints yields a certainty equivalent decision rule for the time path of the policy instrument. The optimal feedback rule relates the instrument to changes in the general state of the real economy.

The target variables, inflation and the output gap, depend on not only the current monetary policy instrument but also expectations about future policy decisions. As the IS curve shows, the output gap depends on the future path of the interest rate. As the Phillips curve shows, inflation depends on the current and future behaviors of the output gap. In this macro environment, central bank credibility of future policy intentions becomes a critical issue in monetary policy (Kydland and Prescott, 1977; Blanchard and Gali, 2010; Gali, 2015). The central bank that can credibly indicate its intent to maintain low and steady inflation around the 2% target threshold in the foreseeable future may be able to reduce current inflation with less welfare cost in terms of output retracement. Specifically, central bank credibility and commitment can help better balance the trade-off between output and inflation. In this positive light, path-dependent monetary policy commitment accords with the dual mandate of maximum sustainable employment and price stability.

The key distinction between discretionary policy changes and interest rate rules is whether current central bank commitments constrain the future course of monetary policy in any credible way. In each instance, the optimal result is a feedback policy that relates the policy instrument to the current state of the real economy in a very specific way. Most macro models are nowhere near the point where it is plausible for central bank decision-makers to obtain a highly specific policy rule for practical use with great confidence. However, it is still useful and pragmatic for macro policy-makers to work through the cases of rules rather than discretion in order to develop a set of normative guidelines for monetary policy behaviors (Kydland and Prescott, 1977; Clarida, Gali, and Gertler, 1999; Blanchard and Gali, 2010; Gali, 2015).

Result 1: To the extent that cost push inflation is present, there is a short-run trade-off between inflation and output variability.

Each quarter the central bank adjusts the policy instrument (cf. the nominal interest rate) to drive inflation, output, and expectations about their future paths in order to maximize economic welfare (with minimal quadratic losses in terms of output and inflation variances), subject to the quasi-linear constraints such as the IS curve and the Phillips curve. The solution yields the first-order optimality condition that there is a mysterious and inexorable proportional trade-off between output and inflation. This optimality condition shows that the central bank often chooses to lean against the wind countercyclically by increasing the interest rate more than 1% in order to contract demand below full capacity whenever inflation is about 1% above target. When inflation is about 1% below target, the central bank reduces the interest rate by more than 1% to boost demand (Taylor, 1979; Clarida, Gali, and Gertler, 1999; Blanchard and Gali, 2010; Gali, 2015). If cost push factors drive inflation, it is only possible for the central bank to reduce inflation in the medium term by contracting demand.

Result 2: The optimal monetary policy includes the low and steady inflation target in the sense that the central bank aims to achieve inflation convergence to the 2% to 4% target over time. Extreme inflation targets would involve adjusting short-term interest rates immediately to hit some inflation target zone of 2% to 4%. This rather extreme policy approach would be optimal under one of 2 circumstances: (1) cost push inflation is absent, or (2) there is no concern for output divergence.

Svensson (1997) and Ball (1997) show that it would be optimal for the central bank to attain the gradual convergence of inflation and the output gap. In a basic sense, the gradual convergence helps ensure significantly smaller quadratic welfare costs in terms of inflation and output variances. Analyzing smooth interest rate changes, Woodford (2003) shows that the same thesis holds true in the presence of interest rate inertia. Steinsson (2003) further supports this notion in the more general case of inflation persistence. In essence, it would be optimal for the central bank to alter the nominal interest rate to drive gradual changes in output and inflation because this gradual convergence affects not only the current output gap and inflation rate but also expectations about their likely future time paths. In this positive light, this gradual convergence can help ensure minimal economic welfare costs in terms of both output and inflation variances.

Result 3: Under the optimal monetary policy, the nominal interest rate should rise sufficiently to boost the real rate in response to gradual pervasive hikes in inflation expectations.

When inflation is above target, the optimal monetary policy requires that the central bank raises the real interest rate to contract demand. This Taylor principle provides a simple and intuitive criterion for monetary policy evaluation. For instance, Clarida, Gali, and Gertler (1999) find that pre-Volcker U.S. monetary policy seems to have violated this strategy. Since 1979, however, the Federal Reserve System appears to have adopted the implicit inflation target strategy in accordance with the Taylor interest rate principle. Over this historical period, the Federal Reserve System has systematically raised the real interest rate in response to current and future hikes in inflation expectations.

Result 4: The optimal monetary policy calls for adjusting the interest rate to offset demand shocks, but accommodates potential output shocks.

An important task of monetary policy is to draw a distinction between the sources of business cycle shocks (i.e. demand shocks versus potential output shocks). A permanent rise in productivity helps boost potential output, but this rise also offsets output demand due to the adverse impact on permanent income. In this scenario, monetary policy-makers should not adjust the nominal rate in response to potential output shocks. Alternatively, central bank decision-makers reduce the nominal rate in response to adverse demand shocks. Countering demand shocks pushes both output and inflation in the right direction. Demand shocks cannot force a short-run trade-off between output and inflation. In sum, the optimal policy requires adjusting the nominal interest rate to offset key demand shocks, but accommodates potential output shocks.

The core contributions of Kydland and Prescott (1977), Barro and Gordon (1983), and Rogoff (1985) shine light on the persistent inflationary bias under discretion. The ultimate source of this inflationary bias is a central bank that desires to push output above its natural efficient level. So subsequent monetary policy discussions focus on the short-run pains of disinflating the real economy with interest rate hikes. Nominal wage and price rigidities often depend on the future paths of both prices and wages. In turn, these market expectations depend on the short-term course of monetary policy. To many New Keynesian macro economists, this logic suggests that monetary policy decisions can cause first-order ripple effects on real business cycle fluctuations. In this fundamental sense, the central bank that can manage to establish monetary policy credibility may be able to reduce inflation at lower cost. This desirable outcome accords with the near-term policy goal of price stability with minimal output disruption.

Specifically, quadratic welfare gains from central bank credibility arise even when the central bank is not trying to push output above its natural efficient level. There may be quadratic welfare gains from establishing some form of both credibility and commitment for the central bank to curtail inflation. Under plausible restrictions on the form of the feedback rule, the optimal policy under commitment differs from the alternative policy under discretion in a simple and intuitive way. A feasible solution entails appointing some conservative central bank chair with a greater distaste for inflation than society as a whole (Rogoff, 1985). In practice, this hawkish monetary policy stance helps boost economic output and employment toward their maximum sustainable levels with low and steady intermediate inflation rates.

Result 5: If the central bank wants to boost output above the potential output level, a suboptimal equilibrium may arise from discretionary monetary policy with inflation persistently above target and no gain in output.

The central bank can use discretion to boost output above the potential output level with some suboptimal inflationary bias; however, the output gap eventually closes and there should be no real gain in output in the long run. Equilibrium inflation rises to the point where the central bank no longer tries to expand output. Because there is no long-run trade-off between output and inflation (i.e. the output gap converges to zero in the long run regardless of medium-term inflation fluctuations), long-term equilibrium inflation becomes systematically above target.

This analysis has both important positive and normative policy implications. On the positive side, the theory helps explain why inflation may remain persistently higher in the pre-Greenspan era from the late-1960s to the early-1980s. On the normative side, this analysis shows that there may be gains from committing to some Taylor interest rate rules in the course of monetary policy. Alternatively, the central bank can make some institutional arrangements for fiscal-monetary policy coordination in order to achieve the same purpose. In accordance with this purpose, the central bank has leverage over short-term interest rate adjustments to reduce inflation with minimal output disruption over the course of monetary policy. The central bank can therefore accomplish the dual mandate of price stability and maximum sustainable employment at lower welfare cost.

Result 6: Appointing a conservative central bank chair (who assigns a higher cost to inflation than society as whole) helps reduce the relatively inefficient inflationary bias under discretion.

Friedman and Kuttner (1996) point out that inflation now appears well under control in most OECD countries despite the absence of any obvious domestic institutional arrangements for central bank credibility. The Phillips curve has become flat in the sense that there is virtually no apparent trade-off between output and inflation. In light of this evidence, macro economists from Barro and Cochrane to Sargent and Sims indicate that the Phillips curve seems to have become the Phillips cloud.

In America, Australia, Britain, Canada, Europe, and Japan, the central bank boards have effectively tried to appoint conservative central bank chairs with clear distaste for inflation (Rogoff, 1985). The hawkish monetary policy stance helps boost output and employment toward their respective maximum sustainable levels with low and steady intermediate inflation rates from quarter to quarter. As inflation depends on future output gaps and market expectations, the central bank tries to convince the private sector that the conservative central bank chair seeks to contain inflation in the future with no demand contraction in the meantime. The central bank attempts to enhance monetary policy credibility by committing to Taylor interest rate rules. This central bank credibility helps improve economic welfare gains (in the form of lower output and inflation variances).

Result 7: If price markups and sluggish price adjustments depend on expectations of future economic conditions, the central bank can credibly commit to some Taylor interest rate rule of both output and inflation stabilization to attain a better trade-off between output and inflation. This gain from commitment arises even if the central bank cannot prefer to increase output above the potential output threshold. Under commitment, the equilibrium solution resembles the alternative case of discretion where the central bank assigns to inflation a higher cost than the true social cost.

Clarida, Gali, and Gertler (1999) analyze the globally optimal solution to the linear quadratic policy problem under central bank commitment (Currie and Levine, 1993; Woodford, 1998). Steinsson (2003) and Woodford (2003) further extend the New Keynesian baseline framework to the more general cases of inflation persistence and interest rate inertia. In each case, the optimal policy calls for adjusting changes in the output gap in response to inflation. Hence, central bank commitment alters the level rule for the output gap under discretion to a difference rule for the output gap. If inflationary pressures vary inversely with the real interest rate, Taylor-style interest rate rules may inadvertently lead to suboptimal self-fulfilling fluctuations in both output and inflation.

Result 8: In the globally optimal monetary policy rule with commitment, the central bank partially adjusts demand in response to inflationary pressures. The basic idea relates to exploiting the dependence of current inflation on likely future demand. In addition, it may be better for the central bank board to appoint a conservative chair in order to raise welfare under discretion. However, it may not be possible for the central bank chair to attain the globally optimal monetary policy rule with this well-known strategy.

A standard criticism of applying a low and steady inflation target is that information about the impact of monetary policy on inflation is only available with a long lag. In practice, this information lag makes it almost impossible for key macro economists to monitor monetary policy performance. To generate the correct inflation forecasts, the central bank must implement a sound structural model of the macro economy. Structural vector autoregressions (VAR) generate reasonable forecasts only if the macro economy converges to some stationary equilibrium state (Sims, 1980, 1996, 2012). A traditional alternative approach to applying the target variables such as inflation and the output gap is to focus on the observable and controllable variables that exhibit high correlation with the target variables in the data. Broad monetary aggregates from M2 to M3 are the best known examples of intermediate targets. In most OECD countries, money supply growth shows one-to-one correspondence with inflation. This evidence echoes the famous Friedman observation that inflation is always and everywhere a monetary phenomenon.

However, broad monetary aggregates often cannot attain stable covariances with nominal GDP and the output gap etc. For this reason, unstable co-movements in money demand have effectively forced a retreat from strict money supply growth targets. Most central banks now focus on both output and inflation targets and the nominal interest rate for monetary policy coordination.

Result 9: With imperfect information, the optimal monetary policy rules are the key certainty equivalent versions of the perfect information case. Monetary policy rules must involve the rational forecasts of target variables such as price inflation, wage growth, and the output gap, in contrast to ex post behaviors and observable targets such as broad money aggregates from M1 to M2 and M3.

Result 10: Large unobservable money demand shocks can produce high volatility of interest rates when the central bank uses some form of broad money aggregates as the monetary policy instrument. For this reason, it would be better for the central bank to use some form of interest rates as the monetary policy instrument.

In most OECD countries, there is clear partial adjustment to movements in inflation and the output gap. The central bank continually learns about the real economy as the hawkish central bank chair adjusts monetary policy decisions. In this context, model uncertainty becomes a formidable problem. In fact, model uncertainty helps introduce at least some degree of policy caution. When push comes to shove, the basic law of inadvertent consequences counsels caution.

Another explanation for policy conservatism and interest rate inertia relates to the fear of disrupting financial markets worldwide (Goodfriend, 1991; Campbell, 1995). Sharp interest rate increases can generate capital losses and collateral damages, especially for commercial banks and other financial institutions due to interest rate risk. This consideration helps explain why the Federal Reserve System appears to only gradually adjust interest rates during rare times of severe financial stress.

Result 11: Parameter uncertainty may reduce the response of the monetary policy instrument to disturbances in the real economy. This uncertainty motivates a better smoother path of the interest rate (than what the certainty equivalent policy implies).

Result 12: Small departures of output from target tend to generate larger quadratic welfare costs than small departures of inflation from target. In this well-known case, an opportunistic approach to disinflation may be optimal. This policy is equivalent to targeting inflation around some zone of 2% to 4% (rather than a particular level of 2%).

Result 13: Results 1 to 4 that describe optimal monetary policy under discretion in the New Keynesian baseline macro model are applicable in the more general case with inflation and output persistence (Steinsson, 2003; Woodford, 2003).

Erceg, Henderson, and Levin (2000) analyze a New Keynesian DSGE model with nominal wage and price rigidities. The volatility of price inflation induces dispersion in prices across firms and hence inefficient dispersion in output levels. The volatility of wage inflation induces dispersion in wages across firms and therefore inefficient dispersion of employment across households. Attaining the Pareto optimal market equilibrium would require not only a zero output gap and complete stabilization of price inflation, but also complete stabilization of wage inflation. Because the Pareto optimum is not feasible in practice, the central bank faces trade-offs in stabilizing wage growth, price inflation, and the output gap.

In DSGE stochastic calibration, the welfare cost of each hybrid interest rate rule is virtually comparable to the welfare cost of the optimal interest rate rule for a broad variety of structural parameters. The welfare cost of applying a low inflation target would be substantial. In most OECD countries, however, governments would view wage growth (or wage inflation) as a desirable economic policy outcome. In reality, few central banks would raise the nominal interest rate in response to increases in wage growth. For this reason, Gali (2015) points out that it may not be reasonable for most central banks to maneuver interest rate adjustments in response to pure wage inflation (apart from price inflation and the output gap). Several central banks such as the Federal Reserve System and European Central Bank etc regard wage growth as one of the auxiliary macro variables for monetary policy consideration.

In addition to output and inflation variances, Woodford (2003) includes interest rate variance in the welfare loss function. This simple innovation reveals the preference for most central banks to smooth the nominal interest rate over time. Specifically, this interest rate inertia arises from the fact that most central banks prefer gradual interest rate adjustments to a sudden once-and-for-all interest rate liftoff from the zero lower bound. This smooth interest rate rule can empower most central banks to achieve a greater degree of stability of inflation and the output gap, without too much variation in the level of interest rates. This macro stabilization shines light on path-dependent monetary policy decisions. The evolution of target variables such as output and inflation depends on not only the current monetary policy decisions, but also how the private sector expects the central bank to conduct monetary policy in the future. An effective central bank response to new inflationary pressures often requires the transmission mechanism that the private sector foresees changes in the entire future path of interest rates.

Steinsson (2003) analyzes optimal monetary policy in a New Keynesian model of inflation persistence. The Phillips curve nests a standard forward-looking Phillips curve and a standard backward-looking Phillips curve as special cases. In DSGE stochastic calibration, reasonable changes in effective tax rates result in relatively small shocks, whereas, reasonable variation in the monopoly power of producers can create large disturbances to the Phillips curve. In accordance with the previous empirical results of Fuhrer and Moore (1995) and Gali and Gertler (1999), it would be optimal for most central banks to bring inflation back down in a gradual manner (instead of an immediate interest rate liftoff from zero in the purely forward-looking Phillips curve).

Nakamura and Steinsson (2008) present 5 major facts about prices in the U.S. real economy. For consumer prices, the median frequency of non-sale price changes is about half of the median frequency of sale price changes (9% to 12% per month versus 19% to 20% per month). Almost one-third of non-sale price changes are price decreases. The frequency of price increases tends to covary significantly with inflation (whereas, the size and frequency of price decreases do not). The median frequency of price changes is highly seasonal; this frequency is highest in the first quarter and then declines in the rest of the year. There is virtually no evidence of upward-sloping hazard functions of price changes for individual products. All of this evidence accords with the New Keynesian baseline model with slow nominal price adjustments and monopolistic competitive forces.

Nakamura and Steinsson (2010) present empirical evidence in support of the view that about one-third of the U.S. real business cycle arises from nominal shocks. A multi-sector menu cost model accounts for the cross-sectional distribution of both the size and frequency of price changes in the U.S. real economy. In this model, the introduction of heterogeneity in the frequency of price changes appears to triple the degree of monetary non-neutrality. Also, the introduction of intermediate inputs further triples the degree of monetary non-neutrality. In a nutshell, the Nakamura-Steinsson multi-sector model with intermediate inputs helps generate substantial variation in real output in response to the calibration of nominal shocks that can account for about a quarter of the U.S. real business cycle.

Gabaix (2020) derives and proposes a behavioral New Keynesian macro model of fiscal and monetary policy coordination when economic agents are not fully rational. Here economic agents are partially myopic and cannot perfectly anticipate future rare events. As economic agents react myopically to distant rare events, forward guidance is much less powerful in the behavioral model than forward guidance in the traditional New Keynesian baseline model. Monetary policy-makers maneuver interest rate adjustments in order to follow the Taylor principle (that the short-term nominal interest rate should increase more than one-for-one in response to near-term increases in inflation). It is much easier for monetary policy-makers to satisfy this Taylor principle when economic agents are partially rational. Even with a time-invariant nominal interest rate, there is only one equilibrium as long as economic agents are myopic enough.

In a similar vein, the behavioral New Keynesian macro model can help explain the stability of economies stuck at the zero lower bound. The zero lower bound is much less costly in the behavioral model. The optimal monetary policy departs from the simple and intuitive inflation target zone of 2% to 4% when monetary policy-makers commit to some Taylor interest rate rules. In the behavioral model, fiscal stimulus can cause first-order ripple effects on output, consumption, employment, and even capital accumulation. Myopic economic agents tend to consume more when they receive tax cuts and debt-driven transfers from the central bank. In response to a permanent increase in the nominal interest rate, inflation declines in the short run (as the Keynesian effect manifests in lower inflation expectations) and then rises in the long run (so that long-run Fisher neutrality holds with respect to inflation).

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-09-25 15:33:00 Wednesday ET

Product market competition and online e-commerce help constrain money supply growth with low inflation. Key e-commerce retailers such as Amazon, Alibaba, an

2018-10-15 09:33:00 Monday ET

Several pharmaceutical companies now switch their primary focus from generic prescription drugs to medical specialties such as cardiovascular medications an

2022-04-25 10:34:00 Monday ET

Corporate ownership governance theory and practice The genesis of modern corporate governance and ownership studies traces back to the seminal work

2018-11-05 10:40:00 Monday ET

Former Fed Chair Janet Yellen worries about U.S. government debt accumulation, expects new interest rate increases, and warns of the next economic recession

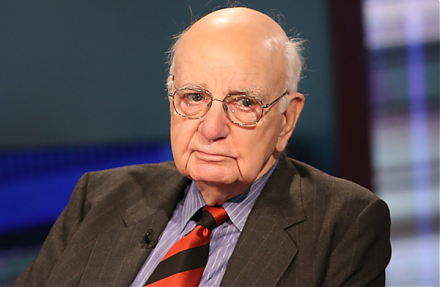

2018-10-23 12:36:00 Tuesday ET

Former Fed Chair Paul Volcker releases his memoir, talks about American public governance, and worries about plutocracy in America. Volcker suggests that pu

2017-08-25 13:36:00 Friday ET

The U.S. Treasury's June 2017 grand proposal for financial deregulation aims to remove several aspects of the Dodd-Frank Act 2010 such as annual macro s