2022-02-05 09:26:00 Sat ET

stock market behavioral finance daniel kahneman richard thaler prospect theory financial system stability noise trader investor sentiment loss aversion efficient markets hypothesis random walk hypothesis arbitrage short sale eugene fama robert shiller

Modern themes and insights in behavioral finance

Shiller (2003) states that financial economics has evolved a long way from the days when the efficient markets theory was widely thought to be proved beyond doubt (Fama, 1963, 1965a, 1965b, 1970; Samuelson, 1965). Since that time, there has been a massive volume of research on testing the Efficient Markets Hypothesis (EMH) in a number of contexts. Some of such research sheds skeptical light on the EMH paradigm. Shiller (2003) begins his critique of the EMH with his research on excess volatility in the stock market. Shiller sees the 1980s as a key time of academic discussions on the consistency of the EMH model for the aggregate stock market. Of particular concern is whether U.S. stocks exhibit excess volatility relative to what the EMH model would predict. If most of the volatility in the stock market was unexplained, then we would question the basic foundations of the EMH model.

Using long-run data on stock prices, West (1988) reports that the variation of innovations in stock prices is 4 to 20 times the theoretical upper bound. Campbell and Shiller (1988) recast the time-series model in terms of a cointegrated model of real prices and real dividends and find evidence of excess volatility. Campbell (1991) provides a variance decomposition of U.S. stock returns and finds that most of the variation of the stock market conveys information about future returns rather than future dividends. All this evidence seems to reject the EMH model that connects stock prices to their intrinsic value (present value of future cash flows).

The more recent evidence suggests that even though the aggregate stock market seems to be inefficient, individual stocks prices show some correspondence to the EMH model. In other words, the EMH present value model for the stock market as a whole seems unsupported by the data, but there is some evidence that the cross-sectional variation in stock prices relative to accounting measures such as earnings-to-price and book-to-market show some relation to the present value model. In response, Paul Samuelson posits that the stock market could be micro efficient but macro inefficient since there is large predictable variation across firms in their predictable dividend streams but little predictable variation in aggregate dividends.

Some evidence backs up Samuelson’s claim on micro efficiency. Vuolteenaho (2002) shows in a vector-autoregressive model that the book-to-market ratio of U.S. firms explains a rather large fraction of changes in future earnings. Cohen, Polk and Vuolteenaho (2002) report that 75 to 80 percent of the variation across firms in their book-to-market ratios can be explained in terms of future variation in profits. In addition to the above Jung and Shiller (2002) report that the price-dividend ratio helps forecast the present value of future dividend changes. The above results accord with the EMH model in a broad sense.

Shiller (2003) observes that a lot of the focus of academic discussions has shifted away from such econometric analyses of time series on stock prices, dividends, and earnings etc towards building models of human psychology as these models relate to financial markets. A couple of salient examples help illustrate the progress of behavioral finance: feedback models and obstacles to smart money. The key references for the large volume of research on behavioral finance models are the books written by Hersh Shefrin (2000) and Andrei Shleifer (2002).

Behavioral feedback models focus on the price-to-price interactions among individual stocks. When speculative prices go up and in turn create success for some investors, this price surge may help attract public attention, promote word-of-mouth enthusiasm, or raise expectations for further price increases. This process then boosts investor demand and thereby generates another round of prices increases. If nothing upsets this positive feedback, it may produce a “speculative bubble” after many rounds. As a result, high expectations for further price rises support very high current prices. The resultant high prices are ultimately unsustainable since they are high only due to expectations of further price rises. So the bubble eventually bursts, and prices fall down as a result.

In his book Irrational Exuberance published at the peak of the stock market bubble in March 2000, Shiller contends that the above feedback transmitted by word-of-mouth and the media was at work in producing the tech bubble. Shiller further argues that the natural self-limiting behavior of bubbles suggested a perilous outlook for stocks in the near future then. Indeed, the presence of such feedback finds support in cognitive psychology. This field suggests that human judgments of the probability of future events embed systematic biases. For example, Kahneman and Tversky show that judgments tend to rely on a representativeness heuristic, where people predict by looking for the closest match to past patterns without any attention to the observed probability of matching the pattern. By the same token, people often tend to match stock price patterns into salient categories such as dramatic and persistent price trends, leading to feedback dynamics, even if these categories may be rare in fundamental analysis.

Daniel, Hirshleifer and Subramanyam (1999) show that the psychological principle of biased self-attribution could promote price feedback. According to Daryl Bem (1965), biased self- attribution is a rather common pattern of human behavior: individuals often attribute events that confirm the validity of their actions to their own high ability, but these individuals often attribute events that disconfirm their actions to bad luck or sabotage. In historical episodes of bubbles such as tulipmania, British railways, Japanese real estate, U.S. stock market boom, and subprime mortgages, the above human interactions could play an important role. Indeed these key parameters of human behavior could be the essential cause of speculative bubbles that appear to recur across centuries in different countries.

Even if feedback does not imply price momentum, the evidence dismisses the random walk character of stock prices in any case. Jegadeesh and Titman (1993) show that winning stocks beat losing stocks by 12 percent over the following year. Further, DeBondt and Thaler (1985) report that winning stocks tend to show negative cumulative returns over the 3-year horizon. These results imply that stock returns contain momentum at short to intermediate horizons but tend to mean revert over long horizons.

Another branch of behavioral finance focuses on “obstacles to smart money” or “limits on rational arbitrage” (DeLong, Shleifer, Summers and Waldman, 1990a and 1990b; Shleifer and Vishny, 1997; Barberis and Shleifer, 2002). Smart money can buy and sell stocks to offset the effects of irrational investors. But if smart money no longer owns the mispriced stocks and faces short-sale constraints, then smart money may not clear up mispricings in the market. In this case, mispricings persist over time. For instance, overpriced stocks could be in a situation where zealots have bought into a stock so much that only zealots can own or trade shares. So these zealots alone determine the stock price. Smart money that identifies the stock price as excessively high may have used up all the available shortable shares and then become unable to short more shares. As a result, the limits on arbitrage allow mispricings to persist.

Some recent studies seek to detect the presence of obstacles that might constrain short sales indirectly by observing the differences of opinion that affect the stock price if it is hard to short stocks. For example, Scherbina (2000) measures differences of opinion by calculating the dispersion of analysts’ earnings forecasts. She finds that stocks with a high dispersion of analysts’ earnings forecasts have lower subsequent returns. In theory, we could connect these low returns to the resolution of uncertainty around the stock’s fundamental prospect. Chen, Hong, and Stein (2000) measure differences of opinion by a breadth of ownership measure derived from a database on mutual fund portfolios. This breadth variable is the ratio of the number of mutual funds that hold a long position in the stock to the total number of mutual funds for that quarter. Chen et al report that firms in the top decile by breadth of ownership outperform those firms in the bottom decile by about 5 percent per year after adjusting for a number of control factors.

Shiller (2003) touches on Kahneman and Tversky’s prospect theory (1979) to finish the loop on the recent progress of behavioral finance. Prospect theory suggests that most people are far more upset by losses than they are pleased by equivalent gains. In fact, most people are so upset by losses that they even take large risks with the hope of avoiding any losses at all. The pain of regret often induces stock investors to hold onto their losing stocks for too long. In other words, people often tend to prefer not to put themselves in situations that might force psychologically difficult decisions in the future.

Lastly, Shiller (2003) finds it important to bear in mind the weaknesses of the EMH model. Also, it is important to maintain an eclectic view of further research in financial economics. While a number of theoretical models of efficient markets have their place as illustrations or characterizations of an ideal world, it is not wise to maintain these models in their pure form as accurate descriptors of actual markets. It is important to distance ourselves from the stark presumption that price changes always reflect timely information. Evidence from behavioral finance helps us understand, for instance, that the recent global stock market turbulence had its roots in human foibles, mental shortcuts, and feedback relations. The major challenge for financial economists is to make this reality a better part of their new models.

Thaler (1988) illustrates the winner’s curse by presenting evidence on the “coin jar auction”. In particular, Thaler finds that the average bid tends to be significantly less than the value of the coins. This result reflects the fact that most bidders are averse to risk. Also, the winning bid almost always exceeds the value of all the coins in the jar. This outcome accords with the thrust of the “winner’s curse”, which suggests that the economic agent wins an auction only because he or she has submitted the highest bid. In the context of active asset management, investors face a somewhat similar problem. In particular, informed investors must not ignore the prevailing market price because this price embeds information about the other investors’ signals. Thereby, the appropriate response is to alter expectations in a Bayesian manner. As a result, the above response moves the investor toward the prevailing market price that reflects the average signals. As we see an increase in the number of independent signals, the investor should attach a lower weight to his or her own price estimate. Like the winner’s curse, if the investor overlooks the market price as a valuable signal about the risky asset’s fair value, his or her own estimate may be too extreme relative to the whole sample (rather than the global mean).

The laboratory evidence shows that it is not easy to avoid the winner’s curse. Even subjects who are given learning opportunities fail to appreciate the need to be a bit more conservative when the number of bidders increases. There are numerous studies that claim to have found evidence of the winner’s curse in market contexts. For example, Cassing and Douglas (1980) look at the market for free agents in baseball and report that free agents tend to get overpaid. The owners of major league baseball teams have come to the same conclusion and appear to have responded with the effective tactic of collusion.

Roll (1986) applies the concept of the winner’s curse to corporate takeovers. The puzzle is to explain why firms are willing to pay big premiums above the market price to acquire another firm. The evidence suggests that there is little or no gain to the buyer while stockholders of target firms make significant profits when their firms get acquired. Roll offers the managerial hubris hypothesis as a plausible answer. According to this view, the cash-rich acquirer looks for potential target firms, estimates the value of the target, and bids for the target if and only if the estimated value exceeds the market value. To test the hubris hypothesis, Roll reviews the data on stock prices of bidders and targets around the announcement date. This hubris hypothesis predicts that the combined value of the bidder and the target should decline a bit to reflect transaction costs. In brief, the value of the target should rise while the value of the bidder should fall. Loughran and Vijh (1997) provide evidence in support of this prediction.

Financial markets often exhibit sharply rising prices and subsequent declines that cannot be justified by fundamental or realistic economic assessments (Dreman and Lufkin, 2000). The immediate availability of public information about each stock, along with omnipresent media analysis, seems to have done nothing to reduce the magnitude of bubbles.

Caginalp et al (2001) report on a large number of laboratory market experiments. These lab experiments demonstrate that it is possible to reduce the size of a market bubble under the following conditions: (a) a low initial level of liquidity or less total cash vis-à-vis the value of total shares, (b) deferred dividends, and (c) a bid-ask book that is open to traders. Conversely, a large bubble arises when the opposite conditions exist.

Caginalp et al’s experiments trace out the evolution of market prices over 15 periods. Classic economics predicts that the trading prices fluctuate in a tight range near a fundamental value. In the above experiments, the subjects can observe the fair value of the asset on the trading screen. Many experiments under a variety of conditions show that the asset price often starts below the fundamental value during the first period. Then the asset price rises far above the fundamental value in the middle to late periods. Sometime between the 11th and 15th periods the asset price begins to crash and usually goes below the fundamental value.

According to Smith, Suchanek, and Williams (1988), the traders know all information about the asset, so the only source of uncertainty would be the future actions of the other traders. The strategies of the other traders manifest in the price change in each period after the first. As the price increases above the fundamental value, the traders become aware that the other traders appear to make decisions based on many factors beyond valuation alone. This feature contradicts classical price theory because it assumes that each trader not only self-optimizes but also relies on the self-optimization of the other traders.

In the context of the bubble experiments, the deviation from the fundamental value reveals information that the other traders do not engage in idealized game theoretic behavior based on fundamental value. Rather, at least some of the traders tend to use a momentum strategy. For instance, some traders place orders with the expectation of a subsequent rise in the price. So even the traders who have not planned to carry out a momentum strategy are induced to recognize it as an important factor in setting the temporal evolution of asset prices.

Caginalp and Balenovich (1999) and Caginalp et al (2000) use a differential equations model to capture both supply and demand forces for value or momentum sentiment. In this model, an initially underpriced asset spurs purchases from value sentiment. This demand creates an uptrend that eventually induces momentum. In turn, this momentum creates trend sentiment to buy even after the asset price has exceeded the fundamental value. This uptrend continues until the momentum traders have an inadequate amount of cash, then the asset price begins to plateau or decline. Any price decline spurs momentum sentiment to sell the asset. In turn, this sentiment results in further price decreases precipitously.

The Efficient Markets Hypothesis (EMH) asserts that market prices fully reflect all available information. The recent advances in behavioral finance present several critiques of the EMH model. The most enduring critique stems from psychologists and behavioral economists who argue that the EMH relies upon counterfactual assumptions in regard to human behavior or rationality. Lo (2007) claims that the recent research in evolutionary psychology or cognitive neurosciences may help reconcile the EMH with behavioral anomalies.

According to Paul Samuelson (1965), an informationally efficient market makes it difficult to forecast price changes. In other words, prices fully embed the information and expectations of all participants in an efficient market. In contrast to Samuelson’s path to the EMH, Fama (1963, 1965a, 1965b, and 1970) puts his interest in the statistical properties of stock prices to resolve the debate between technical analysis and fundamental analysis. Gene Fama’s interest in empirical analysis yields significant contributions such as event studies, econometric tests of single- and multi-factor linear asset pricing models, and many anomalies in stock, bond, currency and commodity markets.

Much of the early EMH literature revolves around the random walk hypothesis that suggests unforecastable stock price changes. More recently, Lo and MacKinlay (1988) exploit the fact that stock return variances scale linearly under the random walk hypothesis: the variance of a 2-week return is twice the variance of a 1-week return if the random walk hypothesis holds. Lo and MacKinlay construct a variance ratio test that rejects the random walk hypothesis for weekly U.S. stock return indices. In particular, stock return variances grow faster than linearly as the holding period increases. This result implies positive serial correlation in weekly stock returns. Oddly enough, Lo and MacKinlay also report that individual stock returns pass the above test of the random walk hypothesis.

For holding periods much longer than 1 week, say, 3 to 5 years, Fama and French (1988) and Poterba and Summers (1988) find negative serial correlation in U.S. stock return indices. This result suggests that stock returns tend to mean revert over long horizons. The implication of this result for active asset management is that longer-term investors such as young investors should seek to invest more in stocks to reap better risk-return payoffs. The long-term mean reversion of stock returns hence has been a strong argument for asset allocation toward U.S. stocks.

A common explanation for departures from the EMH is that investors do not always react in proper proportion to new information. Since the mid-1980s, the asset pricing literature has identified a number of empirical facts as “anomalies” that require an alternative theory other than the CAPM. For instance, DeBondt and Thaler (1985) find that most U.S. stocks tend to reverse their performance over the 3-year horizon. Chopra, Lakonishok, and Ritter (1992) re- confirm this long-run reversal of stock returns after correcting for size and market risk. The other anomalies include the size effect (Banz, 1981; Keim, 1983; Roll, 1983), the profitability of short-term stock return reversals (Rosenberg et al, 1985; Chan, 1988; Lo and MacKinlay, 1990c), the profitability of medium-term stock return momentum (Jegadeesh and Titman, 1993 and 2001; Chan, Jegadeesh, and Lakonishok, 1996), the accrual effect (Sloan et al, 1996 and 2006), the information content of earnings-price and book-to-market ratios (Basu, 1977; Fama and French, 1992), and the excess volatility of stock returns etc (West, 1988; Campbell and Shiller, 1988; Campbell, 1991).

Lo (2007) notes that the strongest critiques of the EMH revolve around the preferences and behavior of market participants. Psychologists and experimental economists have identified a number of departures from the EMH paradigm of investor rationality. These departures are in the form of behavioral biases that are ubiquitous to human judgment under uncertainty. Many of these behavioral biases can lead to undesirable outcomes for an investor’s economic welfare: overconfidence (Barber and Odean, 2001; Gervais and Odean, 2001), loss aversion (Kahneman and Tversky, 1979; Shefrin and Statman, 1985; Odean, 1998), mental accounting (Tversky and Kahneman, 1981), herding (Devenow and Welch, 1996; Huberman and Regev, 2001), and so forth. These critics of the EMH contend that investors often exhibit irrational, predictable, or financially ruinous behaviors. The experimental and empirical evidence points out that the EMH may be far from the reality of financial markets.

Grossman and Stiglitz (1980) go a step farther to say that it is impossible to achieve perfectly informationally efficient markets. If markets are perfectly efficient, there is no incentive nor profit for economic agents to gather information. In that case, there would be little reason to trade and markets would eventually collapse. Alternatively, the degree of market inefficiency determines the effort that investors are willing to expend to gather and trade on information. Hence, a market equilibrium can arise only when there are sufficient profit opportunities or inefficiencies to compensate investors for the transaction costs. The profits earned by these attentive investors can be viewed as “economic rents” that accrue to those investors who are willing to engage in such activities.

The methodological differences between mainstream and behavioral economics suggest that an alternative to the traditional deductive paradigm of neoclassical economics may be crucial to reconcile the EMH with its behavioral critics. One particularly promising notion is to view financial markets from a biological perspective. Within an evolutionary framework, markets, instruments, institutions and investors interact dynamically according to the law of economic selection. Under this view, financial agents compete and adapt, but they do not necessarily do so in an optimal fashion (Farmer and Lo, 1999; Farmer, 2002; Lo, 2002, 2004, and 2005). In contrast to the classical postulate that individuals maximize utility with rational expectations, this evolutionary view makes more modest claims and treats investors as organisms that have been honed to maximize the long-term survival of their genetic material through generations of natural selection. Under this evolutionary framework, prices reflect as much information as dictated by the mix of environmental conditions and the number and nature of species in the economy or “market ecology”. If multiple species (or the members of a highly populous species) compete for scarce resources within a market, that market is likely to be “efficient”.

As a consequence, we cannot evaluate market efficiency in a vacuum. The notion of adaptive market efficiency depends on the context, just as insect populations advance and decline as a function of the seasons, the number of predators and prey, and their abilities to adapt to an ever-changing environment. Then the profit opportunities are similar to the amount of food and water in a local ecology. More resources help deter competition. As market competition increases due to a decline in food, resources deplete and in turn cause a decline in the animal population eventually. We would then expect to see less fierce competition. At this point, the cycle starts over again. The above evolutionary view leads to the new synthesis: the adaptive market hypothesis (AMH).

Under the AMH, behavioral biases abound. Investment strategies undergo cycles of gains or losses in response to volatile business conditions. Competitors enter and exit the market. As profit opportunities shift, we would expect to see cyclical variation in the composition of the investor base. History matters through the forces of natural selection. Regardless of whether prices fully reflect all available information, the particular path that market prices have taken over the past few years can affect aggregate risk preferences.

Noise trading refers to the act of trading on noise as if it were information. Investors who trade on noise are often willing to trade even though they would be better off opting out of the market from an objective point of view. It pays for those with information to trade when there are a lot of noise traders in the market. Moreover, it even pays for investors to look for costly information that they can then trade on. Most of the time, the noise traders as a group lose money when they trade, whilst the information traders as a group make money.

The effects of noise on the world, and on our views of the world, can be quite profound. In the sense of a large number of small events, noise is often a causal factor that is much more powerful than a small number of large events can be. In many cases, noise makes it possible to trade in financial markets, and thus allows us to observe prices for financial assets. Noise causes markets to be somewhat inefficient, but often prevents us from taking advantage of inefficiencies. In the form of uncertainty about future tastes and technology by sector, noise causes business cycles and makes them highly resistant to laws and regulations. In the form of expectations that need not follow rational rules, noise causes inflation to oscillate, at least in the absence of a gold standard or fixed exchange rates. In the form of uncertainty about what relative prices would be with other exchange rates, noise makes us think incorrectly that changes in exchange rates or inflation rates cause changes in trade or investment flows. Most generally, noise makes it very difficult to test either practical or academic theories about the way that financial markets work. We are forced to act largely in the dark.

Samuelson (1965) proves that stock prices should follow a random walk if rational investors require a fixed rate of return. Also, Fama (1965) shows that stock prices are indeed close to a random walk. These landmark studies suggest that the efficient markets hypothesis seems to have rallied in the early days of modern finance theory. Michael Jensen (1978) says that “the efficient markets hypothesis is the best established fact in all of social sciences.”

Shleifer and Summers (1990) assert that the efficient market hypothesis has lost ground soon after the publication of Shiller’s (1981) and Leroy and Porter’s (1981) volatility tests, both of which find stock market volatility to be far greater than what dividend changes could justify. Shleifer and Summers (1990) review the noise trader approach to finance as an alternative to the efficient markets hypothesis. This alternative rests on 2 major assumptions. Firstly, some investors are not fully rational and their demand for risky assets relates to investor beliefs or sentiments that do not depend on fundamental news. Secondly, arbitrage can be risky and so limited to some extent. These assumptions together imply that changes in investor sentiment often outweigh arbitrage. Hence, these changes in investor sentiment affect security returns.

Shleifer and Summers see the market as the sum of 2 types of investors: rational arbitrageurs and noise traders. Arbitrageurs form rational expectations about security returns. In contrast, the opinions and trading patterns of noise traders may be subject to systematic biases. It may be useful to draw a line between these types of investors although this line may be blurred in practice. In any case the arbitrageurs help bring prices toward fundamental values while noise traders often allow deviations from fundamental values to persist over time.

Arbitrageurs play a crucial role in finance. They trade to ensure that if a stock has a perfect substitute or a portfolio of other securities that yields the same return, the price of the stock equals the price of the substitute portfolio. If the price of the stock falls below the price of the substitute portfolio, arbitrageurs sell the portfolio and buy the stock until the prices reach an equilibrium, and vice versa if the price of the stock rises above the price of the substitute portfolio. Arbitrage thereby assures that the relative prices of stocks must be in line for there to be no riskless arbitrage opportunities.

Although riskless arbitrage ensures that the relative prices are in line, it does not help to pin down the prices of stocks as a whole. These assets may not have close substitute portfolios. So if these stocks get mispriced, there is no riskless hedge for the arbitrageur. For example, an arbitrageur who thinks that some stocks are underpriced cannot buy these stocks and sell the substitute portfolio since such a portfolio does not exist. Instead, the arbitrageur can buy these stocks in hopes of a supernormal return, but this arbitrage is no longer riskless. If the arbitrageur is averse to risk, his demand for underpriced stocks would be rather limited. With a finite number of arbitrageurs, their combined demand curve is no longer perfectly elastic.

At least a couple of risks limit arbitrage. The first is “fundamental risk” that deviations from fundamental values could persist. The second risk stems from the “unpredictability of future resale price” (DeLong, Shleifer, Summers, and Waldmann, 1990). If future mispricing turns out to be more extreme after the arbitrage trade takes place, the arbitrageur suffers a loss on his position. Fear of this loss limits the size of the arbitrageur’s initial position and so keeps him or her from driving the price all the way to the fair value.

When arbitrage is limited and investor demand for securities responds to noise and views of popular models, security prices move in response to such changes in investor demand as well as changes in fundamental value. Arbitrageurs counter the shifts in demand due to changes in investor sentiment, but do not eliminate the effects of such shifts on the price completely.

Some shifts in investor demand for securities are completely rational. But not all changes in investor demand are so rational. Some changes in investor demand can be seen as a response to changes in investor sentiment that do not fully reflect market information. These changes could be a response to pseudo-signals that investors believe convey information about future returns. These pseudo-signals would not convey information in a fully rational model (Black, 1986).

Compared to arbitrageurs, noise traders might be on average more aggressive either because they are overoptimistic or because they are overconfident. In this case, noise traders bear at least some risk. If investors get rewarded for taking risk in the market, noise traders can earn higher returns even though they tend to buy high and sell low on average. With these higher returns, noise traders as a group do not disappear from the market.

When noise traders earn high average returns, many other investors might imitate them and ignore the fact that these lucky noise traders take more risk. This imitation adds more money to follow noise trader strategies. Noise traders might then attribute their investment success to skill rather than luck. As noise traders who perform well become more aggressive, their effect on investor demand increases.

Not only do arbitrageurs spend time and money to predict noise trader moves, arbitrageurs also try to take advantage of these moves. When noise traders are optimistic about particular securities, it pays arbitrageurs to create more of these securities. These securities may be new share issues, mutual funds, penny oil stocks, junk bonds, or any securities that happen to be overpriced at the moment. It also pays arbitrageurs to carve up corporate cash flows in ways that make the securities with claims to these cash flows most attractive to investors. Then the Modigliani-Miller theory does not apply in a world where investor sentiment affects security prices and noise traders do not see through the corporate veil. Just as entrepreneurs use time and money to build casinos to take advantage of gamblers, arbitrageurs establish investment banks and brokerage firms to predict and feed noise trader demand.

Arbitrageurs cannot easily predict when noise traders become optimistic or pessimistic over time. This unpredictability contributes to resale price risk because the resale price of an asset depends on the state of noise trader sentiment. If investor sentiment affects a wide range of assets in the same way, this resale price risk becomes systematic and so requires a premium in equilibrium. Consequently, assets subject to whims of investor sentiment should yield higher average returns than similar assets not subject to such whims. In other words assets subject to unpredictable swings in investor sentiment must be underpriced relative to their fundamental values.

DeLong et al (1990) describe 2 applications of the above argument. The first pertains to the so-called equity premium puzzle (Mehra and Prescott, 1985). DeLong et al assert that stocks are probably subject to larger fluctuations of investor sentiment than bonds. So equilibrium returns on stocks must be higher than what their fundamentals suggest. DeLong et al reverse this argument to say that the higher average risk premium is evidence of more unpredictable investor sentiment about stocks. In addition to the above, the second application pertains to the pricing of closed-end mutual funds. An investor who wants to liquidate his holdings of a closed-end fund must sell his shares to other investors; that is, he or she cannot just redeem the shares as in the case of an open-end fund. Closed-end funds show an interesting puzzle in finance since their net asset value tends to be systematically higher than the price at which these funds trade. DeLong et al apply the same argument to the case of closed-end funds. If investor sentiment about closed-end funds affects many other securities, investors should get rewarded for bearing resale price risk. Therefore, closed-end funds should on average sell at a discount. In other words, closed-end funds sell at large discounts on average because these discounts fluctuate, and most investors would require an extra return for bearing the risk of volatile discounts. Lee, Shleifer, and Thaler (1989) report that when discounts on closed-end funds narrow, small stock portfolios tend to perform well. Thereby, discounts on closed-end funds reflect an individual investor sentiment that affects returns on small stocks held largely by individuals. This result supports the noise trader approach to finance.

Many investors are often inclined to extrapolate or chase the trend. Trend chasers buy stocks after they appreciate in value or sell stocks after they depreciate in value, i.e. the trend chasers follow positive feedback strategies. Other strategies that rely upon extrapolative expectations are stop loss orders and portfolio insurance. The former prescribes selling out stocks after a cascade of losses regardless of future prospects while the latter involves buying more stocks to increase exposure to risk when prices increase or selling out stocks to cut exposure to risk when prices decrease.

When a large number of investors follow positive feedback strategies, it may not be optimal for arbitrageurs to counter shifts in the demand of these investors. It may pay arbitrageurs to jump on the bandwagon themselves. Arbitrageurs could fuel further feedback by buying the stocks that positive feedback investors like. Then arbitrageurs could sell out these stocks near the peak to take the profits. Although arbitrageurs eventually sell out and help prices return to fundamental values, these arbitrageurs feed the short-run price bubble rather than help it to dissolve (DeLong et al, 1990). Therefore, the key to success is not to counter the irrational wave of enthusiasm about a price bubble, but the secret recipe is to ride this wave for a while and then sell out much later. A number of studies support the above noise trade model that predicts positive feedback in prices. For instance, Cutler, Poterba, and Summers (1989) find evidence of a positive autocorrelation of returns at horizons of a few weeks or months and a negative autocorrelation at horizons of a few years for stock, bond, foreign exchange, and gold markets. The evidence of a positive serial correlation at short horizons suggests that a large number of positive feedback traders must be present in the market. Rational arbitrage alone does not eliminate the effects of their trades on prices.

Shleifer and Summers provide an alternative to the efficient markets theory. This alternative stresses the joint roles of investor sentiment and limited arbitrage in determining asset prices. The notion of limited arbitrage is more general and plausible as a fair description of markets for risky assets than the presumption of perfect arbitrage that helps substantiate the efficient markets theory. With limited arbitrage, shifts in investor sentiment are a crucial determinant of asset prices. Investors who trade on noise could be worse off than they would be if their expectations were rational. Noise traders need not lose money on average. But noise traders earn higher average returns only because it entails greater risk to trade on noise. If investors had perfect foresight and rationality, they would know that it is not wise to trade on noise. In brief, the noise trader model shows great promise in behavioral finance.

Lamont and Thaler assess the practicality of the law of one price (hereafter the Law), which states that the same goods must have the same prices. Orthodox economic theory suggests that the Law should hold true in competitive markets with no transaction costs and no trade barriers. In practice, however, details about market institutions are important in determining whether violations of the Law can occur. The absence of arbitrage opportunities is the basis of modern finance theory. In financial markets, the Law states that the same securities must have the same prices. Otherwise, smart investors could make unlimited profits by buying the cheap securities and selling the expensive ones.

Lamont and Thaler consider a number of examples to show that there are indeed violations of the Law. The examples include twin shares (e.g. Royal Dutch and Shell), dual share classes (e.g. Molex), and corporate spinoffs (3Com and Palm). The last example is a vivid illustration that the Law can deviate far from the reality:

“On the day before the IPO for Palm, 3Com was selling for $104 per share. The Palm shares were sold to the public at $38 a share, but ended the day selling for $95 (after trading as high as $165 per share). During the same day, the stock price of 3Com fell 21 percent during the day to $82…The so-called “stub value of 3Com” or the implied value of 3Com’s non-Palm assets was –$63 per share…To add insult to injury, 3Com had about $10 a share in cash!”

This Palm/3Com episode is not unique. Lamont and Thaler (2003) show many examples of mispricings during the 1998-2000 stock market bubble. A potential cause of the mispricings can be short-sale constraints. The inability to short sell the overpriced stocks could limit the extent of rational arbitrage. The risks to arbitrageurs are particularly large in situations with no terminal date. A key risk is the so-called “noise trader risk” that after taking an initial large position, the price/value disparity widens and so causes the net wealth of the arbitrageurs to decline (DeLong et al, 1990). Another real-world example of noise trader risk is the dramatic fate of Long Term Capital Management:

“LTCM had a massive number of convergence trades in place in the summer of 1998. These trades were directional bets that mispricings would narrow…When spreads widened in 1998, LTCM faced financial distress due to the divergence of asset prices and fundamental values. LTCM tried to raise new money, but found no takers, despite the fact that these convergence trades had presumably become more attractive as the price/value disparity rose. Then LTCM was forced to enter into an agreement with its creditors, leading to an eventual liquidation of its positions. This worst scenario had been anticipated one year earlier by Shleifer and Vishny (1997) in their paper on limits to arbitrage. Shleifer and Vishny discussed the possibility that arbitrage opportunities might fail to get eliminated. In this case, mispricings could widen and persist if arbitrageurs had to exit the market prematurely due to adverse market movements.”

Baker and Wurgler (2007) discuss the twin basic assumptions behind behavioral finance. The first assumption is that many investors are subject to sentiment (DeLong, Shleifer, Summers, and Waldmann, 1990). In broad terms, investor sentiment is a belief about future cash flows and investment risks that cannot be easily justified by the facts at hand. Further, the second assumption is that it can be costly and risky to bet against sentimental investors (Shleifer and Vishny, 1997). Rational traders are not as aggressive in driving prices to fundamental values as the classical model would suggest. In the terms of behavioral finance, there are limits to arbitrage. In the recent decade, we have experienced the Internet bubble and its subsequent Nasdaq and telecom crashes, the housing bubble and then the subprime mortgage crisis, and the recent financial crisis highlighted by the bankruptcy of Lehman Brothers. These episodes seem to validate the above 2 premises of behavioral finance.

Baker and Wurgler (2007) develop the “top-down” or macro investor sentiment approach to finance. This top-down approach stresses the measurement of reduced-form and aggregate sentiment and traces its effects on market returns and individual stocks. The new directions build on the above broader assumptions of behavioral finance, investor sentiment and limits to arbitrage, to explain which stocks are likely to be most affected by sentiment. In particular, stocks of low capitalization, younger, unprofitable, highly volatile, non-dividend paying, and growth companies are likely to be disproportionately sensitive to the broad waves of investor sentiment.

Baker and Wurgler (2006) use interim advances in behavioral finance theory to provide sharp tests for the effects of sentiment. In the noise trader model of DeLong et al (1990) investors are either rational arbitrageurs or noise traders. The latter are prone to exogenous sentiment. These investors compete and set prices in the market. But rational arbitrageurs are limited in various ways. Such limits largely stem from short time horizons, trading costs, and short-sale constraints. As a result, prices are not always at their fundamental values. In turn, mispricings could persist over time due to (a) a change in investor sentiment on the part of the irrational noise traders, or (b) limits to arbitrage from the rational arbitrageurs.

Baker and Wurgler (2006) build a sentiment index based on the 6 proxies: trading volume or NYSE turnover, the dividend premium, the closed-end fund discount, the number and first- day returns on IPOs, and the equity share in new issues. Some of the sentiment proxies may reflect economic fundamentals to some extent. For instance, IPO volume depends partly on investment opportunities. To remove such macro influences, Baker and Wurgler regress each proxy on a set of macroeconomic indicators such as growth in industrial production, growth in durable, nondurable, and services consumption, growth in employment, and the NBER recession indicator. Baker and Wurgler then use the residual terms from these regressions as the proxies for investor sentiment. These proxies have a common sentiment component, so it is possible to iron out the residual idiosyncrasies by averaging these proxies into an index. This index helps test for return predictability conditional on the state of sentiment.

Baker and Wurgler (2006) find evidence in support of their sentiment model. When investor sentiment is low, the average future return on speculative stocks exceeds the return on bond- like stocks. When sentiment is high, the average future return on speculative stocks is lower than the return on bond-like stocks. This evidence helps explain the puzzle that riskier stocks sometimes have lower average returns. It is important to note that this latter result is striking because at first glance it seems inconsistent with the classical asset pricing model.

Baker and Wurgler (2007) outline the top-down approach to behavioral finance and the stock market. In particular, Baker and Wurgler take the origin of investor sentiment as exogenous and then focus on its empirical effects. Not only is it possible to measure investor sentiment, but the waves of sentiment also affect individual stock returns. Investor sentiment appears to have the greatest impact on stocks that are difficult to value or arbitrage in practice. In brief, the positive relationship between risk and return is kept intact when sentiment is low. When investor sentiment is high, we would expect to see an inverse link between risk and return.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-07-19 09:25:00 Sunday ET

Senior business leaders can learn much from the lean production system with iterative continuous improvements at Toyota. Takehiko Harada (2015)

2018-06-03 07:35:00 Sunday ET

Several recent events explain why Trump may undermine multilateral world order. First, Trump withdraws the U.S. from the 12-nation Trans-Pacific Partnership

2024-05-05 10:31:00 Sunday ET

Stock Synopsis: Pharmaceutical post-pandemic patent development cycle In terms of stock market valuation, the major pharmaceutical sector remains at its

2018-07-19 18:38:00 Thursday ET

Goldman Sachs chief economist Jan Hatzius proposes designing a new Financial Conditions Index (FCI) to be a weighted-average of interest rates, exchange rat

2018-03-03 11:37:00 Saturday ET

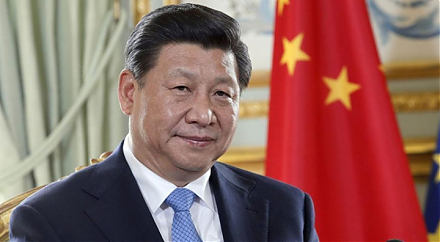

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de

2019-01-05 11:39:00 Saturday ET

Reuters polls show that most Americans blame President Trump for the recent U.S. government shutdown. President Trump remains adamant about having to shut d