2017-07-25 10:44:00 Tue ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

NerdWallet's new simulation suggests that a 25-year-old millennial who earns an inflation-free base salary of $40,456 and saves 15% each year faces a 99%+ chance of maintaining at least his or her initial investment over 40 years.

This analysis shows that the adverse effects of even significant downturns can be smoothed out by a long-term fundamental investment strategy, if the investor is willing to stay the course.

Given the opportunity cost of avoiding the stock market altogether (which could be as much as $3 million over 40 years) and the monetary benefits of compound interest for 4 decades, the bigger real risk may be not investing in stocks at all.

Although past stock market performance cannot guarantee that the typical investor earns a hefty 10% average historical return in the future, the core value of investing in stocks with compound interest can be significant over a long time.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-03-03 05:39:00 Friday ET

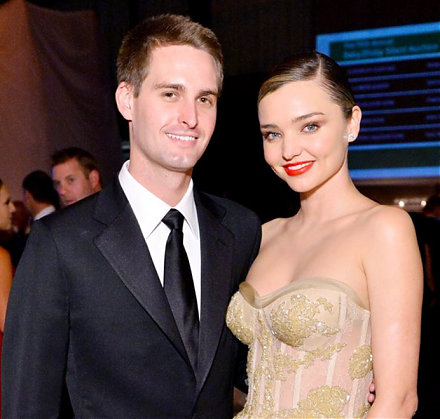

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2019-08-04 08:26:00 Sunday ET

U.S. and Chinese trade negotiators hold constructive phone talks after Presidents Trump and Xi exchange reconciliatory gestures at the G20 summit in Japan.

2022-11-30 09:26:00 Wednesday ET

Climate change and ESG woke capitalism In recent times, the Biden administration has signed into law a $375 billion program to better balance the economi

2019-07-07 18:36:00 Sunday ET

The Chinese central bank has to circumvent offshore imports-driven inflation due to Renminbi currency misalignment. Even though China keeps substantial fore

2017-10-27 06:35:00 Friday ET

Leon Cooperman, Chairman and CEO of Omega Advisors, points out that the current Trump stock market rally now approaches normalization. The U.S. stock market

2019-11-15 13:34:00 Friday ET

The Economist offers a special report that the new normal state of economic affairs shines fresh light on the division of labor between central banks and go