2020-11-17 08:27:00 Tue ET

patent distinctive capabilities business management management consultants principal owners solo practitioners best practices value creation intellectual property trademark copyright licenses proprietary assets service innovations customer-centric metrics flywheel trust brand team dynamism leadership competitive advantages okr

Management consultants can build sustainable trust-driven client relations through the accelerant curve of business value creation.

Alan Weiss (2016)

Million dollar management consultancy: professional guides and best practices

Most management consultants aim to improve customer relations and conditions. These management consultants share subject matter expertise, business process content, or both. Most management consultants should perform well to accomplish the right tasks, jobs, and missions in accordance with customer value creation (not just time units, fees, or service surcharges). With a wide range of positive options, most management consultants often learn to use leverage to improve the chances of success, unbundle products and services, and offer both distinctive capabilities and competitive advantages in a transparent manner. Most management advisors think of the sixth sale first and so aim for sustainable trust-driven business relations through the accelerant curve of customer value creation. A solid brand of business management consultancy requires passion, competency, and market need. In fact, any pair without the third becomes weak and unproductive. From time to time, core intellectual property protection helps strengthen the business brand.

The main mantra of most management consultancy suggests that referrals are the coinage of market niche specialty. Most management consultants strive to perform great work to collect referrals, endorsements, and references. The ultimate goal of all management consultants should be sustainable success but not perfection. Key management consultants often remember that there is always a bigger boat. Good wealth arises from having leisure time to enjoy life apart from work and study. The collective wisdom of both great skills and experiences can help many independent consultants sustain the boutique business management consultancy practices and agencies. Many management consultants often serve as lifelong learners who are happy to sharpen the saw on a regular basis. When push comes to shove, the law of inadvertent consequences counsels caution.

Management consultants help improve customer relations and conditions.

Most management consultants strive to improve customer relations and conditions. Many consultants offer subject matter expertise, content, or institutional knowledge; and other consultants advise on business systems, operations, and processes etc. The most powerful and competent management consultants provide both services. In this unique fashion, the high-skill consultants can become collaborative partners with their customers. With optimal business value creation, these great consultants can command higher fees for their best practices. Many management consultants who assist with their hands (but not their brains) are only temporary contractors or expensive employees in contrast to practical consultants with intellectual curiosity. Most management consultants should view themselves as helpful stewards of their customers. These customers are often buyers who exercise authority to recruit key management consultants to accomplish specific tasks and jobs. In due time, these consultants help their buyers by imparting technical expertise, knowledge, advice, and other intellectual capital over a reasonable time frame.

Many management consultants build Chapter C, Subchapter S, or LLC companies to protect their proprietary and intellectual assets from business loans. In practice, these management consultants often engage in business collaboration with public corporations and other large enterprises. These consultants often learn to secure intellectual property protection in the form of patents, trademarks, or copyrights etc. From time to time, many management consultants seek to secure health insurance and retirement plans as their companies grow in due course. These consultants or business owners often minimize unnecessary expenditures for both staff and office space. With happy self-employment, some management consultants run their own million-dollar business agencies at home with no employees. Some management consultants can outsource some services to attorneys and tax accountants. At the outset, these consultants maintain lean and effective core business operations with flexible work hours and arrangements. These solo practitioners focus on branding boutique professional services to improve their presence and reputation over time. Management consultancy fees must reflect the incremental value creation for most clients. This incremental value creation often arises from tangible business gains, emotional benefits, and other cost reductions such as higher worker retention rates. It would be unethical for management consultants to charge hefty fees on the mere number of work hours.

Sometimes most management consultants can choose to unbundle products and services to focus on the central objectives and key results (OKR). For sustainable profitability, most consultants often learn to better align their distinctive capabilities and competitive advantages with customer-centric metrics such as cloud software enhancements, premium product features, service innovations, e-books, research articles, analytic reports, and so on. When most management consultants choose to unbundle products and services, the whole tends to be greater than the sum of its parts. The strategy can further help most management consultants and principal business owners sharpen the saw over time.

The market gravity flywheel comprises many sales techniques that consultants can use to attract new customers. The flywheel includes trade books, columns, analytic reports, research article, and so on. These management consultants and business owners often join trade associations, share referrals, and forge strategic alliances. In practice, most management consultants can secure work by keeping customers through the market gravity flywheel. In accordance with the Pareto principle, many management consultants focus on the top 80% of customers and then jettison the bottom 20% of customers. The former often help improve profitability, offer greater informational value, and often turn out to be pleasant team collaborators.

Many management consultants build and improve trust-driven client relations and conditions through the accelerant curve of business value creation. The accelerant curve connects higher fees to fewer barriers to entry. In this important way, these management consultants and principal business owners upsell premium products and services to both new and extant customers. This accelerant curve rests on the robust client-consultant bond typically in the form of after-sale services, intellectual property licenses, or exclusive contracts. These consultants often learn to promote themselves by fixating on their distinctive capabilities and competitive advantages in terms of both business value and collaboration. As business owners, these key management consultants must maintain a longer-term view of customer relations because the current deal can often lead to many future business partnerships with both iterative continuous improvements and product feature enhancements.

Management consultants often build and enhance their presence and reputation.

The key to presence both creates and nurtures a brand. For each solo practitioner, the brand is his or her name. For a boutique firm, the brand is the corporate name. The 3 major requirements for a powerful brand include product-market fit, passion, and competence. Any pair without the third often becomes weak and unproductive. Most management consultants, solo practitioners, and principal business owners write, speak, and appear in the media to uphold their wider networks. In time, these consultants derive new products and services to meet the essential needs of blue-ocean markets. What worked well in the past often cannot be the best answer for present-day challenges. One size often cannot fit all. Sometimes solo practitioners and principal business owners establish strategic alliances with some other subject matter experts. These joint business partnerships can exponentially improve client conditions and relations as these core principal business owners and management consultants tap into complementary skills.

Many management consultants and principal business owners can often serve as thought leaders who advance intellectual capital in some core market niche fields. People who never fail often turn out to be those people who never try hard. In this positive light, many management consultants and principal business owners learn from their mistakes and even epic failures to sharpen the saw over time. For better intellectual capital accumulation, most management consultants build and update their own intellectual property in due course. This intellectual capital often includes blog posts, columns, comments, research articles, analytic reports, and books etc. Sometimes management consultants and principal business owners subcontract, franchise, or license their intellectual property such as software and machinery.

As a principal business owner, the management consultant strives to build a trust-driven mutual relationship with the economic buyer. Despite fissiparous tendencies, both parties must agree upon the main objectives and key results (OKR), business outcomes, and success metrics (in addition to both final deliverables and services). This client-consultant bond helps most management consultants write up business proposals in a prudent manner. Both parties remain responsible for non-disclosure agreements, fee payment methods, joint expenses, and other terms and conditions. The management consultant and his or her economic buyer both must ensure that the corporate middle managers (who usually control daily core business operations) understand the project goals and milestones without distorting both the efforts and intentions of senior management.

From time to time, the success metrics indicate whether the current management consultancy project has met the main objectives and key results (OKR). The clients can often recognize the fact that the management consultancy work has improved both client conditions and relations. All of the documents and deliverables must be viewed as confidential trade secrets. Both sides must be clear about the ownership and usage of patents, trademarks, and copyrights etc. In most cases, management consultants own what they owned before the project; clients own what they owned before the project; and so both the client and the consultant co-own whatever they built, designed, or developed together from project inception to completion.

The main mantra of most management consultancy suggests that referrals are the coinage of market niche specialty. Most management consultants strive to perform great work to collect referrals, endorsements, and references. The ultimate goal of all management consultants should be sustainable success but not perfection. Key management consultants often remember that there is always a bigger boat. Good wealth arises from having leisure time to enjoy life apart from work and study. The collective wisdom of both great skills and experiences can help many independent consultants sustain the boutique business management consultancy practices and agencies. Many management consultants often serve as lifelong learners who are happy to sharpen the saw on a regular basis.

Management consultants leverage team work streams to make the whole greater than the sum of its parts.

Team leadership is often the greatest influence on organizational performance. In order to improve client conditions and relations, management consultants can help middle managers, senior advisors, specialists, and team members work together in an effective manner. As the prescient adage suggests, one plus one must equal 165 in most business organizations. If the whole cannot be better than the sum of its parts, both senior managers and supervisors add minimal value. Most business leaders often learn to recognize the fresh reminder that internal promotions cannot be rewards for past performance. In the broader business context, consultants help both business leaders and executive managers make wise and prescient strategic decisions on internal promotions and succession plans etc to offer valuable high-skill knowledge workers and team members fresh opportunities in the future. From time to time, consultants serve as behavioral coaches and mentors who weigh the pros, cons, and trade-offs of internal promotions against the concomitant costs and benefits of external recruitment.

It is often essential for all relevant team members to work well together in business organizations. Teams and committees are distinct entities and thus serve different purposes. Teams are internal groups of people who perform well together, support one another, and succeed as a whole unit. By contrast, committees are key internal groups of people who share resources, proprietary assets, and independent work streams in the broader business context. From time to time, the collective wisdom of both executive committees and their strategic decisions can contribute to team dynamism and efficiency.

Corporate clients often recruit management consultants for professional help with organizational development. As principal business owners, these consultants often focus on both the longer-term strategic solutions and short-term tactical solutions. Long-term strategic solutions emphasize the long prevalent practice that business leaders make decisions with both core competences and distinctive capabilities in response to external threats, risks, and opportunities. In contrast, tactical solutions serve as the specific tools and techniques etc that optimize the current view of both near-term crises and culture changes. From short-term tactical solutions to longer-term strategic solutions, most management consultants often encourage corporate business leaders, senior managers, advisors, specialists, knowledge workers, and other team members to think outside the black box in light of both sustainable and disruption innovations. Sustainable innovations often help modify the current tech advances, whereas, disruptive innovations revolutionize future industries and even consumer behaviors. Management consultants help transform real growth options into proprietary assets that attract sustainable cash flows. This dual transformation contributes to longer-term sustainable business value creation. This value creation indeed helps improve client conditions and relations over time.

As principal business owners, many management consultants often need to make key strategic decisions, trade-offs, and legal and proper choices. It is vital for these consultants to behave in accordance with both the letter and spirit of the law. These consultant behaviors must further accord with both the core values and beliefs of the business organization. With different degrees of business value creation, it can be reasonable for external business consultants to charge different fees to different clients for similar services. However, it would not be ethical for many management consultants to charge different fees to different buyers at the same client company if these buyers require identical business needs with the same services. There can be many suitable ways for consultants to skin the cat, but all roads eventually lead to Rome.

Both solo practitioners and boutique firms build equity from their business inception. Many techniques include up-to-date relational databases, long-term relations with core clients and vendors, intellectual property licenses for patents and trademarks, referrals, endorsements, references, media interviews, social talks, and seminars. Sometimes solo practitioners and management consultants consider selling their own consultancy firms and proprietary assets to larger enterprises and even public corporations. As principal owners, solo practitioners and management consultants often present their professional consultancy firms as attractive intellectual capital trailblazers or new technological advances to external successors and prospective buyers.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-06-07 10:36:00 Thursday ET

AT&T wins court approval to take over Time Warner with a trademark $85 billion bid despite the Trump administration prior dissent due to antitrust conce

2018-05-07 07:32:00 Monday ET

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri

2020-09-10 08:31:00 Thursday ET

Most business organizations should continue to create new value in order to achieve long-run success and sustainable profitability. Todd Zenger (2016)

2017-10-09 09:34:00 Monday ET

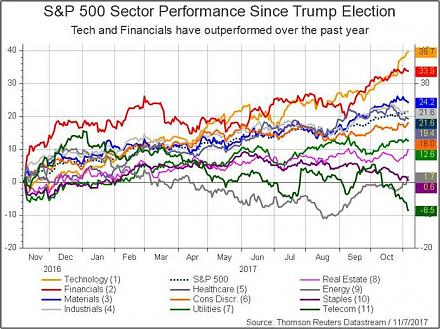

The current Trump stock market rally has been impressive from November 2016 to October 2017. S&P 500 has risen by 21.1% since the 2016 presidential elec

2019-01-25 13:34:00 Friday ET

Netflix raises its prices by 13% to 18% for U.S. subscribers. The immediate stock market price soars 6.5% as a result of this upward price adjustment. The b

2018-01-07 09:33:00 Sunday ET

Zuckerberg announces his major changes in Facebook's newsfeed algorithm and user authentication. Facebook now has to change the newsfeed filter to prior