2018-11-05 10:40:00 Mon ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Former Fed Chair Janet Yellen worries about U.S. government debt accumulation, expects new interest rate increases, and warns of the next economic recession. Yellen points out that the current fiscal debt-and-deficit trajectory is unsustainable in the long run. The famous Sargent-Wallace unpleasant monetarist arithmetic rule suggests that if the government continues to accumulate fiscal deficits, incessant government debt issuance would induce higher inflation in the form of seigniorage taxes. Yellen also suggests that the U.S. Treasury might want to consider raising taxes with lower retirement expenditures. She observes the probable outcome that the current debt-deficit dilemma may exacerbate as more baby-boomers retire with greater retirement and health care needs.

With respect to monetary policy decisions, Yellen advocates gradual interest rate increases for better inflation containment in light of strong wage growth and labor market momentum. The current key interest rate hike helps ensure the sound-and-stable scenario that the U.S. economy cannot overheat due to cyclical tides. As of November 2018, the Federal Reserve has raised the interest rate 3 times year-to-date, and stock analysts and economists expect the FOMC to approve another key interest rate increase in December 2018. Yellen expects the next U.S. economic recession to be far off until late-2020. The next recession should be mild (but not deep and terrible).

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-05-01 11:38:00 Tuesday ET

America and China play the game of chicken over trade and technology, whereas, most market observers and economic media commentators hope the Trump team to

2020-09-10 08:31:00 Thursday ET

Most business organizations should continue to create new value in order to achieve long-run success and sustainable profitability. Todd Zenger (2016)

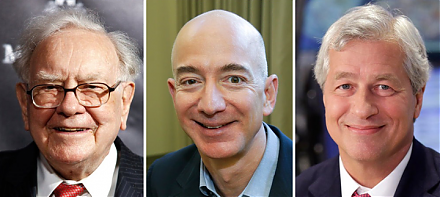

2018-01-23 06:38:00 Tuesday ET

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

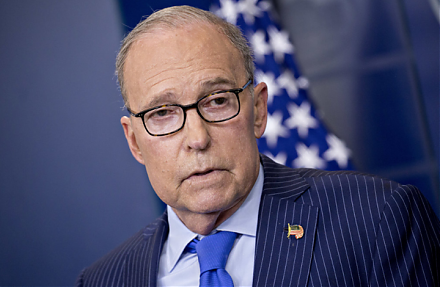

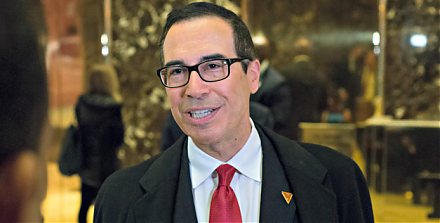

2017-05-25 08:35:00 Thursday ET

Treasury Secretary Steve Mnuchin has released a 147-page report on financial deregulation under the Trump administration. This financial deregulation seeks

2018-08-17 11:45:00 Friday ET

In accordance with the extant corporate disclosure rules and requirements, all U.S. public corporations have to report their balance sheets, income statemen

2027-04-30 12:31:00 Friday ET

In recent years, the current AI-driven stock market rally may or may not turn out to be another major asset bubble in global human history. For the pract