2019-10-11 13:40:00 Fri ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Apple CEO Tim Cook maintains a frugal low-key lifestyle. With $625 million public wealth, Cook leads the $1 trillion tech titan Apple in the post-Jobs era. As a native Alabaman son of a shipyard worker and a pharmacy employee, nonetheless, Cook keeps his low-key life habits and hobbies. His public personal wealth comes from $622 million Apple shares and $3 million stock options in Nike (as Cook now serves on its board of directors). Like his predecessor Steve Jobs and other tech founders from Jeff Bezos and Bill Gates to Larry Page and Mark Zuckerberg, Cook focuses his attention and energy on technological advancement and legacy innovation.

Cook leads a frugal solitary life, buys clothes-and-shoes at the Nordstrom semi-annual sale, and lives in a relatively modest $1.9 million home in Palo Alto (in stark contrast to the median home price of $3.5+ million in the San Francisco Bay Area). Money cannot motivate Tim Cook because he spends most time trying to find the next disruptive innovation that revolutionizes the market for smart mobile devices. Cook serves as a wise tech trailblazer in product diversification as he pioneers the post-Jobs trifecta of iPhone Xs, iPhone Xs Max, and iPhone XR.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-01-08 08:25:00 Wednesday ET

Conservative Party wins the British parliamentary majority in the general election with hefty British pound appreciation. In response to this general electi

2018-11-11 13:42:00 Sunday ET

Michael Bloomberg provides $80 million as campaign finance for Democrats to flip the House of Representatives in the November 2018 midterm elections, gears

2018-05-19 09:29:00 Saturday ET

Treasury Secretary Steve Mnuchin indicates that the Trump team puts the trade war with China on hold. The interim suspension of U.S. tariffs should offer in

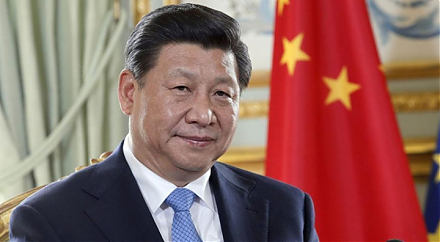

2018-03-03 11:37:00 Saturday ET

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de

2019-12-16 11:37:00 Monday ET

America and China cannot decouple decades of long-term collaboration in trade, finance, and technology. In recent times, some economists claim that China ma

2019-06-23 08:30:00 Sunday ET

The financial crisis of 2008-2009 affects many millennials as they bear the primary costs of college tuition, residential demand, health care, and childcare