2019-07-23 09:22:00 Tue ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Harvard economic platform researcher Dipayan Ghosh proposes some alternative solutions to breaking up tech titans such as Facebook, Google, Apple, and Amazon. As Ghosh suggests, breaking up tech titans would only serve to punish innovative tech enterprises that have already created tremendous economic value. The major tech titans have become quasi-monopolies that necessitate a novel and stringent set of *utility regulations* for better privacy protection and personal data usage. In fact, these regulations should obstruct the capitalistic overreaches of tech titans in order to protect the public against economic exploitation. Facebook, Google, Apple, and Amazon reap substantive mercenary gains from their network services when more people use these services.

Their current infrastructure makes it extraordinarily difficult for new entrants to offer competitive levels of consumer utility. The tech titans extract consumer currency on the basis of personal data and attention. Moreover, these tech pioneers extract consumer currency on one side of the platform, and then exchange such currency for monetary revenue at high margins on the other side of the same platform. This subtle but corrosive form of economic exploitation seems objectionable to Justice Department, Federal Trade Commission, and European Commission. Ghosh thus advocates an alternative case for utility regulations in lieu of breaking up the tech titans such as Facebook, Google, Apple, and Amazon.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-05-09 08:31:00 Wednesday ET

CBS and its special committee of independent directors have decided to sue the Redstone controlling shareholders because these directors might have breached

2017-11-19 08:37:00 Sunday ET

In 2000, a former law professor at Harvard proposed establishing the Financial Product Safety Commission in order to protect consumer rights in the provisio

2018-07-01 08:34:00 Sunday ET

Are China and Russia etc gonna dethrone the petrodollar? Over the years, China, Russia, France, Germany, and Japan have made numerous attempts to use their

2019-08-31 14:39:00 Saturday ET

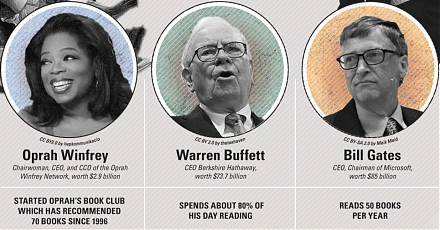

AYA Analytica finbuzz podcast channel on YouTube August 2019 In this podcast, we discuss several topical issues as of August 2019: (1) Warren B

2023-12-09 08:28:00 Saturday ET

International trade, immigration, and elite-mass conflict The elite model portrays public policy as a reflection of the interests and values of elites. I

2019-08-30 11:35:00 Friday ET

The conventional wisdom suggests that chameleons change their skin coloration to camouflage their presence for survival through Darwinian biological evoluti