2019-05-05 10:34:00 Sun ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Former Vice President Joe Biden enters the next U.S. presidential race with many moderate-to-progressive policy proposals. At the age of 76, Biden stands out the presidential race as the favorite among Democratic voters in the recent polls. Biden enters the fray with a half-century of government experience with senior roles as the former chairman of Senate Foreign Relations Committee and vice president under President Barack Obama. On public finance, Biden cites high health care and energy costs as the primary threats to the economic prosperity of U.S. firms. Addressing these economic issues helps U.S. firms better compete worldwide. In addition, Biden supports better balancing the fiscal budget with deficit reductions. This fiscal policy stance contrasts with big tax cuts under the Trump administration. Biden indicates the essential need for U.S. banks to operate under the 5 key pillars of financial regulation: capital rules, low-leverage limitations, liquidity requirements, macroprudential stress tests, and deposit insurance constraints.

On agriculture, Biden opposes importing non-native species, which inadvertently alter domestic vegetation, compete with native species, introduce new diseases, and interfere with maritime commerce. Biden also supports a $15 minimum wage proposal, higher taxation on capital investment income, no tuition for public college students, and broader infrastructure.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-08-05 08:33:00 Wednesday ET

Business leaders often think from a systemic perspective, share bold visions, build great teams, and learn new business models. Peter Senge (2006) &nb

2017-06-21 05:36:00 Wednesday ET

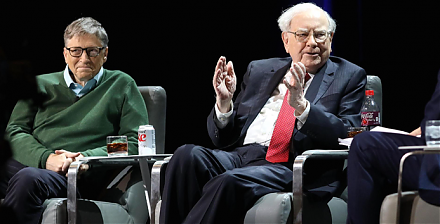

In his latest Berkshire Hathaway annual letter to shareholders, Warren Buffett points out that many people misunderstand his stock investment method in seve

2019-07-17 12:37:00 Wednesday ET

Gold prices surge above $1400 per ounce amid global trade tension and economic policy uncertainty. Both European Central Bank and Bank of Japan may consider

2025-09-24 09:49:53 Wednesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2023-02-21 08:27:00 Tuesday ET

Mark Granovetter follows the key principles of modern economic sociology to analyze social relations and economic phenomena. Mark Granovetter (2017) &

2018-04-17 12:38:00 Tuesday ET

Value investment strategies make investors wiser like water with core fundamental factor analysis. Value investors tend to buy stocks below their intrinsic