2018-04-23 07:43:00 Mon ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Harvard professor and former IMF chief economist Kenneth Rogoff advocates that artificial intelligence helps augment human productivity growth in the next decade. A small but influential cult touts the Hungarian-American mathematician John von Neumann's singularity theory: someday smart machines will become so complex and intricate that they invent other smart machines without any human intervention.

Beyond this singularity point, technology advances exponentially.

An key existential battle between man and machine leads us to expect a significant increase in productivity growth. Most social angst over artificial intelligence focuses on economic inequality and the future of work. The government should encourage greater female laborforce participation, pay equity, and high-skill immigration when workforce growth and natural birth decline sharply. Global capital investment slows down in the multi-year aftermath of the global financial crisis from 2008 to 2009. In fact, low interest rates worldwide reinvigorate business investments in machinery, capital equipment, and artificial intelligence. Probable pickup in productivity growth can arise from smart and productive uses of artificial intelligence. This pickup can be a core catalyst for change and so creates incentives for financial intermediaries and firms to introduce technological advances. This virtuous circle can offset some slowdown in workforce participation.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-03-23 08:26:00 Friday ET

Personal finance and investment author Thomas Corley studies and shares the rich habits of self-made millionaires. Corley has spent 5 years studying the dai

2019-05-09 10:28:00 Thursday ET

President Trump ramps up 25% tariffs on $200 billion Chinese imports soon after China backtracks on the Sino-American trade agreement. U.S. trade envoy Robe

2018-08-09 16:36:00 Thursday ET

President Trump applies an increasingly bellicose stance toward the Iranian leader Hassan Rouhani as he rejects a global agreement to curb Iran's nuclea

2017-08-31 09:36:00 Thursday ET

The Trump administration has initiated a new investigation into China's abuse of American intellectual property under Section 301 of the Trade Act of 19

2024-05-05 10:31:00 Sunday ET

Stock Synopsis: Pharmaceutical post-pandemic patent development cycle In terms of stock market valuation, the major pharmaceutical sector remains at its

2019-09-23 12:25:00 Monday ET

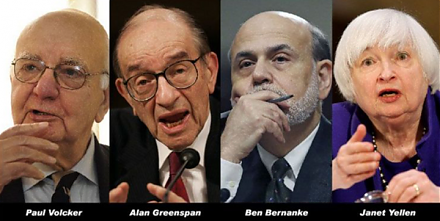

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit