2018-08-19 10:34:00 Sun ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

The World Economic Forum warns that artificial intelligence may destabilize the financial system. Artificial intelligence poses at least a trifecta of major risks to the financial ecosystem. First, inadequate user data validation and authentication may threaten consumer consent and privacy. The recent Facebook-driven Cambridge Analytica debacle causes major user privacy concerns and worries about the use and abuse of artificial intelligence applications in macrofinance and other financial services.

In August 2018, Google, Facebook, and Twitter have to remove numerous pages and posts to clean up their social networks due to Russian and Iranian inauthentic coordination for political purposes. Also, the Trump administration further blocks the potential acquisitions of U.S. electronic payment service providers by China's Ant Financial Group due to national economic security concerns. Tech platforms such as Facebook, Google, Apple, Amazon, and Microsoft should share the blame for egregious user privacy invasion and non-authentic user data access.

Second, technological advances in both cloud-computing power and algorithmic trade telecommunication help mold a highly non-linear and dense financial network. As an inadvertent consequence, one node of this network can cause exogenous shocks to propagate quickly and unpredictably to other parts of the global financial ecosystem.

As an inadvertent consequence, one node of this network can cause exogenous shocks to propagate quickly and unpredictably to other parts of the global financial ecosystem. Typical examples include the U.S. subprime mortgage crisis and the European sovereign debt crisis with severe socioeconomic malaise throughout the global economic recession from 2008 to 2012.

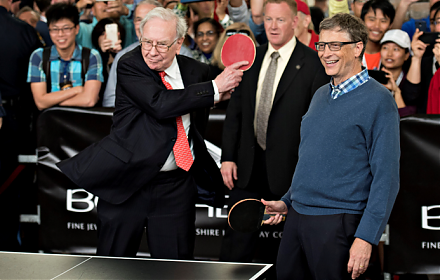

Third, artificial intelligence applications may induce online financial service users to engage in risky transactions that expose them to fraud or other cyber hazards. For instance, Bitcoin, Ethereum, Litecoin, and other cryptocurrencies exhibit highly volatile price fluctuations and hefty techy barriers to entry. Some of these crypto-currencies may involve esoteric investment projects in financial crime, collusion, or terrorist finance. In fact, several famous financial market experts such as Warren Buffett, Jamie Dimon, and Jim Cramer recommend stock investors to refrain from trading cryptocurrencies. Cryptocurrencies cannot be a valid authentic medium of exchange because only a few countries accept them as fiat money or legal tender. Neither can these cryptocurrencies serve as a reasonable store of value because the vast majority of them exhibit extreme price variation within a short time frame.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-05-21 07:39:00 Monday ET

Dodd-Frank rollback raises the asset threshold for systemically important financial institutions (SIFIs) from $50 billion to $250 billion. This legislative

2018-03-09 08:33:00 Friday ET

David Solomon succeeds Lloyd Blankfein as the new CEO of Goldman Sachs. Unlike his predecessors Lloyd Blankfein and Gary Cohn, Solomon has been an investmen

2022-02-05 09:26:00 Saturday ET

Modern themes and insights in behavioral finance Shiller, R.J. (2003). From efficient markets theory to behavioral finance. Journal of Economi

2019-09-11 09:31:00 Wednesday ET

Central banks in India, Thailand, and New Zealand lower their interest rates in a defensive response to the Federal Reserve recent rate cut. The central ban

2018-10-30 10:41:00 Tuesday ET

Personal finance author Ramit Sethi suggests that it is important to invest in long-term gains instead of paying attention to daily dips and trends. It

2019-04-30 19:46:00 Tuesday ET

AYA Analytica finbuzz podcast channel on YouTube April 2019 In this podcast, we discuss several topical issues as of April 2019: (1) Our proprietary