2018-10-23 12:36:00 Tue ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Former Fed Chair Paul Volcker releases his memoir, talks about American public governance, and worries about plutocracy in America. Volcker suggests that public governance entails running the government with few unproductive policy debates. As the U.S. central bank, the Federal Reserve need not adhere to an explicit 2% symmetric inflation target. The current neutral interest rate hike can continue even when inflation rises above the target range of 2%-2.5%. Volcker supports stronger supervisory powers for both the Federal Reserve and Treasury. Both regulatory agencies should continue to conduct regular macroprudential stress tests on the systemically-important financial institutions (SIFIs) once per year in the post-Dodd-Frank era. SIFIs should build up sufficient core capital buffers to safeguard against extreme losses that might arise in rare times of financial stress. Also, the Volcker rule separates commercial bank activities from proprietary investment transactions. This firewall serves as a safety valve between safe bank deposits and risky asset investments.

Volcker worries about the impact of money on the U.S. political system, and he expresses grave concerns about the recent trend that America seems to devolve into a plutocracy. In his view, U.S. democratic regulations should restrict the direct influence of crazy rich Americans over political affairs.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-01-21 07:25:00 Sunday ET

As he refrains from using the memorable phrase *irrational exuberance* to assess bullish investor sentiments, former Fed chairman Alan Greenspan discerns as

2018-05-15 08:40:00 Tuesday ET

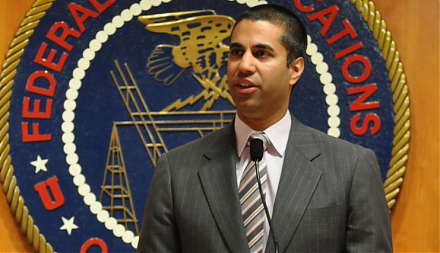

Net neutrality rules continue to revolve around the Trump administration's current IT agenda of 5G telecom transformation. Republican Senate passes the

2020-10-27 07:43:00 Tuesday ET

Most agile lean enterprises often choose to cut costs strategically to make their respective business models fit for growth. Vinay Couto, John Plansky,

2018-07-11 09:39:00 Wednesday ET

In recent times, the Trump administration sees the sweet state of U.S. economic expansion as of early-July 2018. The latest CNBC All-America Economic Survey

2023-08-21 12:25:00 Monday ET

Steven Shavell presents his economic analysis of law in terms of the economic outcomes of both legal doctrines and institutions. Steven Shavell (2004)

2018-09-23 08:37:00 Sunday ET

Bank of America Merrill Lynch's chief investment strategist Michael Hartnett points out that U.S. corporate debt (not household credit supply or bank ca