2018-11-01 08:36:00 Thu ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Ford and Baidu team up to test autonomous cars in China. For the next few years, Ford and Baidu plan to collaborate on the car design and user acceptance test of driverless vehicles in China. Ford provides autonomous vehicles that fits the Baidu proprietary autonomous navigation system Apollo. On-road car tests begin to take place in 2018Q4.

Ford and Baidu both aim to achieve the U.S. SAE Level 4 standard. The U.S. SAE industry classification measures the level of *human involvement* in autonomous vehicles, and the SAE Level 4 standard stipulates that driverless vehicles can run autonomously within specific areas under the correct weather conditions. By this standard, the Ford-Baidu autonomous vehicles require no human intervention at all. Although Ford and Baidu have yet to disclose the financial terms and ownership structure details of this Sino-U.S. joint venture, the tech firms leverage innovative artificial-intelligence and wireless connectivity solutions that improve the safe and convenient passenger experiences in different environments.

Most user acceptance tests are likely to take place in China, and the ultimate Level 4 driverless vehicles will run on both Chinese and American soil. Through this core strategic partnership with Baidu, Ford can secure its competitive advantage and moat in autonomous cars in response to intense competition from Uber, Lyft, Tesla, and Waymo etc. Autonomous vehicles remain a top long-term strategic priority for several world-class carmakers from Audi and BMW to Mercedes-Benz and Toyota.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-12-09 08:44:00 Sunday ET

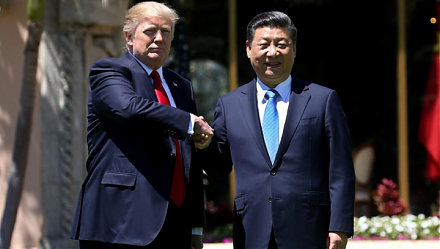

President Trump meets with Chinese President Xi again at the G20 summit in the city of Buenos Aires, Argentina, in late-November 2018. President Donald Trum

2019-01-04 11:41:00 Friday ET

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years sin

2020-05-07 08:26:00 Thursday ET

Disruptive innovators often apply their 5 major pragmatic skills in new blue-ocean niche discovery and market share dominance. Jeff Dyer, Hal Gregersen,

2019-11-23 08:33:00 Saturday ET

MIT financial economist Simon Johnson rethinks capitalism with better key market incentives. Johnson refers to the recent Business Roundtable CEO statement

2019-02-17 14:40:00 Sunday ET

U.S. economic inequality increases to pre-Great-Depression levels. U.C. Berkeley economics professor Gabriel Zucman empirically finds that the top 0.1% rich

2018-11-21 11:36:00 Wednesday ET

Apple upstream suppliers from Foxconn and Pegatron to Radiance and Lumentum experience sharp share price declines during the Christmas 2017 holiday quarter.