2018-07-09 09:39:00 Mon ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

The Federal Reserve raises the interest rate again in mid-2018 in response to 2% inflation and wage growth. The current neutral interest rate hike neither boosts nor constrains inflationary pressure. FOMC minutes reveal some members' concerns about whether the Trump tariffs would dampen robust macroeconomic momentum and full employment. When western allies such as Canada, Europe, and Mexico lash back with retaliatory steel and aluminum tariffs, this ripple effect may weaken 2.7%-3% U.S. economic growth and production. Both capital equipment and risky asset investments may deteriorate in light of international trade frictions.

Also, FOMC members express their concern about potential yield curve inversion that might signal the dawn of an economic recession. Whether a recession lurks around the corner remains an open controversy. While both stock market valuation and domestic demand continue to indicate investor optimism, the core term spread between short-and-long-term interest rates warns of potential output contraction.

In light of its dual mandate of price stability and maximum employment, the Federal Reserve may raise the interest rate twice in the second half of 2018. The current interest rate hike may continue above the neutral threshold sometime in mid-2019.

On balance, the recent Fed Chair transition from Yellen to Powell reflects the fact that the medium-term monetary policy stance has shifted from dovish to hawkish. A dovish monetary policy stance focuses on attaining full employment, whereas, a hawkish stance emphasizes inflation containment.

This monetary policy transition is a major inflection point that shines fresh light on the inexorable and mysterious New Keynesian trade-off between price stability and employment.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2022-10-25 11:31:00 Tuesday ET

Corporate investment insights from mergers and acquisitions Relative market misvaluation between the bidder and target firms drives most waves of mergers

2019-02-06 10:36:49 Wednesday ET

President Trump delivers his second state-of-the-union address to U.S. Congress. Several key themes emerge from this presidential address. First, President

2017-02-07 07:47:00 Tuesday ET

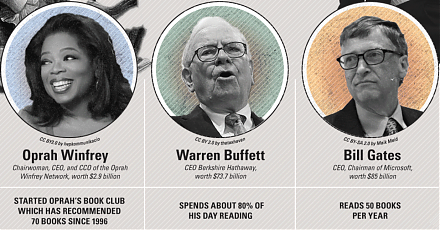

With prescient clairvoyance, Bill Gates predicted the recent sustainable rise of Netflix and Facebook during a Playboy interview back in 1994. He said th

2018-10-30 10:41:00 Tuesday ET

Personal finance author Ramit Sethi suggests that it is important to invest in long-term gains instead of paying attention to daily dips and trends. It

2019-11-15 13:34:00 Friday ET

The Economist offers a special report that the new normal state of economic affairs shines fresh light on the division of labor between central banks and go

2020-02-02 10:31:00 Sunday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement