2018-12-07 11:35:00 Fri ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Fed Chair Jerome Powell hints slower interest rate increases because the current rate is just below the neutral threshold. NYSE and NASDAQ share prices rebound in response to the accommodative monetary policy moderation. Dow Jones surges about 600 points primarily due to this less hawkish stance. Wall Street expects the current interest rate hike to taper off. As a result, the U.S. dollar weakens a little bit relative to the major trade-weighted-average greenback index.

FOMC minutes reveal the high likelihood of another quarter-point increase in the federal funds rate in December 2018. However, some FOMC members propose removing the reference to *further gradual increases* in the target range insofar as the current stock market conditions persist. The federal funds rate might be near its neutral level so that some further rate hikes might inadvertently slow the current macroeconomic expansion and productivity growth. Within the target neutral range of interest rates, the U.S. economy operates with lower unemployment (3.7%) with minimal inflationary pressure (2%). Several FOMC members continue to express their deep concerns about Sino-U.S. tariff tension, corporate leverage, and public debt accumulation. The Trump team should exercise a fair bit of fiscal discipline in taxation and infrastructure with interim arrangements for Sino-American fair trade.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-04-10 11:33:00 Friday ET

Elon Musk envisions a bold fantastic future with his professional trifecta of lean startup enterprises SolarCity, SpaceX, and Tesla. Ashlee Vance (2015)

2017-03-03 05:39:00 Friday ET

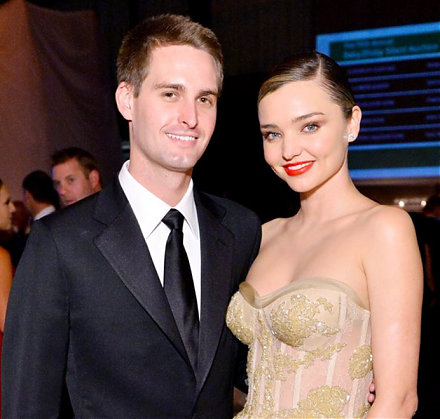

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2019-08-06 07:28:00 Tuesday ET

Former basketball star Shaq O'Neal has almost quadrupled his net worth once he learns and applies an ingenious investment strategy from Amazon Founder J

2019-05-05 10:46:10 Sunday ET

This video collection shows the major features of our AYA fintech network platform for stock market investors: (1) AYA stock market content curation;&nbs

2018-06-11 07:44:00 Monday ET

Facebook, Apple, Amazon, Netflix, and Google (FAANG) have been the motor of the S&P 500 stock market index. Several economic media commentators contend

2019-01-10 17:31:00 Thursday ET

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would be