2019-03-29 12:28:00 Fri ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

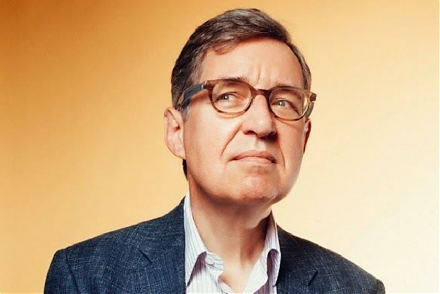

Federal Reserve Chair Jerome Powell answers CBS News 60 Minutes questions about the recent U.S. economic outlook and interest rate cycle. Powell views the current U.S. economic outlook as a favorable one. The federal funds rate hits the neutral threshold where the U.S. economy operates near full employment with low inflation. Powell reiterates the *patient* approach to further raising the interest rate as the U.S. economy grows at a moderate pace.

Although about 7 million Americans fall behind their auto loan payments and retail sales decline at the highest pace in the post-crisis period, Powell remains positive about U.S. economic growth in 2019-2020. As the American real GDP growth rate increases above 3%, there are healthy upticks in both wage growth and consumer confidence.

In light of the recent Sino-U.S. trade and Brexit negotiations, Powell considers the biggest macro risk to be a likely economic output slowdown in China and Europe. Powell considers the U.S. financial system to be more resilient with high capital buffers that help absorb extreme losses in key times of severe financial stress. The Federal Reserve is independent in the generic sense that the monetary authority needs to execute monetary policy decisions in a strictly non-political way.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-07-07 10:33:00 Friday ET

Warren Buffett invests in American stocks across numerous industries such as energy, air transport, finance, technology, retail provision, and so forth.

2019-04-25 09:35:00 Thursday ET

Bridgewater hedge fund founder Ray Dalio suggests that the current state of U.S. capitalism poses an existential threat for many Americans. Dalio deems the

2018-12-13 08:30:00 Thursday ET

The recent arrest of HuaWei senior executive manager may upend the trade truce between America and China. At the request of several U.S. authorities, Canadi

2023-09-07 11:30:00 Thursday ET

Michael Woodford provides the theoretical foundations of monetary policy rules in ever more efficient financial markets. Michael Woodford (2003)

2018-12-23 13:39:00 Sunday ET

The House of Representatives considers a government expenditure bill with border wall finance and therefore sets up a shutdown stalemate with Senate. As fre

2019-07-27 17:37:00 Saturday ET

Capital gravitates toward key profitable mutual funds until the marginal asset return equilibrates near the core stock market benchmark. As Stanford finance