2017-05-19 09:39:00 Fri ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

FAMGA stands for Facebook, Apple, Microsoft, Google, and Amazon. These tech giants account for more than 15% of market capitalization of the American stock market (NYSE, NASDAQ, and AMEX). Facebook's recent acquisitions of WhatsApp, Instagram, and Oculus have expanded the social media network to encapsulate more than 2 billion active users worldwide. At present, Google still beats Facebook in terms of average revenue per user (ARPU) (about $45 vis-à-vis $20) and dominates the global Internet search and advertisement market.

Microsoft heralds its latest Windows 10 operating system updates and Office 365 suites for better user experience and word-of-mouth proliferation. Moreover, Amazon introduces Retail 2.0 or the Internet of Everything (IoE) in lieu of typical e-commerce with its recent acquisition of Whole Foods to better compete with Wal-Mart, Best Buy, Macy's, Neiman Marcus, JC Penny, and so on.

Apple brings about its iPhone X with AMOLED curvy touch screen and wireless charging functions to celebrate the 10th anniversary of its revolutionary smart phone launch. Many upstream international iPhone suppliers experience hefty stock market gains in recent times. We expect FAMGA to continue to dominate in social media, IoE, software, Internet search and advertisement, and mobile technology with their *competitive moats* from rare and inimitable patents and new proprietary technologies to increasingly inclusive and powerful platforms, networks, and algorithms.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-12-09 08:28:00 Saturday ET

International trade, immigration, and elite-mass conflict The elite model portrays public policy as a reflection of the interests and values of elites. I

2018-12-11 10:34:06 Tuesday ET

Several eminent American China-specialists champion the key notion of *strategic engagement* with the Xi administration. From the Hoover Institution at Stan

2024-10-14 11:33:00 Monday ET

Stock Synopsis: Video games continue to take both screen time and monetization from many other forms of entertainment. We are broadly positive about the

2018-03-07 07:34:00 Wednesday ET

President Trump tweets his key decision to oust State Secretary Rex Tillerson after several months of intense disagreement over diplomatic affairs. Trump so

2017-12-09 08:37:00 Saturday ET

Michael Bloomberg, former NYC mayor and media entrepreneur, criticizes that the Trump administration's tax reform is a trillion dollar blunder because i

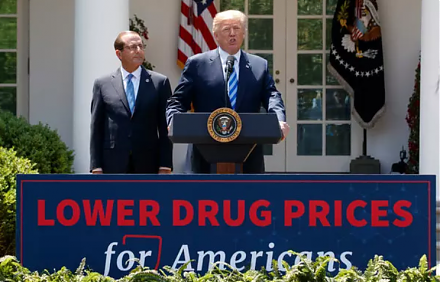

2018-05-07 07:32:00 Monday ET

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri