2017-12-15 07:42:00 Fri ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Disney acquires 21st Century Fox in a $52 billion landmark deal. This deal has a total value of about $66 billion while Disney assumes $14 billion of Fox's net debt. Bob Iger will remain Disney's CEO and key chairman to oversee this mega media integration until December 2021. In fact, the resultant Disney-Fox M&A deal will give Disney more media content when Disney launches its own video streaming service on demand.

The Economist suggests that as the Mouse acquires the Fox, this mega media deal will accelerate Hollywood's modern transformation from a film capital to a video streaming service town. Disney's ambitious acquisition of Fox and its own affiliates remains subject to approval by their shareholders and regulators, and this acquisition combines Disney and Fox as powerful film studios. Franchises such as Avatar and X-Men will join Disney's formidable library of Marvel titles, Pixar animation hits, and Star Wars films. In addition, Disney gains dozens of cable networks to add to its own collection, as well as Fox's equity stake in Sky, a European satellite broadcaster.

CNBC and CNN both report that if U.S. antitrust laws approve this mega media deal, it means stiffer competition for video streaming service providers such as Netflix, Amazon, and YouTube. As a consequence, film viewers and consumers benefit much from better content distribution and scale in this broad horizontal consolidation across the media industry landscape.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-11-23 08:33:00 Saturday ET

MIT financial economist Simon Johnson rethinks capitalism with better key market incentives. Johnson refers to the recent Business Roundtable CEO statement

2019-02-09 08:33:00 Saturday ET

Apple provides positive forward guidance on both revenue and profit forecasts for iPhones, iPads, and MacBooks. In the Christmas 2018 festive season, MacBoo

2025-09-21 12:32:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-08-06 07:28:00 Tuesday ET

Former basketball star Shaq O'Neal has almost quadrupled his net worth once he learns and applies an ingenious investment strategy from Amazon Founder J

2019-11-03 12:30:00 Sunday ET

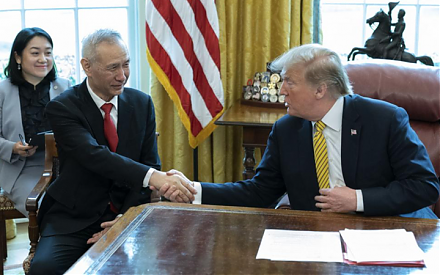

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice

2023-12-10 09:23:00 Sunday ET

U.S. federalism and domestic institutional arrangements A given country is federal when both of its national and sub-national governments exercise separa