2019-06-11 12:33:00 Tue ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Dallas Federal Reserve Bank President Robert Kaplan expects the U.S. economy to grow at 2.2%-2.5% in 2019-2020 as inflation rises a bit. In an interview with Fox Business Network, Kaplan indicates that it might be too soon to gauge the ripple effects of U.S. tariffs on core Chinese and European imports, dollar gyrations, and inflationary concerns.

As the Federal Reserve remains patient on the next monetary policy adjustments, credible central bank communication can help circumvent financial imbalances in the U.S. real economy. Meanwhile, the Sino-American trade tension intensifies, so many stock market analysts now consider low inflation to be transitory. As Federal Reserve balance sheet shrinkage continues, some stock market analysts expect this balance sheet strategy to halt in light of higher U.S. Treasury bond yields. The higher yields may inadvertently tighten credit conditions for mortgage borrowers and corporate debtors. In this negative light, this logic leads to financial imbalances in the form of exorbitant mortgage and business debt. These financial imbalances can exacerbate the real estate and business debt dilemma. When push comes to shove, monetary policymakers need to consider the potential ramifications of credit supply shortage before Federal Reserve steers the next interest rate adjustments.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-06-17 10:35:00 Sunday ET

In the past decades, capital market liberalization and globalization have combined to connect global financial markets to allow an ocean of money to flow th

2018-07-13 09:41:00 Friday ET

Yale economist Stephen Roach warns that America has much to lose from the current trade war with China for a few reasons. First, America is highly dependent

2023-06-19 10:31:00 Monday ET

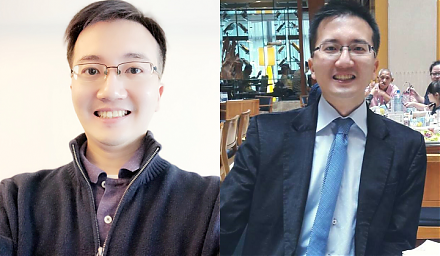

A brief biography of Dr Andy Yeh (PhD, MFE, MMS, BMS, FRM, and USPTO patent accreditation) Dr Andy Yeh is responsible for ensuring maximum sustainable me

2024-03-26 09:30:00 Tuesday ET

Stock Synopsis: ESG value and momentum stock market portfolio strategies Since 2013, we have been delving into the broad topics of ESG (Environmental, So

2018-09-21 09:41:00 Friday ET

Former World Bank and IMF chief advisor Anne Krueger explains why the Trump administration's current tariff tactics undermine the multilateral global tr

2019-07-30 15:33:00 Tuesday ET

All of the 18 systemically important banks pass the annual Federal Reserve stress tests. Many of the largest lenders announce higher cash payouts to shareho