2018-06-17 10:35:00 Sun ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

In the past decades, capital market liberalization and globalization have combined to connect global financial markets to allow an ocean of money to flow through them. In emerging-economies, the gross foreign financial position can be as large as annual GDP. In rich economies, the ratio can rise even more. Given the sheer size of cross-border capital flows, these co-movements can have enormous effects on local economic conditions.

The capital flows across borders is good since financial openness allows investors in rich countries to seek out large returns in capital-scarce emerging-economies. Yet, capital flows may not always follow this peculiar pattern. Money can often flow in the other direction. Less mature emerging-economies often save to safeguard against fickle global financial markets and hence amass large quantities of foreign-exchange reserves. This global savings-glut suggests that an ocean of money can swamp individual economies. The U.S. Federal Reserve determines the turn of the tide. American monetary policy shapes the global appetite for risk because of the dollar's exorbitant privilege in global finance. When the Fed changes course, asset prices, returns, and market volatilities move in its wake, with all sorts of inadvertent consequences for other countries.

Most economies face a fundamental dilemma: these economies can choose open capital markets to attract the foreign investment that emerging markets need to reinvigorate their economic climate, but only if these economies can accept losing domestic control over the global business cycle. For many emerging-economies, this inexorable trade-off seems to be a fair price to pay in global finance. However, when the Fed eventually raises its interest rate, the trade-off will then tilt toward a capital exodus from emerging-economies back to America. When push comes to shove, the law of inadvertent consequences counsels caution.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2025-10-12 13:32:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

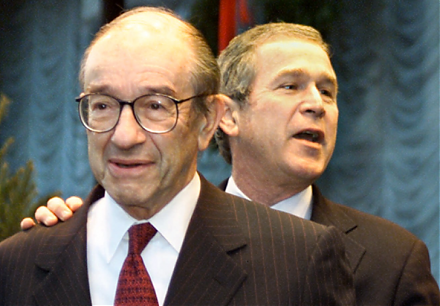

2018-01-21 07:25:00 Sunday ET

As he refrains from using the memorable phrase *irrational exuberance* to assess bullish investor sentiments, former Fed chairman Alan Greenspan discerns as

2018-08-01 11:43:00 Wednesday ET

Apple becomes the first company to hit $1 trillion stock market valuation. The tech titan sells about the same number of smart phones or 41 million iPhones

2024-10-27 07:56:01 Sunday ET

Stock Synopsis: China Internet tech titans continue to grow amid greater competition. We launch our unique coverage of top 25 China Internet stocks. In t

2018-04-17 12:38:00 Tuesday ET

Value investment strategies make investors wiser like water with core fundamental factor analysis. Value investors tend to buy stocks below their intrinsic

2018-10-03 11:37:00 Wednesday ET

Fed Chair Jerome Powell sees a remarkably positive outlook for the U.S. economy right after the recent interest rate hike as of September 2018. He humbly su