2017-11-13 07:42:00 Mon ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washing-ton Business School. Buffett said his investment business Berkshire Hathaway was the best career because he enjoys what he does. He said it is important to take a big swing when extraordinary investment opportunities emerge. Alluding to his own experiences as a stock market investor, Buffett noted the need for a typical investor to act quickly when these great investment opportunities arise because "there is no time to be reading a book on the modern portfolio theory of diversification". Buffett further explained that when one finds a company or a business idea within his or her own circle of competence, the price is right, the people are right, then the investor should barrel in.

For Gates, his best business decision was to go into partnership with Microsoft co-founder Paul Allen. Gates explained the importance of working with a person who "shares our vision, earns our trust, and complements us with a different set of skills". Buffett concurred and regarded his long-time reliable business partner Charlie Munger as his best friend with sound expert judgement. For Gates and Buffett, friendship and clairvoyance are the backbone of their business success.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-05-11 10:28:00 Saturday ET

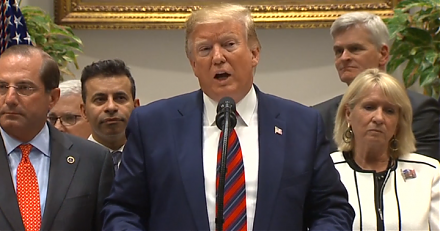

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr

2020-07-19 09:25:00 Sunday ET

Senior business leaders can learn much from the lean production system with iterative continuous improvements at Toyota. Takehiko Harada (2015)

2018-03-01 07:35:00 Thursday ET

Trump imposes high tariffs on steel (25%) and aluminum (10%) in a new trade war with subsequent exemptions for Canada and Mexico. The Trump administration&#

2019-11-23 08:33:00 Saturday ET

MIT financial economist Simon Johnson rethinks capitalism with better key market incentives. Johnson refers to the recent Business Roundtable CEO statement

2018-06-08 13:35:00 Friday ET

The Federal Reserve delivers a second interest rate hike to 1.75%-2% and then expects subsequent rate increases in September and December 2018 to dampen inf

2025-07-26 09:26:00 Saturday ET

Nir Eyal and Ryan Hoover explain why keystone habits lead us to purchase products, goods, and services in our lives. The Hooked Model can help shine new lig