2020-01-15 08:31:00 Wed ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Anti-competitive corporate practices may stifle U.S. innovation. In recent decades, wage growth, economic output, and productivity tend to stagnate as U.S. income and wealth inequality rises due to the pervasive increase in the market share and profitability of the most dominant tech titans. This dominance prevails across many bellwether industries such as telecommunication (e.g. AT&T, Sprint, T-Mobile, and Verizon), e-commerce (Amazon, Alibaba, and eBay), social media (Facebook and Twitter etc), digital music and video (Apple, Disney, HBO, Netflix, Spotify, and YouTube), mobile technology (Apple, Samsung, and HuaWei etc), cloud software (Google and Microsoft), finance (Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo), and air transport (Delta and Southwest etc).

From 1987 to 2016, the total share of U.S. employment by big firms with more than 5,000 employees surges from 28% to 34%, and the average share of revenue by the top 4 tech titans in each of the 900 economic sectors grows from 26% to 32%. These economic trends show that tech titans garner much market power with anti-competitive corporate practices. Antitrust regulators now probe into the borderline practices that may inadvertently stifle American innovation by smaller startups and other lean enterprises.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-11-15 13:34:00 Friday ET

The Economist offers a special report that the new normal state of economic affairs shines fresh light on the division of labor between central banks and go

2018-01-17 05:30:00 Wednesday ET

European Union antitrust regulators impose a fine on Qualcomm for advancing its key exclusive microchip deal with Apple to block out rivals such as Intel an

2025-09-21 12:32:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-12-22 14:38:00 Saturday ET

Federal Reserve raises the interest rate to the target range of 2.25% to 2.5% as of December 2018. Fed Chair Jerome Powell highlights the dovish interest ra

2018-05-03 07:34:00 Thursday ET

Sprint and T-Mobile propose a major merger in order to better compete with AT&T and Verizon. This mega merger is worth $26.5 billion and involves an all

2017-10-21 08:45:00 Saturday ET

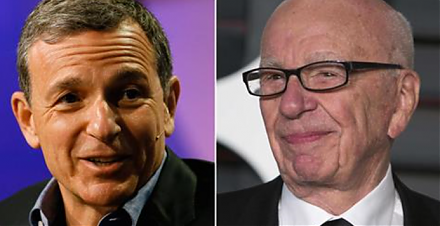

Netflix stares at higher content costs as Disney and Fox hold merger talks. Disney has held talks to acquire most of 21st Century Fox's business equity.